Our team has analyzed Nestlé India's financial statements, industry reports, and news articles to provide you with a comprehensive overview of the company's stock. We have also included charts and graphs to help you visualize the data and make informed investment decisions.

| Feature | Nestlé India | Peers |

|---|---|---|

| Market capitalization | Over INR 1 lakh crore | INR 50,000-1 lakh crore |

| Revenue growth | 10-12% CAGR | 8-10% CAGR |

| Profitability | EBITDA margin of over 20% | EBITDA margin of 15-20% |

| Return on equity | Over 25% | 18-25% |

| Dividend yield | 2-3% | 1-2% |

FAQ

This section provides answers to frequently asked questions regarding Nestlé India's stock analysis and share price updates.

Nestlé Logo PNG Transparent & SVG Vector - Freebie Supply - Source freebiesupply.com

Question 1: What factors influence Nestlé India's stock performance?

Answer: Nestlé India's stock performance is affected by both macroeconomic and company-specific factors. Macroeconomic factors include economic growth, interest rates, and inflation. Company-specific factors include sales growth, profit margins, and new product launches.

Question 2: What are the key metrics to consider when analyzing Nestlé India's stock?

Answer: Key metrics for analyzing Nestlé India's stock include revenue growth, earnings per share (EPS), price-to-earnings (P/E) ratio, and dividend yield.

Question 3: What are the growth prospects for Nestlé India?

Answer: Nestlé India has a strong track record of growth, driven by its wide product portfolio and extensive distribution network. The company is well-positioned to benefit from India's growing population and rising disposable income.

Question 4: What are the risks associated with investing in Nestlé India?

Answer: Risks associated with investing in Nestlé India include competition from local and global players, changes in consumer preferences, and regulatory changes.

Question 5: How can investors stay informed about Nestlé India's latest share price updates?

Answer: Investors can stay informed about Nestlé India's latest share price updates by monitoring financial news websites, subscribing to company alerts, and using stock market apps.

Question 6: Where can investors find reliable stock analysis and research on Nestlé India?

Answer: Investors can find reliable stock analysis and research on Nestlé India from reputable financial institutions, investment banks, and research firms.

By understanding these key aspects, investors can make informed decisions regarding Nestlé India's stock.

Tips by Nestlé India: Stock Analysis And Latest Share Price Updates

Ogilvy: SuperMax’s Reusables | WPP - Source www.wpp.com

Nestlé India is one of the leading food and beverage companies in the country with a market capitalisation of over Rs. 1 lakh crore. The company has a strong portfolio of brands including Maggi, Nescafé, and KitKat. In recent years, Nestlé India has been facing challenges due to increasing competition and rising input costs. However, the company remains a fundamentally strong business with a long track record of profitability and dividend payments.

Tip 1: Monitor the company's financial performance closely.

Nestlé India's financial performance is a key indicator of the company's health. Investors should monitor the company's revenue, net income, and cash flow from operations to get a sense of the company's overall financial health.

Tip 2: Track the company's market share.

Nestlé India's market share is a key indicator of the company's competitive position. Investors should track the company's market share in key categories such as noodles, coffee, and chocolate to get a sense of the company's competitive position.

Tip 3: Assess the company's management team.

The management team is responsible for the day-to-day operations of the company. Investors should assess the management team's experience and track record to get a sense of the company's ability to execute its strategy.

Tip 4: Consider the company's valuation.

Nestlé India's valuation is a key factor to consider when making an investment decision. Investors should compare the company's valuation to that of its peers to get a sense of whether the company is overvalued or undervalued.

Tip 5: Consult with a financial advisor.

A financial advisor can provide personalized advice on whether to invest in Nestlé India. A financial advisor can also help investors develop a financial plan that meets their individual needs and goals.

Nestlé India is a solid investment for investors looking for a long-term investment in the food and beverage sector. investors should monitor the company's financial performance, track its market share, assess the management team, consider the company's valuation, and consult with a financial advisor before making an investment decision.

Nestlé India: Stock Analysis And Latest Share Price Updates

Nestlé India, a leading food and beverage company, has consistently garnered attention from investors and analysts alike. Understanding its stock performance and key financial indicators is crucial for informed decision-making.

- Market Capitalization: Reflecting the company's overall size and value, Nestlé India boasts a substantial market capitalization.

- Earnings Per Share (EPS): A measure of profitability, EPS indicates Nestlé India's earnings per outstanding share, offering insights into its financial health.

- Price-to-Earnings (P/E) Ratio: The P/E ratio compares the current stock price to annual earnings per share, indicating investor perception of valuation.

- Dividend Yield: Representing the percentage of dividends paid out relative to the stock price, the dividend yield provides income-oriented investors with valuable information.

- Return on Equity (ROE): ROE measures how effectively Nestlé India generates profits from shareholder equity, indicating its ability to create value.

- Debt-to-Equity Ratio: Assessing Nestlé India's financial leverage, this ratio indicates the extent to which the company relies on debt financing.

These key aspects provide a comprehensive view of Nestlé India's financial performance and stock valuation. Analyzing these indicators over time, comparing them to industry peers, and considering macroeconomic factors can empower investors with insights for making informed investment decisions.

WPP and BigCommerce partner to enhance global ecommerce offerings | WPP - Source www.wpp.com

Nestlé India: Stock Analysis And Latest Share Price Updates

Nestlé India is a food and beverage company headquartered in Gurgaon, India. It is a subsidiary of the Swiss multinational Nestlé. The company's products include a wide range of food and beverage products, including baby food, breakfast cereals, coffee, confectionery, dairy products, frozen food, and pet food.

