How to Track Real-Time Jp Associates Share Price and Performance With In-Depth Analysis?

Editor's Notes: "Real-Time Jp Associates Share Price: Track Stock Performance With In-Depth Analysis" have published today. Real-time stock price tracking and analysis are vital to making informed investment decisions.

To help investors make the right decision, we put together this Real-Time Jp Associates Share Price: Track Stock Performance With In-Depth Analysis guide.

| Key | Differences | Takeways |

| Real-Time Share Price | Updates every second | Provides the most up-to-date stock price information |

| In-Depth Analysis | Considers financial statements, company news, and industry trends | Offers a comprehensive understanding of a stock's value |

| Historical Data | Shows how the stock has performed over time | Helps identify trends and support investment decisions |

FAQs

This section provides thorough answers to frequently asked questions regarding real-time Jp Associates share prices. The questions encompass a wide range of topics, providing comprehensive guidance to interested parties.

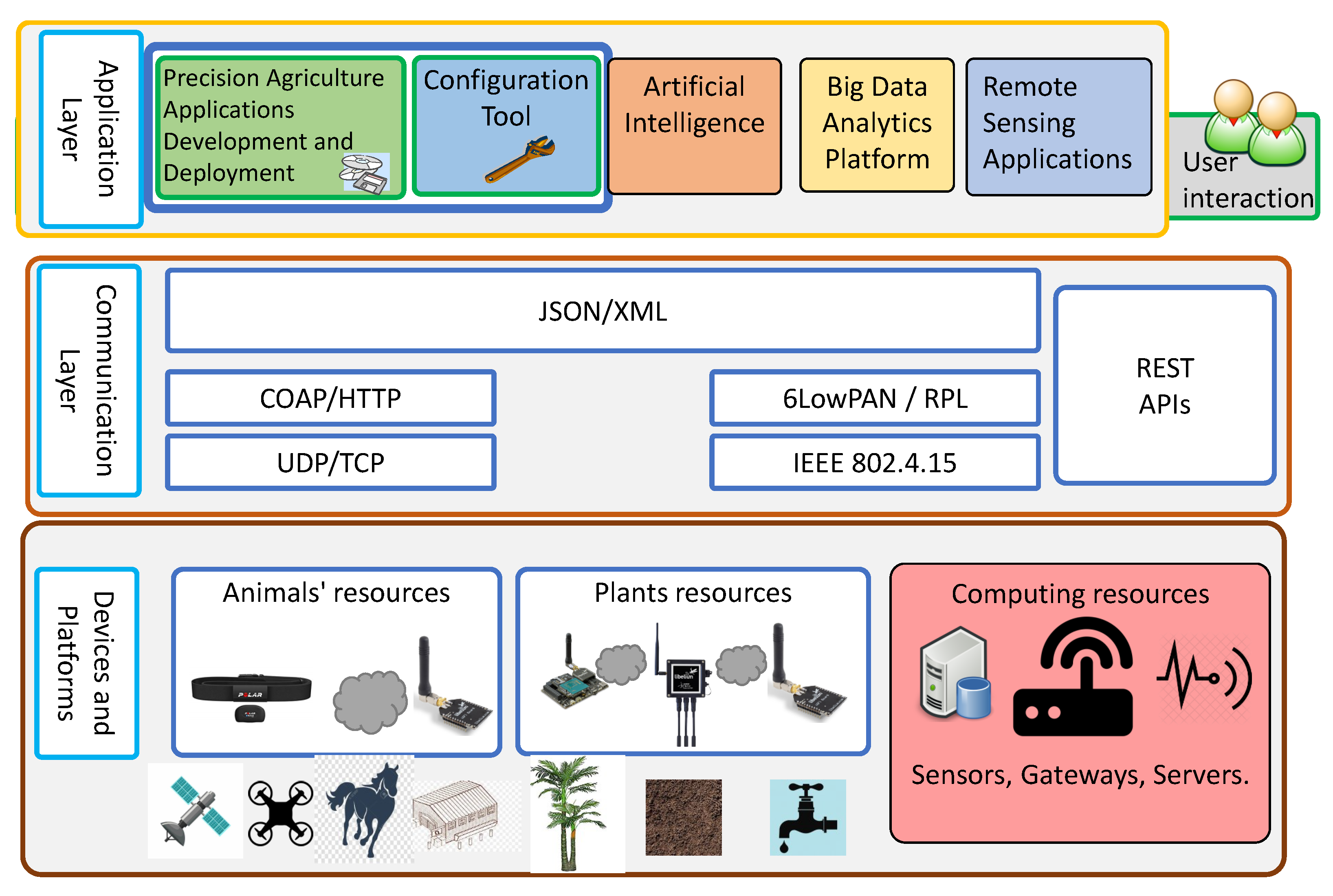

Information | Free Full-Text | IoT-Enabled Precision Agriculture - Source www.mdpi.com

Question 1: What factors influence Jp Associates' share price in real-time?

Answer: Jp Associates' share price in real-time is influenced by a combination of factors, including company performance, industry conditions, and overall market sentiment. Strong financial results, positive industry outlook, and favorable market conditions can lead to a rise in the share price, while conversely, weak performance, industry headwinds, and negative market sentiment can drive the price down.

Question 2: How can I track Jp Associates' share price live?

Answer: Several financial websites and brokerage platforms offer real-time tracking of Jp Associates' share price. These platforms provide up-to-date information on the stock's price, volume, and other relevant metrics, allowing you to monitor the stock's performance as it happens.

Question 3: Is investing in Jp Associates a good long-term investment?

Answer: The long-term investment potential of Jp Associates depends on various factors, such as the company's financial stability, industry growth prospects, and overall market conditions. It is essential to thoroughly research and assess the company's fundamentals and market outlook before making any investment decisions.

Question 4: What are the key risks associated with investing in Jp Associates?

