Cost of Living Allowance: A Comprehensive Guide for Indian Employees The cost of living varies significantly from one city to another in India. This difference in the cost of living can have a major impact on the financial well-being of employees. As a result, many employers in India provide a cost of living allowance (COLA) to their employees.

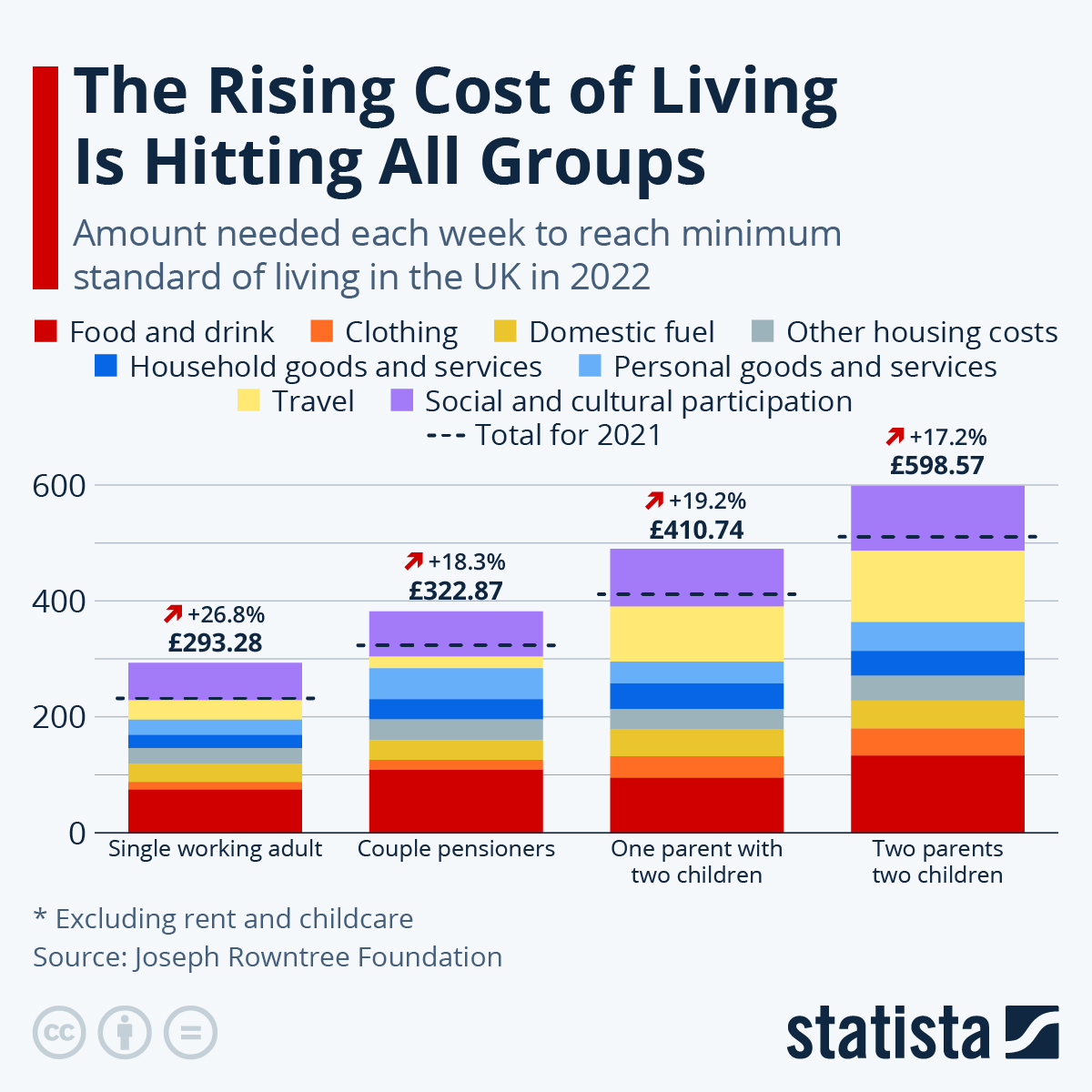

Chart: The Rising Cost of Living Is Hitting All Groups | Statista - Source www.statista.com

Editor's Notes: "Cost Of Living Allowance: A Comprehensive Guide For Indian Employees" have published today date". The purpose of this guide is to provide Indian employees with a comprehensive overview of cost of living allowance. This guide will cover the following topics:

• What is cost of living allowance? • How is cost of living allowance calculated? • What are the benefits of cost of living allowance? • How can I get cost of living allowance?

Key Differences

Main Article Topics

FAQ

This FAQ section provides answers to common questions regarding Cost of Living Allowance (COLA) for Indian employees. Whether you're an employer seeking guidance or an employee seeking clarity, this comprehensive guide covers essential details to ensure a clear understanding of COLA.

