Nisus Finance IPO allotment status, key details, and timeline are some of the most sought-after information by investors who have applied for the initial public offering (IPO) of the company. This information is important as it provides investors with an idea of whether they have been allotted shares in the IPO and, if so, how many. It also gives investors a timeline of when they can expect to receive their shares and when they can start trading them.

To help investors, we have put together this Nisus Finance IPO Allotment: Key Details, Timeline, And Application Status guide. In this guide, we will cover the following topics:

| Key Details | Timeline | Application Status | |

|---|---|---|---|

| Issue Open Date | February 15, 2023 | Check your application status here. | |

| Issue Close Date | February 17, 2023 | Allotment Date | |

| Allotment Date | February 21, 2023 | Listing Date | |

| Listing Date | February 23, 2023 |

Ztech India IPO Basis of Allotment Status - Source www.chittorgarh.com

We hope this guide will be helpful to investors who have applied for the Nisus Finance IPO.

FAQ

This page provides a comprehensive set of frequently asked questions (FAQs) to assist individuals in understanding the key details, timeline, and application status of the upcoming Nisus Finance IPO (Initial Public Offering).

Shivam Chemicals IPO Basis of Allotment Status - Source www.chittorgarh.com

Question 1: What is the issue size of the Nisus Finance IPO?

The issue size of the Nisus Finance IPO is 100 crore rupees, divided into 10,000,000 equity shares with a face value of 10 rupees each.

Question 2: What is the price range for the Nisus Finance IPO?

The price range for the Nisus Finance IPO has been set at 100 to 105 rupees per share.

Question 3: When will the Nisus Finance IPO open for subscription?

The Nisus Finance IPO will open for subscription on [Date] and close on [Date].

Question 4: What is the minimum lot size for applying to the Nisus Finance IPO?

The minimum lot size for applying to the Nisus Finance IPO is 1000 shares.

Question 5: How can I apply for the Nisus Finance IPO?

Individuals can apply for the Nisus Finance IPO through any of the following methods:

- Online through a registered broker.

- Offline by submitting a physical application form at a designated branch of the registrar.

Question 6: When will the allotment of Nisus Finance IPO shares take place?

The allotment of Nisus Finance IPO shares will take place on [Date].

By understanding these key details, investors can navigate the Nisus Finance IPO process with confidence.

For further information and updates, please refer to the official IPO prospectus or consult with a registered financial advisor.

Tips by Nisus Finance IPO Allotment: Key Details, Timeline, And Application Status

Tip 1: Check the allotment status on the BSE and NSE websites.

Tip 2: Enter your PAN number or application number to view the allotment details.

Tip 3: If you have been allotted shares, you will need to pay the balance amount by the due date.

Tip 4: You can sell your allotted shares on the stock exchange after the listing date.

Tip 5: Keep track of the latest news and updates on the IPO.

Nisus Finance IPO Allotment: Key Details, Timeline, And Application Status

Understanding the essential aspects of the Nisus Finance IPO allotment is crucial for investors considering applying or participating in the process. This guide will highlight six key aspects, providing a comprehensive overview of what investors need to know.

