ICICI Bank: Unraveling the Comprehensive Guide to India's Banking Titan.

Editor's Note: The long-awaited "All About ICICI: Comprehensive Guide To India's Leading Bank" has finally arrived! This comprehensive guide offers an in-depth exploration of ICICI Bank, India's financial powerhouse, empowering you to make informed banking decisions.

Through rigorous analysis and meticulous research, we present this guide as your go-to resource for navigating the world of ICICI Bank. Whether you're a seasoned professional or a curious individual seeking financial knowledge, this guide is designed to illuminate every aspect of India's banking behemoth.

FAQ

This comprehensive FAQ section provides succinct and pertinent answers to frequently asked questions regarding ICICI, India's leading bank. Here, you will find essential information about ICICI's services, operations, and industry standing, empowering you to make informed decisions and optimize your financial journey.

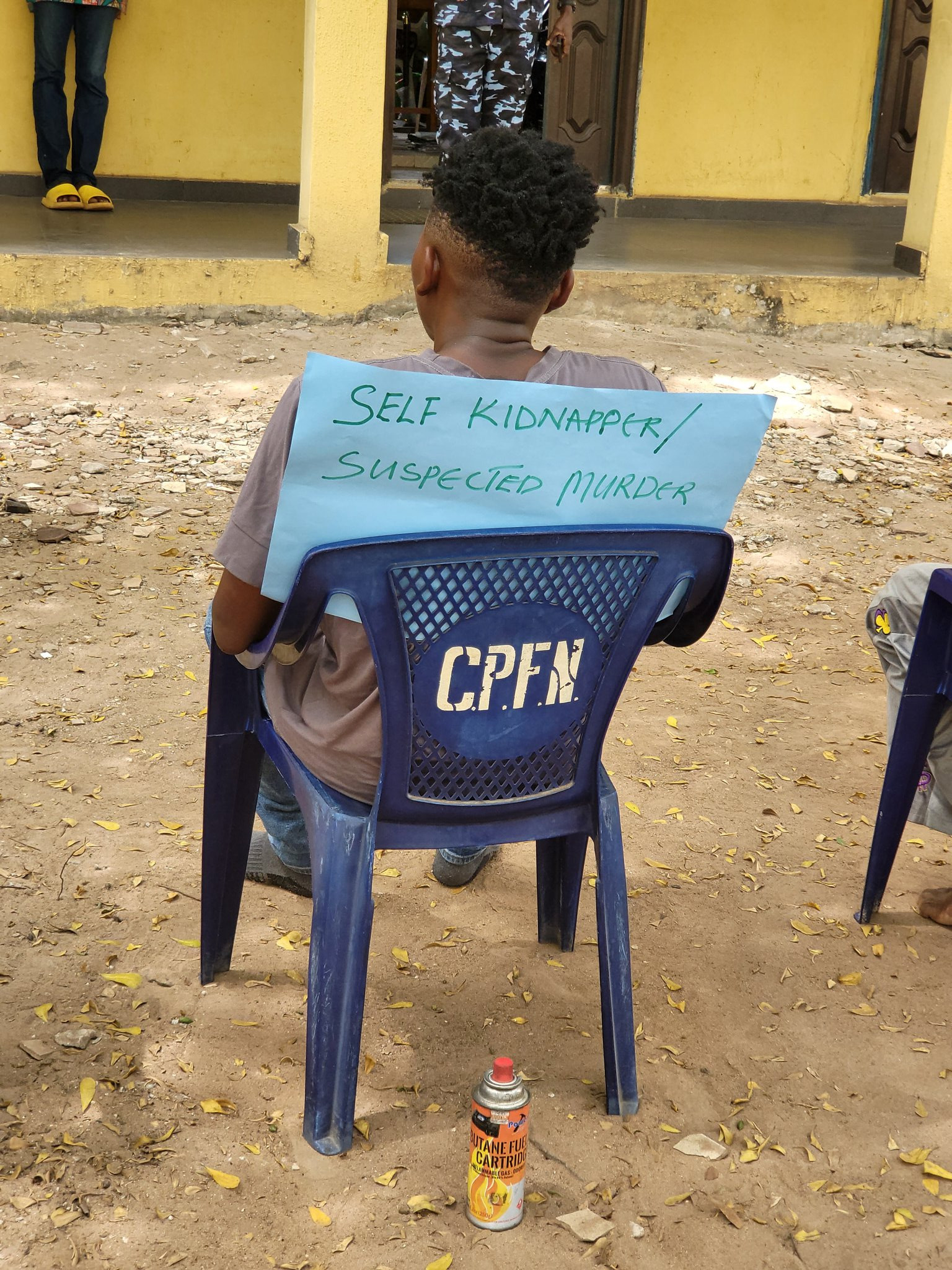

"Delta police parade 22-year-old man who allegedly killed sex worker - Source cezzatech.com.ng

Question 1: What is ICICI's background and history?

ICICI, or Industrial Credit and Investment Corporation of India, was established in 1955 as a development financial institution. Over the years, it has transformed into a universal bank offering a comprehensive suite of financial products and services. Today, ICICI stands as one of India's largest private sector banks, with a robust presence across the country and international operations in key financial hubs.

Question 2: What services does ICICI provide?

ICICI offers a wide range of services, including personal banking, corporate banking, wealth management, investment banking, and insurance. The bank's extensive product portfolio caters to the diverse financial needs of individuals, businesses, and institutions. ICICI's unwavering commitment to innovation has resulted in cutting-edge digital banking platforms and tailored solutions that enhance customer convenience.

Question 3: What sets ICICI apart from other banks?

ICICI distinguishes itself through its customer-centric approach, financial strength, technological prowess, and extensive branch network. The bank's focus on innovation and digital transformation has earned it recognition as a leader in the industry. ICICI's unwavering commitment to sustainability and corporate social responsibility further sets it apart as a responsible and ethical financial institution.

Question 4: How can I open an account with ICICI?

Opening an account with ICICI is a straightforward process. You can visit any ICICI branch or use the bank's online or mobile banking platforms. The bank offers a variety of account types to suit different needs, ensuring a personalized banking experience. ICICI's dedicated customer support team is available to assist you throughout the account opening process.