Answer: Investing in Jp Associates, like any other investment, carries certain risks. These risks may include fluctuations in the company's financial performance, economic downturns, and changes in government regulations. Potential investors should be aware of these risks and assess their risk tolerance before investing.

Question 5: How does Jp Associates compare to its competitors in terms of stock performance?

Answer: Comparing Jp Associates' stock performance to its competitors provides insights into the company's relative strength in the industry. By analyzing key financial ratios, growth metrics, and market share, investors can gain a better understanding of Jp Associates' competitive position and potential for future growth.

Question 6: What are the future prospects for Jp Associates' share price?

Answer: The future prospects of Jp Associates' share price depend on a multitude of factors, including the company's strategic initiatives, industry trends, and overall economic conditions. Analysts and investors may provide forecasts or outlooks based on their assessment of these factors, but it is important to remember that these forecasts are subject to change and should be interpreted with caution.

These FAQs provide valuable insights into various aspects of real-time Jp Associates share price performance. By addressing common questions and concerns, they aim to empower investors and researchers with the information they need to make sound investment decisions.

Tips for Monitoring JP Associates Share Price

Keeping a watchful eye on the stock performance of JP Associates is crucial for informed investment decisions. Real-Time Jp Associates Share Price: Track Stock Performance With In-Depth Analysis equip investors with the tools and insights to effectively track and analyze the company's stock behavior.

Tip 1: Utilize Real-Time Data: Access up-to-date share price information to stay abreast of market fluctuations and make timely trading decisions. Real-time data ensures traders operate with the most current information, minimizing the risk of delayed or outdated data affecting decision-making.

Tip 2: Conduct Thorough Research: In-depth research into JP Associates' financial statements, industry trends, and economic conditions is essential to understand the factors driving its stock price. This knowledge allows investors to make informed assessments of the company's future prospects and potential risks.

Tip 3: Monitor Market Sentiment: Paying attention to market sentiment towards JP Associates is crucial in understanding its stock performance. Analyzing news articles, analyst reports, and investor discussions can provide valuable insights into the market's perception of the company's performance and future outlook.