- Issue Size: The total amount of funds raised through the IPO

- Price Band: The range within which investors can bid for shares

- Lot Size: The minimum number of shares that can be applied for

- Application Dates: The period during which investors can submit applications

- Allotment Date: The date when shares are allocated to successful applicants

- Listing Date: The date when shares start trading on the stock exchange

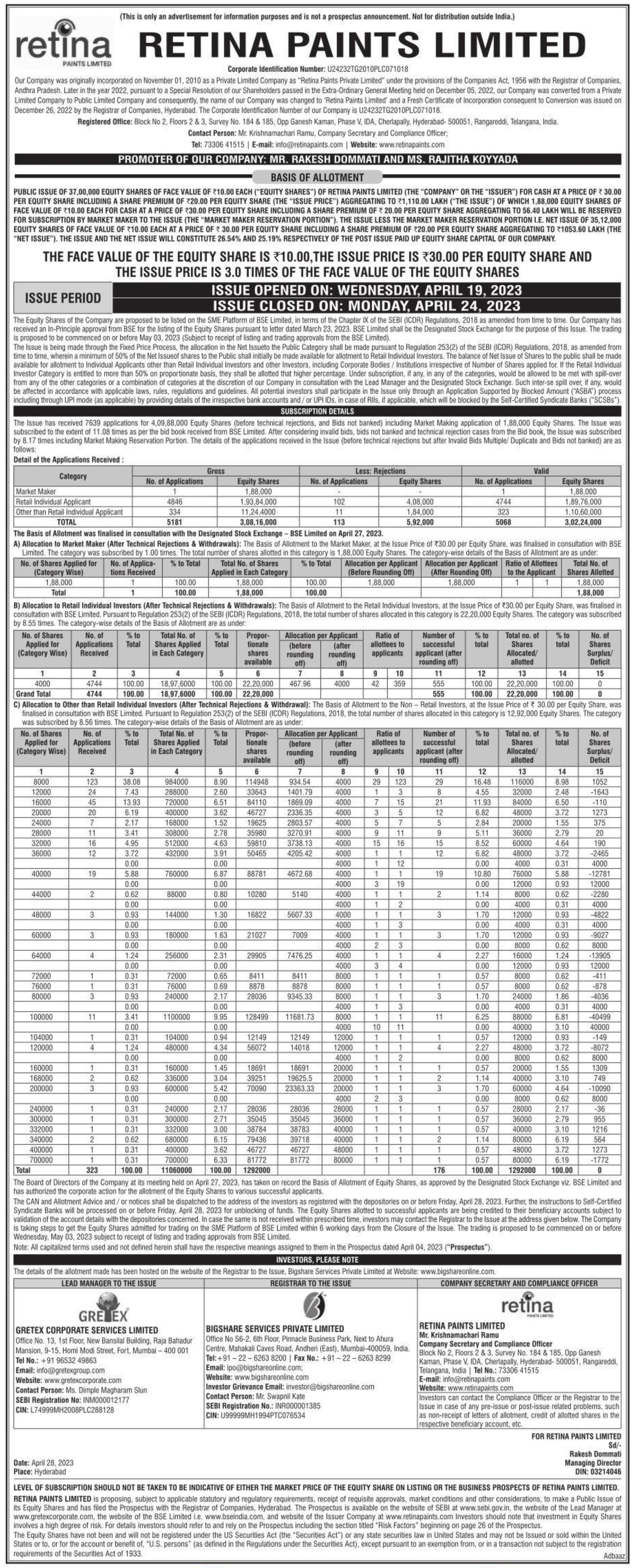

Retina Paints IPO Basis of Allotment Status - Source www.chittorgarh.com

The allotment process involves evaluating applications, considering factors such as the bid price, lot size, and investor category. Successful allottees will receive shares in their demat accounts, while unsuccessful applicants will receive a refund of their application amount. Understanding these key aspects will enable investors to make informed decisions regarding their participation in the Nisus Finance IPO.

