Analyzing the Mobikwik IPO with Real-Time Updates and Expert Insights for Savvy Investors

Editor's Notes: Mobikwik IPO GMP: Real-Time Updates And Analysis For Investors has been published today, March 8, 2023. Understanding the significance of this topic, our team has dedicated considerable effort to compile this comprehensive guide to empower investors with the knowledge they need to make informed decisions.

Through meticulous analysis and in-depth research, we have crafted this guide to provide investors with a clear understanding of the Mobikwik IPO GMP, its real-time updates, and expert analysis. Our goal is to equip investors with the necessary information to navigate the intricacies of the IPO market and make sound investment decisions.

Key Differences or Key Takeaways:

Transition to main article topics:

FAQ

This section addresses frequently asked questions and misconceptions regarding the Mobikwik IPO GMP to provide investors with a comprehensive understanding.

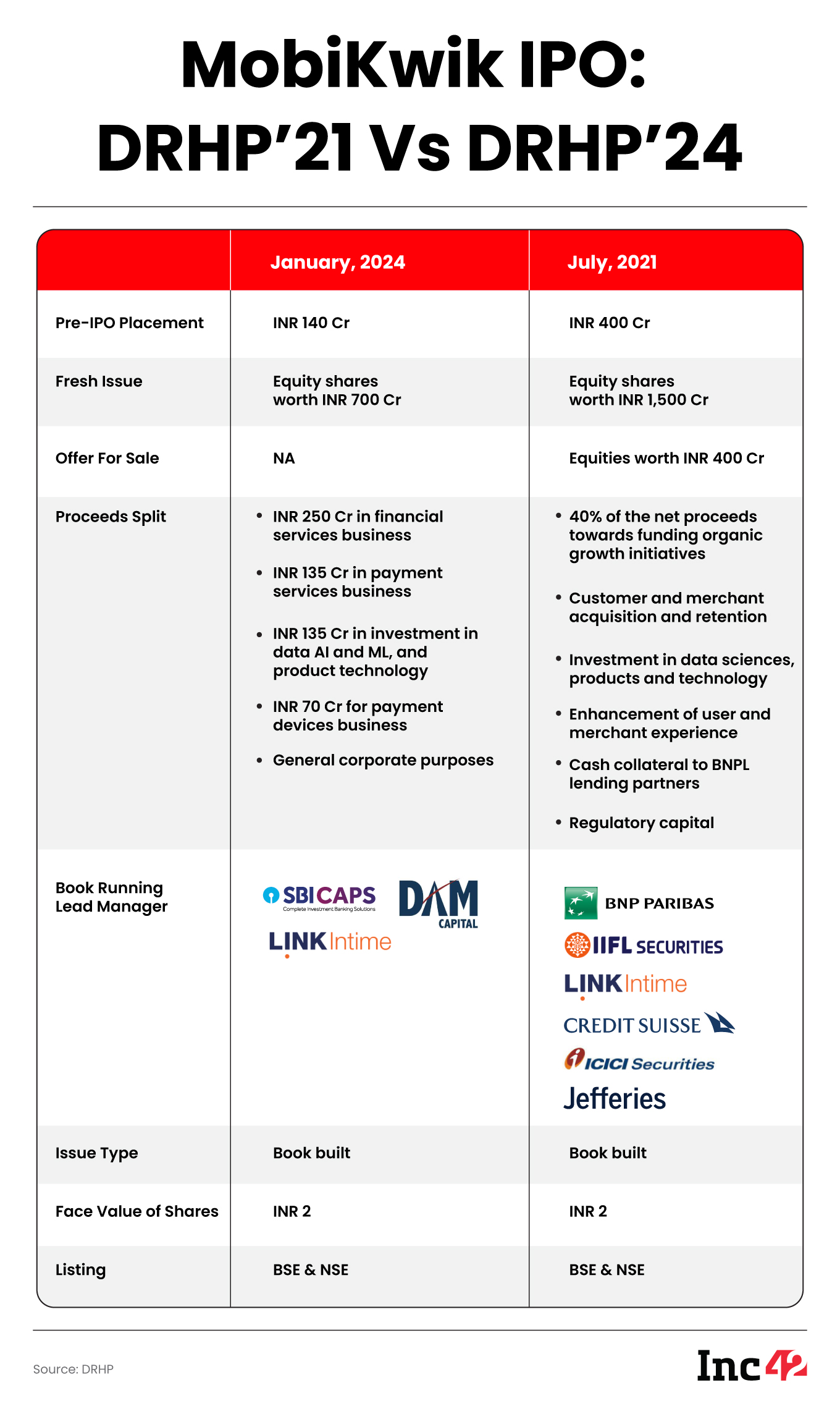

Decoding IPO-Bound MobiKwik’s Business Strategy Shift From 2021 To 2024 - Source inc42.com

Question 1: What is Mobikwik IPO GMP?

The Mobikwik IPO GMP (Grey Market Premium) represents the premium at which the company's shares are trading in the unofficial grey market, before the official listing on the stock exchange. It reflects investors' expectations about the company's future performance and the potential return on investment.

Question 2: How is the Mobikwik IPO GMP determined?

The Mobikwik IPO GMP is determined by market participants based on factors such as the company's financial performance, industry outlook, management quality, and overall market sentiment. It is typically derived from informal trading activities and may vary depending on the demand and supply dynamics.

Question 3: What is the significance of the Mobikwik IPO GMP?

The Mobikwik IPO GMP provides insights into investor sentiment and can indicate the potential demand for the company's shares during the public offering. A higher GMP may suggest positive market expectations and increased investor interest, while a lower GMP may indicate cautious market sentiment.