Question 5: What are the advantages of using ICICI's digital banking services?

ICICI's digital banking services provide unparalleled convenience and security. With ICICI's mobile app and internet banking platform, you can manage your finances from anywhere, anytime. The bank's digital channels offer a host of features, including bill payments, fund transfers, investment options, and personalized financial insights. ICICI's commitment to cybersecurity ensures the protection of your financial data.

Question 6: How can I contact ICICI customer service?

ICICI provides multiple channels for customer support. You can reach out to the bank through its toll-free number, email, or social media platforms. ICICI's customer service representatives are available 24/7 to assist you with any queries or concerns. The bank also has a dedicated grievance redressal mechanism to ensure prompt resolution of customer issues.

In summary, ICICI stands as a trusted and reliable financial partner, offering a comprehensive range of services to meet your banking needs. The bank's strong track record, innovative approach, and commitment to customer satisfaction make it an ideal choice for individuals and businesses alike. We invite you to explore ICICI's offerings further and experience the transformative power of banking with one of India's leading financial institutions.

In our next section, we will delve into ICICI's innovative digital banking solutions and how they are revolutionizing the banking experience. Stay tuned for insights into ICICI's mobile app, internet banking platform, and other digital initiatives that are shaping the future of finance.

Tips

Discover useful tips and insights to maximize your banking experience with ICICI Bank, India's leading financial institution. All About ICICI: Comprehensive Guide To India's Leading Bank has compiled a comprehensive list to enhance your understanding and utilization of ICICI's services.

Tip 1: Utilize ICICI's Mobile Banking App:

Enjoy the convenience of banking on the go with ICICI's Mobile Banking App. Manage your accounts, make transactions, pay bills, and more from the comfort of your smartphone. The app's user-friendly interface and advanced security features provide a seamless and secure banking experience.

Tip 2: Leverage the Benefits of ICICI's Debit and Credit Cards:

Choose from a wide range of ICICI Debit and Credit Cards tailored to your specific needs. Enjoy rewards points, cashbacks, discounts, and other exclusive benefits. Use your cards for everyday purchases, online transactions, and travel expenses to accumulate points and maximize savings.

