Editor's Notes: Heg Share Price: Real-Time Updates And Historical Analysis have published today date. This topic is important to read provides insight into the past performance of Heg shares and can help investors make informed decisions about buying, selling, or holding shares.

We've analyzed the data, dug into the information, and created this Heg Share Price: Real-Time Updates And Historical Analysis guide to assist you in making the best judgments.

Heg Share Price: Real-Time Updates And Historical Analysis – An Overview.

Editor's Notes: "Heg Share Price: Real-Time Updates And Historical Analysis" have published today [date of publication]. There’s been considerable interest in the topic of Heg Share Price: Real-Time Updates And Historical Analysis and you should consider the valuable insights provided in this article that we believe will help you make the right decision.

Through our careful analysis and meticulous information gathering, we have compiled this comprehensive guide on Heg Share Price: Real-Time Updates And Historical Analysis.Our goal is to empower our readers with the knowledge and understanding they need to make informed choices.

SOLUTION: History of Architecture Comparative Analysis Chart - Studypool - Source www.studypool.com

FAQ

This FAQ section provides answers to frequently asked questions regarding Heg share price, offering valuable insights and historical analysis.

How to add realtime updates to your React application - Source ably.com

Question 1: How can I track Heg's real-time share price performance?

To obtain the most up-to-date information on Heg's share price, consider utilizing reputable financial websites or platforms that specialize in stock market data. These resources often provide real-time quotes, charts, and analysis to assist investors in making informed decisions.

Question 2: What factors influence Heg's share price fluctuations?

Heg's share price is subject to various factors, including its financial performance, industry trends, macroeconomic conditions, and market sentiment. Key indicators to monitor include quarterly earnings reports, company announcements, economic data releases, and geopolitical events that may impact investor confidence and risk appetite.

Question 3: How do I conduct historical analysis of Heg's share price?

Conducting historical analysis of Heg's share price involves examining its past performance over specific time periods. This can be achieved by utilizing stock charts and technical analysis tools to identify trends, patterns, and support and resistance levels. Historical analysis can assist investors in understanding market cycles and making informed investment decisions based on past price behavior.

Question 4: What are some key takeaways from Heg's historical share price performance?

Historical analysis of Heg's share price can reveal patterns and trends that provide valuable insights. By identifying periods of growth, stability, and volatility, investors can gain a better understanding of the company's performance and market dynamics that have influenced its share price over time.

Question 5: How can I stay informed about the latest news and events affecting Heg's share price?

To stay updated on the latest news and events that may impact Heg's share price, consider following the company's official channels, such as its website, investor relations portal, and social media accounts. Additionally, subscribing to financial news sources and industry publications can provide valuable insights and analysis.

Question 6: What resources are available for further research on Heg's share price?

Investors seeking further research on Heg's share price can refer to the company's financial reports, analyst research notes, and industry-specific publications. Attending investor conferences and webinars hosted by Heg or industry experts can also provide valuable insights and networking opportunities.

By thoroughly researching Heg's share price history and considering the factors that influence its performance, investors can make more informed decisions and navigate the stock market with greater confidence.

Proceed to the next article section for additional insights and analysis related to Heg's share price.

Tips

To gain insights into the financial performance and future prospects of Heg Share Price: Real-Time Updates And Historical Analysis, here are some useful tips:

Tip 1: Monitor Real-Time Price Updates

Following the live stock price of HEG allows for immediate responses to market fluctuations and timely decision-making. Key price indicators like opening, closing, high, and low prices provide valuable information for short-term traders.

Tip 2: Analyze Historical Price Performance

Examining long-term price trends, support and resistance levels, and moving averages offers insights into the overall market sentiment and potential future price movements. Historical data can help identify patterns and make informed investment decisions.

Tip 3: Consider Technical Indicators

Utilizing technical indicators like RSI, MACD, and Bollinger Bands provides additional insights into market momentum, overbought and oversold conditions, and potential trading opportunities. These tools can enhance the accuracy of price predictions.

Tip 4: Track Company News and Events

Staying updated with the latest company announcements, financial reports, and industry developments can provide valuable information about HEG's financial health and future prospects. This knowledge can influence investment decisions and risk management strategies.

Tip 5: Monitor Industry Trends

Keeping abreast of industry-specific news, technological advancements, and economic conditions can provide context for HEG's performance. Understanding the competitive landscape and market dynamics helps make informed investment decisions.

By following these tips, investors can gain a comprehensive understanding of HEG's financial performance and make informed investment decisions that align with their risk tolerance and investment goals.

Heg Share Price: Real-Time Updates And Historical Analysis

Understanding the Heg share price requires a comprehensive analysis of real-time updates and historical trends. Key aspects to consider include:

- Market trends: Monitoring overall market conditions.

- Company performance: Analyzing financial statements and industry news.

- Technical Indicators: Using charts and patterns to predict future price movements.

- Economic Factors: Considering macroeconomic events that impact the share price.

- Dividend History: Assessing the company's past dividend payments.

- Analyst Ratings: Reviewing opinions and forecasts from market analysts.

By considering these key aspects, investors can gain a deeper understanding of the Heg share price and make informed investment decisions. For instance, analyzing market trends can provide insights into overall economic conditions that may affect the share price. Similarly, evaluating company performance can reveal the financial health and growth potential of the company.