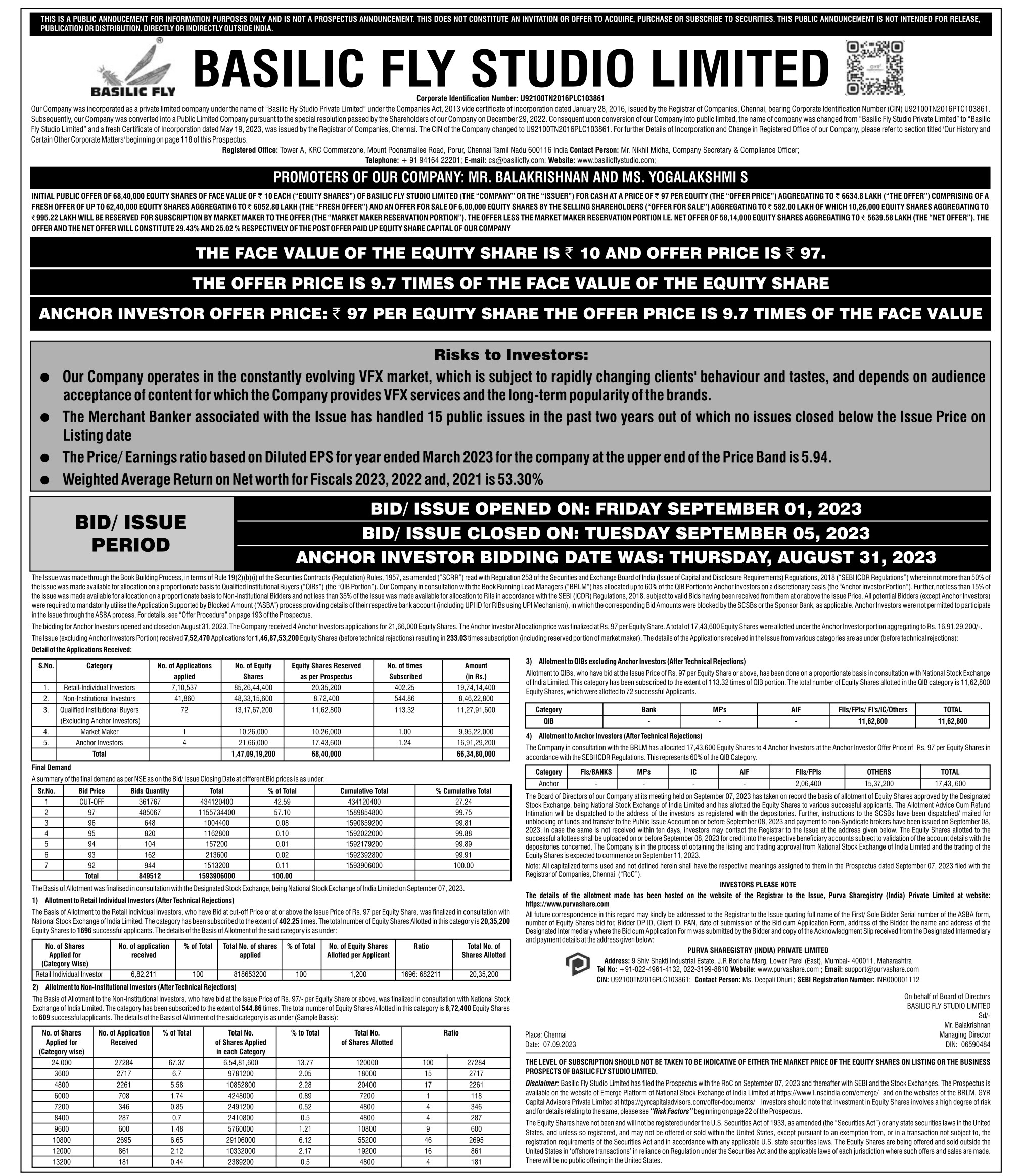

Basilic Fly Studio IPO Basis of Allotment Status - Source www.chittorgarh.com

Nisus Finance IPO Allotment: Key Details, Timeline, And Application Status

The Initial Public Offering (IPO) of Nisus Finance is a highly anticipated event for investors. IPO allotment refers to the process of distributing shares of the company to successful applicants. To fully understand the Nisus Finance IPO allotment, it is crucial to grasp the key details, timeline, and application status.