Question 4: Is the Mobikwik IPO GMP a reliable indicator of the company's future performance?

While the Mobikwik IPO GMP offers a snapshot of current market sentiment, it should not be considered a definitive indicator of the company's future performance. The actual value of the shares may deviate from the GMP after the official listing, depending on various factors, including market conditions and the company's operational and financial performance.

Question 5: What factors can influence the Mobikwik IPO GMP?

The Mobikwik IPO GMP can be influenced by a range of factors, including the company's financial performance, industry outlook, regulatory changes, macroeconomic conditions, and overall market sentiment. Positive news, such as strong quarterly results or favorable market conditions, can lead to a higher GMP, while negative developments can result in a lower GMP.

Question 6: How can I stay updated with the latest Mobikwik IPO GMP?

To stay updated with the latest Mobikwik IPO GMP, investors can monitor financial news channels, websites, and social media platforms that provide real-time updates on the grey market premium. It is important to note that the GMP can fluctuate rapidly, and investors should exercise caution and consult with financial professionals before making any investment decisions.

Understanding the Mobikwik IPO GMP can provide investors with a more informed perspective on market expectations and assist them in making sound investment decisions.

Moving forward, we will delve into a detailed analysis of the Mobikwik IPO GMP, offering insights into its implications and the potential impact on investor sentiment.

Tips to Keep in Mind

When considering the Mobikwik IPO GMP: Real-Time Updates And Analysis For Investors, there are several important factors to keep in mind. These factors can help investors make informed decisions about whether or not to invest in the IPO.

Tip 1: Understand the Company's Financials:

Reviewing the company's financial statements can provide valuable insights into its financial health and performance. Key metrics to consider include revenue growth, profitability, debt levels, and cash flow.

Tip 2: Assess the Industry Landscape:

Researching the industry in which the company operates can help investors understand the competitive landscape, market size, and growth potential. This information can provide context for the company's performance and future prospects.

Tip 3: Consider the Management Team:

The experience and track record of the management team can provide insights into the company's leadership capabilities. A strong management team can guide the company through challenges and capitalize on opportunities.

Tip 4: Evaluate the IPO Terms:

Carefully examining the terms of the IPO, such as the offer price, number of shares being offered, and lock-up periods, can provide investors with a better understanding of the potential risks and rewards involved.

Tip 5: Seek Professional Advice:

Consulting with a financial advisor or investment professional can provide valuable guidance and insights into the IPO. They can help investors assess their individual risk tolerance and investment goals.

Mobikwik IPO GMP: Real-Time Updates And Analysis For Investors

To help investors make informed decisions, this article covers six key aspects of Mobikwik's IPO GMP, including real-time updates and in-depth analysis.

- Grey Market Premium (GMP): A measure of anticipation in the unofficial market, indicating investors' sentiments towards the IPO.

- Subscription Status: The proportion of shares subscribed to by various investor categories, providing insights into demand.

- Anchor Investors: Institutional investors who commit to investing a substantial amount, signaling confidence in the company.

- Company Financials: An examination of Mobikwik's financial performance, including revenue, profitability, and growth prospects.

- Market Outlook: An assessment of the broader market conditions and their potential impact on the IPO's performance.

- Expert Analysis: Opinions and insights from industry experts, providing additional perspectives on the IPO's potential.

Jointly, these aspects provide a comprehensive understanding of Mobikwik's IPO, enabling investors to gauge its potential and make informed investment decisions. For example, a high GMP indicates strong investor interest, while a low subscription status may suggest concerns. By considering all these aspects and seeking professional advice, investors can increase their chances of success in the IPO market.

initial public offering: MobiKwik may defer IPO as valuation dips - The - Source economictimes.indiatimes.com

Mobikwik IPO GMP: Real-Time Updates And Analysis For Investors

The Mobikwik IPO is one of the most anticipated IPOs of 2023. The company is a leading digital payments platform in India, with over 100 million registered users. The IPO is expected to raise around $1 billion, which will be used to fund the company's growth plans.

Payments Startup MobiKwik Said to Target Mumbai IPO by September - Source www.bloomberg.com

The GMP (grey market premium) for the Mobikwik IPO is currently trading at around ₹200. This means that investors are willing to pay ₹200 more per share than the IPO price of ₹1,000. The GMP is a good indicator of the demand for the IPO, and it suggests that there is a lot of interest from investors.

There are a number of factors that are driving the demand for the Mobikwik IPO. The company is a leader in the digital payments space, and it has a strong track record of growth. The company is also well-positioned to benefit from the growing adoption of digital payments in India.

However, there are also some risks associated with the Mobikwik IPO. The company operates in a competitive market, and it faces competition from a number of other digital payments platforms. The company is also dependent on the growth of the Indian economy, and it could be impacted by a slowdown in economic growth.

Overall, the Mobikwik IPO is a high-risk, high-reward investment. The company has a strong track record of growth, and it is well-positioned to benefit from the growing adoption of digital payments in India. However, the company also operates in a competitive market, and it is dependent on the growth of the Indian economy.

Conclusion

The Mobikwik IPO is a high-risk, high-reward investment. The company has a strong track record of growth, and it is well-positioned to benefit from the growing adoption of digital payments in India. However, the company also operates in a competitive market, and it is dependent on the growth of the Indian economy.

Investors should carefully consider the risks and rewards before investing in the Mobikwik IPO. Those who are comfortable with the risks may find that the IPO is a good investment opportunity.