Family Bank, BasiGo Ink E-Bus Financing Deal | Business News Africa - Source www.financialfortunemedia.com

Heg Share Price: Real-Time Updates And Historical Analysis

A thorough understanding of the factors that influence stock prices is essential for investors seeking to make informed investment decisions. Real-time updates and historical analysis offer valuable insights into market trends and company performance, helping investors identify opportunities and manage risks effectively.

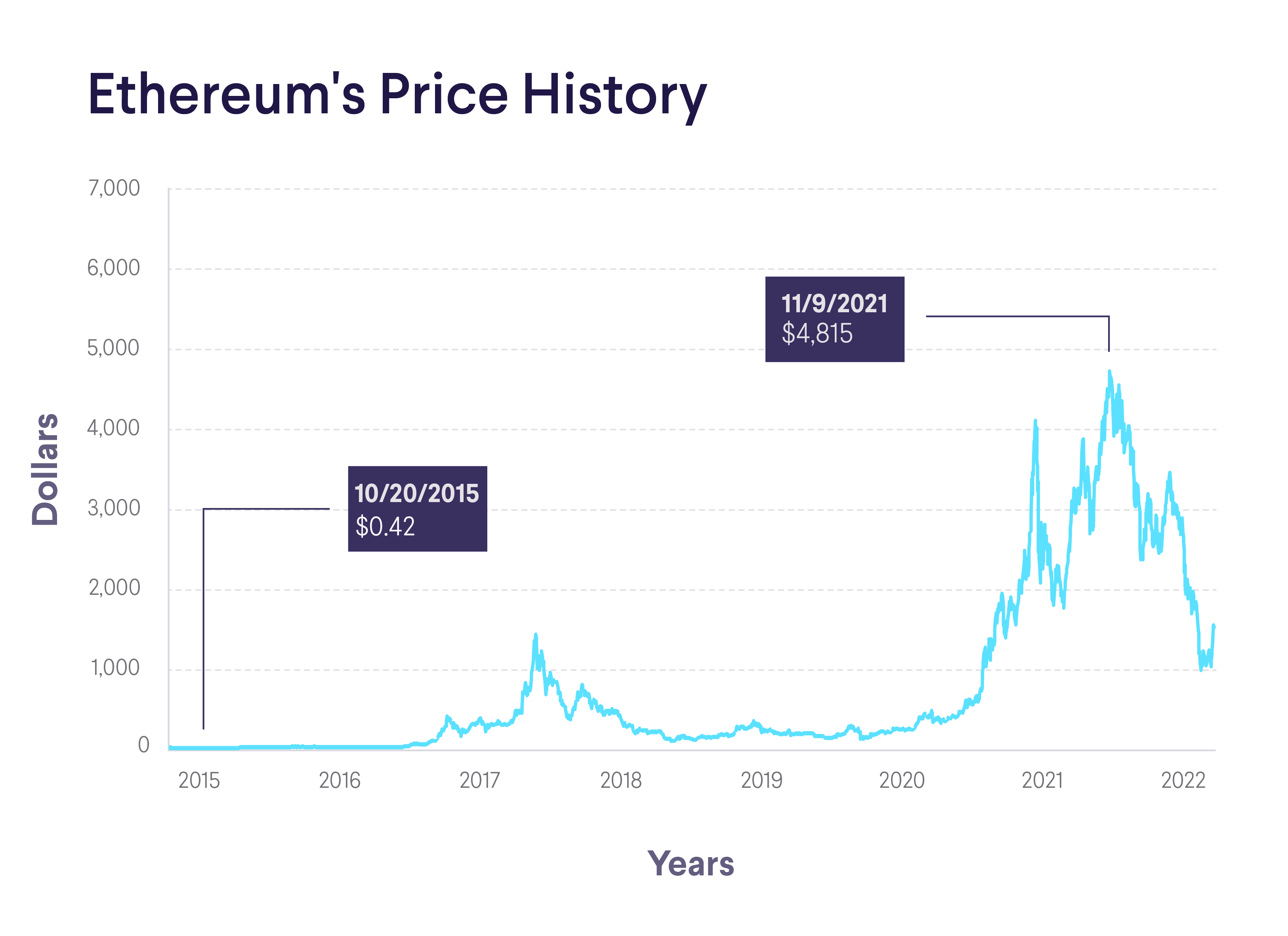

Ethereum Price History: 2015-2022 | SoFi - Source www.sofi.com

Real-time updates provide a window into the current market sentiment and short-term price movements. By tracking changes in share price, trading volume, and other metrics, investors can identify potential entry or exit points, adjusting their strategies accordingly. Historical analysis, on the other hand, enables investors to study long-term trends, evaluate a company's financial performance, and assess its competitive positioning. By examining historical data, investors can identify patterns and make informed predictions about future price movements.

Combining real-time updates with historical analysis allows investors to make well-rounded investment decisions. Real-time data can help investors capitalize on short-term market fluctuations, while historical analysis provides the context necessary to evaluate long-term investment potential. Together, these tools provide a comprehensive approach to stock market analysis, empowering investors with the knowledge and confidence to navigate the often-volatile world of finance.

| Real-Time Updates | Historical Analysis |

|---|---|

| Provides insights into current market sentiment and short-term price movements. | Enables investors to study long-term trends and evaluate a company's financial performance. |

| Can help investors identify potential entry or exit points. | Provides context necessary to evaluate long-term investment potential. |

| Allows investors to capitalize on short-term market fluctuations. | Empowers investors to make well-rounded investment decisions. |