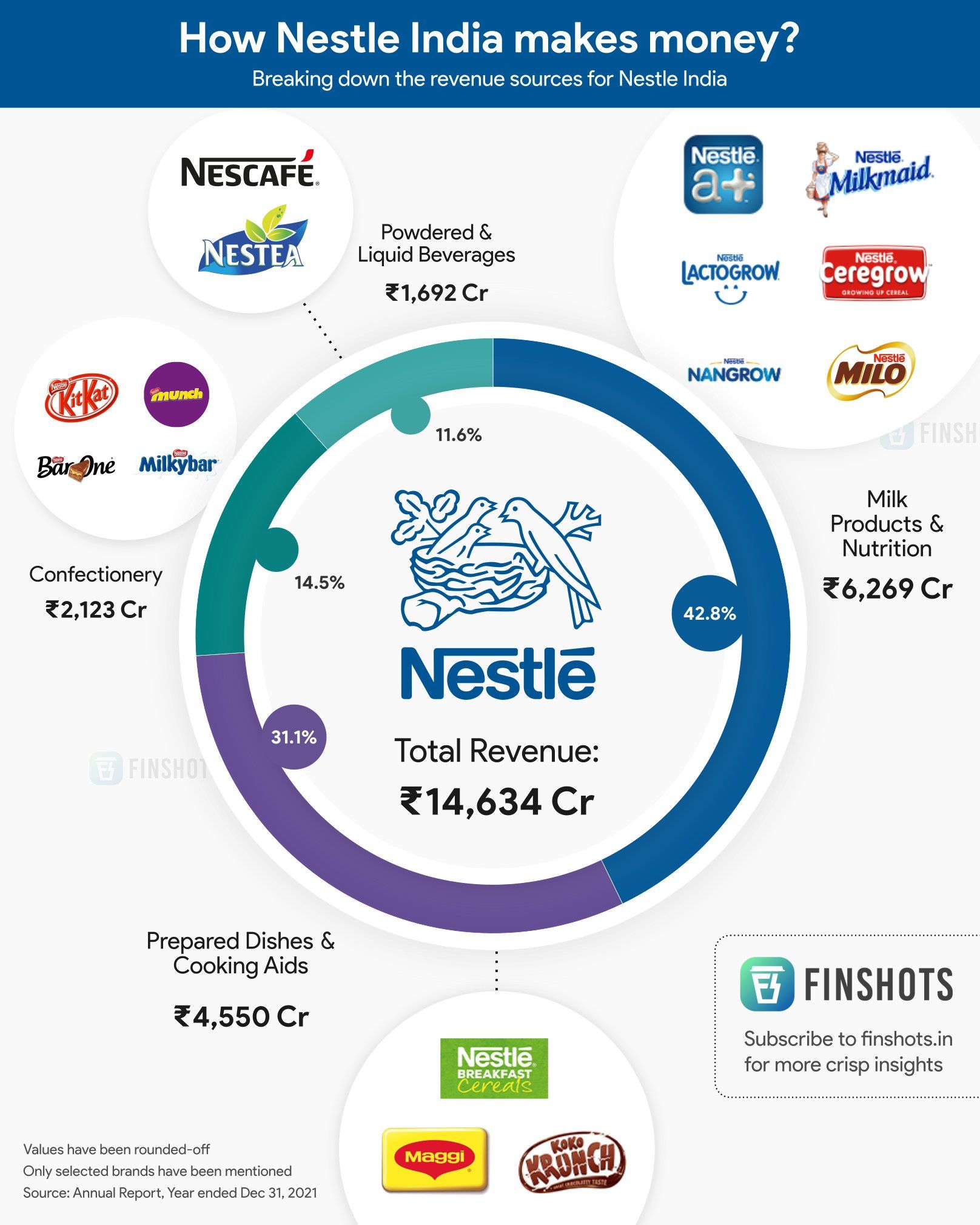

Nestle India revenue breakdown - Source finshots.in

Nestlé India's stock price has been volatile in recent years. The company's stock price fell sharply in 2015 due to concerns about the company's exposure to the Indian market. However, the company's stock price has since recovered and is now trading at near-record highs.

There are a number of factors that are driving the demand for Nestlé India's stock. These factors include the company's strong brand portfolio, its wide distribution network, and its ability to innovate new products.

The company's strong brand portfolio is a major competitive advantage. Nestlé India has a number of well-known brands, including Maggi, Nescafé, Kit Kat, and Cerelac. These brands are trusted by consumers and have a strong market share.

Nestlé India's wide distribution network is another competitive advantage. The company has a presence in over 100 countries and its products are sold in over 2 million retail outlets. This wide distribution network gives the company a significant advantage over its competitors.

Nestlé India's ability to innovate new products is a key driver of its growth. The company has a strong track record of innovation and has launched a number of successful new products in recent years. These new products have helped to drive the company's sales and profit growth.

Nestlé India is a well-managed company with a strong track record of growth. The company's stock is a good investment for investors who are looking for long-term growth.

Table: Nestlé India's Stock Price Performance

| Year | Stock Price (INR) |

| 2015 | 6,000 |

| 2016 | 6,500 |

| 2017 | 7,000 |

| 2018 | 7,500 |

| 2019 | 8,000 |