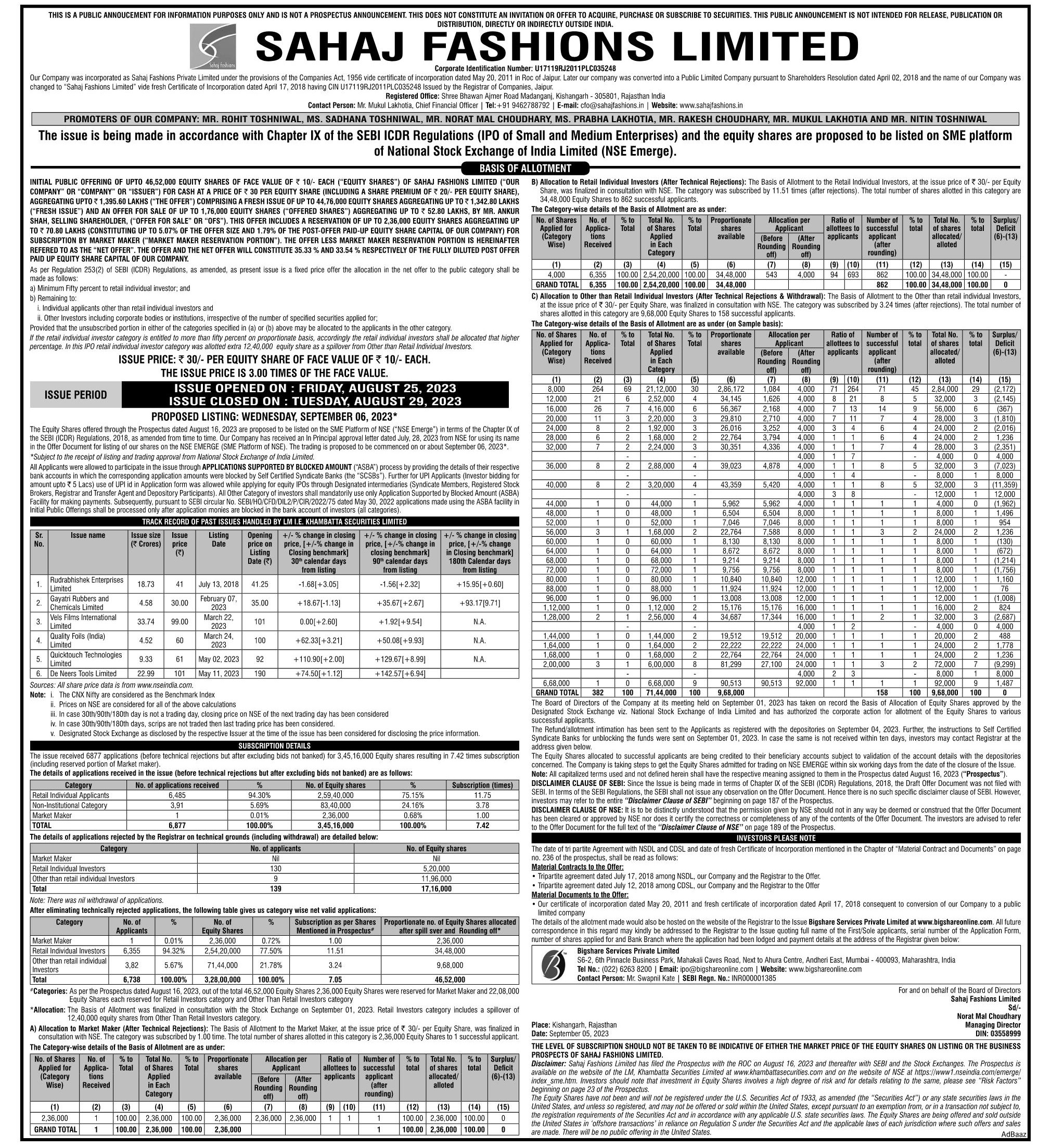

Sahaj Fashions IPO Basis of Allotment Status - Source www.chittorgarh.com

The allotment process commences with the finalization of the basis of allotment, which determines the proportion of shares assigned to each applicant. Eligible investors can track their application status through the designated registrar's website or the stock exchange platform. Post-allotment, successful applicants receive confirmation of their share allocation, along with details on the number of shares allotted and the price at which they were allotted.

By comprehending the Nisus Finance IPO allotment mechanism, investors can stay informed throughout the process, maximizing their chances of successful participation. This understanding empowers them to make informed decisions regarding their investment strategy, ensuring a smooth and seamless experience during the IPO.

| Key Details | Timeline | Application Status |

|---|---|---|

| Issue Size | March 8-10, 2023 | Check Registrar's Website/Stock Exchange Platform |

| Price Band | Basis of Allotment Finalized | Confirmation of Share Allocation, Price, and Quantity |

| Minimum Bid Lot | Allotment Date | Track Post-Allotment Status |

Conclusion

The Nisus Finance IPO allotment process is a crucial aspect of the company's public offering. Understanding the key details, timeline, and application status enables investors to navigate the process effectively, enhancing their chances of successful participation. This knowledge empowers investors to make informed decisions and stay updated throughout the IPO journey.

As the IPO market continues to evolve, it is imperative for investors to stay informed about the various processes involved in public offerings. This will allow them to capitalize on investment opportunities and make well-informed decisions that align with their financial goals.