HOW TO CALCULATE 15% COST OF LIVING ALLOWANCE (COLA) - Source newsnowgh.com

Question 1: What is COLA?

COLA is a monetary allowance paid to employees to offset the increased cost of living in certain geographical locations. It aims to maintain a consistent standard of living for employees in different regions and compensates for inflation and geographic disparities in living expenses.

Question 2: Who is eligible for COLA?

Eligibility for COLA may vary depending on the organization's policies and the specific location where the employee is based. Typically, employees working in areas with a higher cost of living compared to the national average are entitled to COLA.

Question 3: How is COLA calculated?

COLA is typically calculated based on factors such as housing costs, transportation expenses, food prices, and other essential living expenses. The allowance may be adjusted periodically to account for fluctuations in the cost of living.

Question 4: Is COLA taxable?

In India, COLA paid to employees for working in certain cities is tax-free up to a specified limit. This limit is revised periodically and varies depending on the city.

Question 5: Can COLA be included as part of the salary?

While COLA is generally not considered part of the basic salary, some organizations may incorporate it into the salary structure for administrative convenience. However, it's important to note that COLA is typically paid in addition to the regular salary.

Question 6: What are the benefits of COLA?

COLA provides employees with financial assistance to meet the increased expenses associated with living in a particular location. It helps attract and retain employees in areas with a higher cost of living, and ensures a consistent standard of living across different regions.

In summary, understanding COLA is crucial for both employers and employees. Its purpose is to maintain a fair and equitable compensation system that accounts for the varying costs of living in different locations.

Next Article Section:

Tips

To ensure a smooth transition when relocating, several tips should be considered:

Tip 1: Research the cost of living in the new location thoroughly. Cost Of Living Allowance: A Comprehensive Guide For Indian Employees provides detailed information on various factors that impact expenses.

Tip 2: Negotiate a cost of living allowance that covers essential expenses and provides a comfortable standard of living.

Tip 3: Explore cost-saving measures such as shared accommodation, public transportation, and cooking meals at home.

Tip 4: Keep track of expenses and monitor if the allowance is sufficient. Adjust your lifestyle or negotiate with the employer if necessary.

Tip 5: Consider seeking professional advice from a financial advisor or relocation expert for personalized guidance.

Cost Of Living Allowance: A Comprehensive Guide For Indian Employees

Cost of Living Allowance (COLA) Rates as of February 25, 2024 : r - Source www.reddit.com

- Definition: Allowance granted to employees to cover living expenses.

- Purpose: To ensure employees maintain a reasonable standard of living.

- Determination: Calculated based on location, job grade, and other factors.

- Forms: Can be paid as a lump sum, monthly allowance, or reimbursement.

- Taxation: Partially taxable depending on regulations and individual circumstances.

- Impact: Affects employee morale, productivity, and overall financial well-being.

OCOLA decrease for KMC service members Nov. 16, May 16 > Ramstein Air - Source www.ramstein.af.mil

Understanding these aspects is crucial for employers and employees alike. Cost of living allowance plays a significant role in employee satisfaction and retention. It also ensures equitable compensation across different locations and job roles. By considering the factors that determine allowance, organizations can create a fair and transparent compensation system that supports employees' financial well-being and contributes to overall organizational success.

Cost Of Living Allowance: A Comprehensive Guide For Indian Employees

The cost of living allowance (COLA) is an additional payment that some employers provide to their employees to help them cover the cost of living in a particular location. COLA is typically paid in areas where the cost of living is significantly higher than the national average. In India, COLA is a common part of many employment packages, especially for employees who are relocating from other parts of the country.

Disability Living Allowance 2023 – Get Latest News Update - Source latestupdatenews2023.pages.dev

The amount of COLA that an employee receives is typically based on a number of factors, including the employee's salary, the location of the job, and the size of the employee's family. COLA payments are also often adjusted periodically to reflect changes in the cost of living. The COLA plays an important role in helping employees maintain their standard of living when they are working in an area with a high cost of living.

There are a number of benefits to receiving COLA. For employees, COLA can help them to cover the cost of living in a more expensive area. This can make it easier for employees to afford housing, food, transportation, and other expenses.

For employers, COLA can help to attract and retain employees in areas with a high cost of living. By offering COLA, employers can show that they are committed to supporting their employees and helping them to succeed.

COLAs are part of a larger system of wage adjustments designed to ensure that employees have a fair wage regardless of where they work or live.

Conclusion

COLA is an important part of many employment packages in India. It helps employees to cover the cost of living in a particular location and can make it easier for them to afford housing, food, transportation, and other expenses. For employers, COLA can help to attract and retain employees in areas with a high cost of living.

The COLA is a valuable benefit that can help employees and employers alike. It is an important part of the Indian employment landscape and is likely to continue to be a part of many employment packages for years to come.