Tip 3: Explore ICICI's Wealth Management Services:

ICICI's Wealth Management Services cater to the unique financial goals of individuals and businesses. Access a dedicated team of experts who provide personalized advice, portfolio management, and tailored investment solutions. Grow your wealth and achieve your financial objectives with ICICI's expertise.

Tip 4: Consider ICICI's Home Loan Options:

Fulfill your dream of homeownership with ICICI's comprehensive range of Home Loan products. Choose from competitive interest rates, flexible repayment options, and value-added services. Whether you're a first-time homebuyer or looking to upgrade, ICICI has financing solutions to meet your needs.

Tip 5: Take Advantage of ICICI's Insurance Products:

Protect yourself, your family, and your assets with ICICI's comprehensive Insurance products. Explore a range of insurance policies, including life insurance, health insurance, vehicle insurance, and more. Ensure peace of mind and financial security with ICICI's reliable insurance coverage.

Summary:

Empower yourself with these tips to make the most of your banking experience with ICICI Bank. From convenient mobile banking to wealth management services and tailored financial solutions, ICICI has a wide range of offerings to cater to your various banking needs. Embrace these insights to enhance your financial management and achieve your banking goals.

All About ICICI: Comprehensive Guide To India's Leading Bank

ICICI, one of India's leading banks, holds a prominent position in the financial landscape. Understanding its essential aspects provides a comprehensive view of its significance.

ICICI Bank logo in transparent PNG and vectorized SVG formats - Source companieslogo.com

- History and Evolution: Tracing ICICI's journey from its inception to becoming a banking giant.

- Products and Services: Exploring the wide range of financial solutions offered by ICICI.

- Technology and Innovation: Examining ICICI's adoption of advanced technologies and digital banking.

- Financial Performance: Analyzing ICICI's financial growth, profitability, and stability.

- Corporate Governance: Highlighting ICICI's commitment to ethical practices and transparent operations.

- CSR and Sustainability: Reviewing ICICI's initiatives towards social responsibility and environmental sustainability.

These key aspects offer a multifaceted perspective on ICICI, revealing its historical roots, diverse offerings, technological prowess, financial strength, ethical values, and social commitment. Understanding these dimensions helps us appreciate the bank's role in shaping India's financial ecosystem and driving economic growth.

Keerthi S on LinkedIn: ICICI Bank launches ‘Mine’ for millennials - Source www.linkedin.com

All About ICICI: Comprehensive Guide To India's Leading Bank

ICICI, or Industrial Credit and Investment Corporation of India, stands as India's largest private sector bank and a leading financial institution on a global scale. This comprehensive guide delves into the multifaceted aspects of ICICI, offering a profound understanding of its history, banking services, financial performance, and contributions to India's economic landscape.

ICICI Bank Platinum Chip Credit Card - Source campaigns.icicibank.com

ICICI's Genesis and Evolution: ICICI traces its roots to 1955, established as a development financial institution by the World Bank, Government of India, and Indian industry leaders. Over the years, it has evolved into a full-fledged commercial bank, offering a wide range of financial services to individuals, businesses, and institutions. ICICI's customer-centric approach and technological advancements have played a pivotal role in its growth and success.

Comprehensive Banking Services: ICICI's banking services encompass a vast array of offerings, catering to diverse financial needs. The bank's retail banking division provides personal banking accounts, loans, credit cards, and wealth management services. Corporate banking caters to businesses of all sizes, offering working capital solutions, project finance, and trade finance. ICICI also has a strong presence in investment banking and capital markets, providing services such as underwriting, mergers and acquisitions, and private equity.

Strong Financial Performance: ICICI has consistently delivered robust financial performance, reflecting its strong fundamentals and prudent risk management practices. The bank's net interest income, net profits, and return on equity (ROE) have been consistently growing, indicating its ability to generate sustainable profits. ICICI's financial strength has enabled it to expand its operations, invest in technology, and enhance its customer offerings.

Contribution to India's Economy: As India's leading private sector bank, ICICI plays a critical role in supporting the country's economic growth. The bank's lending to various sectors, including infrastructure, manufacturing, and agriculture, has contributed significantly to India's economic development. ICICI's focus on financial inclusion has also expanded access to banking services for marginalized communities, fostering economic empowerment and social progress.