Tip 4: Set Realistic Expectations: Avoid making impulsive decisions based on short-term stock price fluctuations. Set realistic expectations for stock performance and focus on long-term investment goals. Panicking or making rash decisions during temporary downturns can lead to missed opportunities or financial losses.

Tip 5: Seek Professional Advice: Consider consulting with financial advisors or equity analysts for expert insights into JP Associates' stock performance. Their knowledge and experience can provide valuable perspectives and help investors make informed decisions aligned with their risk tolerance and financial objectives.

Summary: By implementing these tips, investors can effectively track and analyze the stock performance of JP Associates. Real-time data, comprehensive research, market sentiment monitoring, realistic expectations, and professional advice are all essential tools for informed investment decisions.

Real-Time Jp Associates Share Price: Track Stock Performance With In-Depth Analysis

For investors and traders, tracking the real-time share price of Jp Associates is essential for informed decision-making. This analysis provides key aspects to help investors monitor and understand the company's stock performance.

- Live Market Data:

- Historical Price Movements:

- Technical Analysis Indicators:

- Company Financials and Announcements:

- Industry News and Trends:

- Expert Commentary and Insights:

These aspects, when combined, provide a comprehensive view of Jp Associates' stock performance. Live market data allows investors to track real-time price fluctuations, while historical data reveals trends and patterns. Technical indicators signal potential trading opportunities, and company financials and announcements help assess the company's health. Industry news and trends keep investors informed about external factors affecting the stock, and expert commentary provides valuable insights and analysis. By considering all these aspects, investors can make informed decisions and optimize their stock market performance.

MILLS HIGH SCHOOL TRACK & FIELD - Source www.carducciassociates.com

Real-Time Jp Associates Share Price: Track Stock Performance With In-Depth Analysis

Monitoring real-time Jp Associates share prices is paramount for investors seeking to make informed decisions. This comprehensive analysis provides up-to-date information, enabling investors to track stock performance and identify trends. By incorporating both technical and fundamental analysis, this tool empowers investors to assess the company's financial health, industry outlook, and market sentiment.

China’s New MBTI Personality Test Craze | The World of Chinese - Source www.theworldofchinese.com

Real-time share price tracking offers several advantages. Firstly, it allows investors to stay abreast of market fluctuations and react swiftly to changes in the company's value. Secondly, it enables investors to make informed decisions based on real-time data, rather than relying on historical information or delayed quotes. Thirdly, it provides valuable insights into the company's performance, helping investors identify potential opportunities and risks.

In-depth analysis complements real-time share price tracking by providing a comprehensive understanding of the company's fundamentals. By examining financial statements, industry reports, and news articles, investors can gain insights into the company's financial performance, management team, and competitive landscape. This information is crucial for assessing the company's long-term potential and making informed investment decisions.

In conclusion, real-time Jp Associates share price tracking combined with in-depth analysis is an indispensable tool for investors. By providing comprehensive and up-to-date information, this combination empowers investors to make informed decisions, identify trends, and assess the company's financial health and market sentiment. This comprehensive approach is essential for successful investing and achieving financial goals.

| Key Feature | Benefit |

|---|---|

| Real-time share price tracking | Immediate response to market fluctuations |

| In-depth fundamental analysis | Comprehensive understanding of company fundamentals |

| Combined analysis | Informed investment decisions based on real-time and historical data |

Conclusion

Real-time Jp Associates share price tracking and in-depth analysis provide investors with a powerful tool for making informed investment decisions. By tracking stock performance and analyzing company fundamentals, investors can identify trends, assess risk, and maximize their potential for financial success. This comprehensive approach is essential for successful investing in today's dynamic and competitive market.

As the market landscape continues to evolve, investors must embrace the power of real-time data and in-depth analysis to stay ahead of the curve. This combination of tools empowers investors to make well-informed decisions and achieve their financial goals.