Interested in "Samvardhana Motherson Share Price: Real-Time Updates, Historical Data, And Expert Analysis"?

We understand the significance of making well-informed investment decisions. With our continuous efforts in analyzing market trends and collecting valuable data, we've curated this comprehensive guide on "Samvardhana Motherson Share Price: Real-Time Updates, Historical Data, And Expert Analysis" to empower you with critical information and analysis.

Key Differences

To provide a clear understanding, we've summarized the key differences in this informative table:

| Attribute | Description |

|---|---|

| Real-Time Updates | Get instant access to the latest stock price movements and market news. |

| Historical Data | Analyze historical stock performance, including price charts, volume data, and more. |

| Expert Analysis | Leverage insights from industry experts, analysts, and financial professionals. |

| Decision-Making Support | With comprehensive information at your fingertips, make informed investment decisions with confidence. |

Main Article Topics

- Understanding Samvardhana Motherson Share Price

- Analyzing Historical Performance

- Expert Insights and Market Predictions

- Investment Strategies and Considerations

- Staying Informed with Real-Time Updates

FAQ

This comprehensive FAQ section provides valuable information and expert insights on Samvardhana Motherson Share Price, covering historical data, real-time updates, and industry analysis.

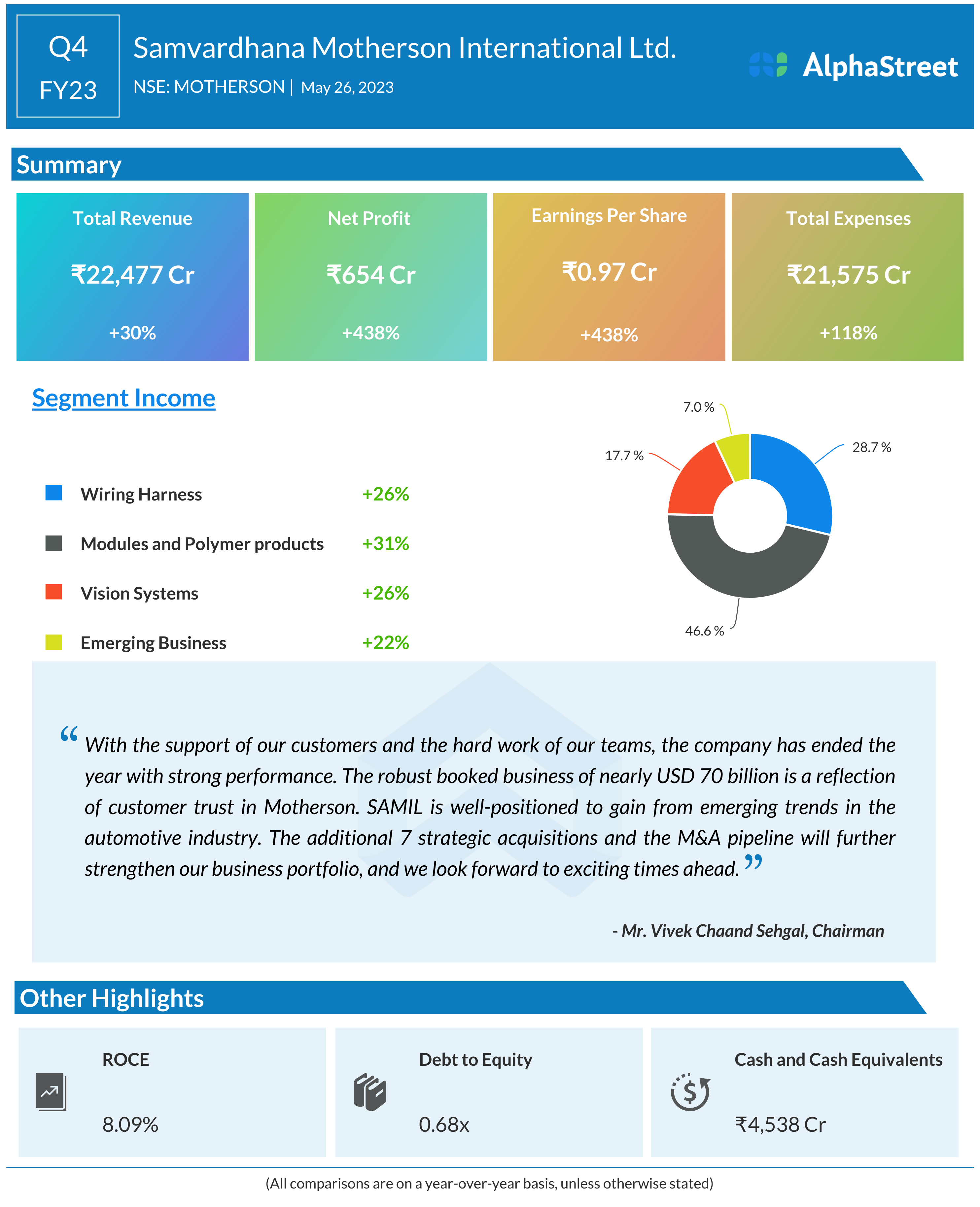

Samvardhana Motherson International Ltd Q4FY23 results out, revenue - Source alphastreet.com

Question 1: What factors influence Samvardhana Motherson share price performance?

The share price of Samvardhana Motherson is influenced by a combination of internal and external factors. Internal factors include the company's financial performance, operational efficiency, and product innovation. External factors include macroeconomic conditions, industry trends, and competitive dynamics.

Question 2: Where can I find historical data on Samvardhana Motherson share prices?

Historical data on Samvardhana Motherson share prices is readily available on various financial websites and data platforms. Reputable sources include Bloomberg, Yahoo Finance, and Google Finance.

Question 3: How do I stay updated on real-time Samvardhana Motherson share price movements?

To stay updated on real-time Samvardhana Motherson share price movements, consider using financial news websites, mobile trading applications, or subscribing to company updates.

Question 4: What is the significance of technical analysis in understanding Samvardhana Motherson share price trends?

Technical analysis involves studying historical price data to identify patterns and trends that may suggest future price movements. While not a perfect predictor, technical analysis can provide valuable insights for traders and investors.

Question 5: How can I assess the intrinsic value of Samvardhana Motherson shares?

Assessing the intrinsic value of Samvardhana Motherson shares typically involves analyzing the company's financial statements, industry outlook, and competitive advantages. Fundamental analysis methods like discounted cash flow valuation or comparable company analysis can provide insights into the company's true worth.

Question 6: What are the key risks associated with investing in Samvardhana Motherson shares?

Investing in Samvardhana Motherson shares carries certain risks, including fluctuations in earnings, competitive pressures, changes in government regulations, and macroeconomic headwinds. Understanding these risks is crucial for making informed investment decisions.

In conclusion, this FAQ section provides a foundation for understanding Samvardhana Motherson share price dynamics and making informed investment decisions. Consulting with a financial professional is always recommended for personalized advice and guidance.

Stay tuned for further analysis and insights on Samvardhana Motherson's share price performance and industry developments.

Tips on Investing in Samvardhana Motherson

Samvardhana Motherson International Limited (SAMIL) is the flagship company of the Motherson Group, one of the world's leading automotive component manufacturers. The company is known for its global presence and strong financial performance. Samvardhana Motherson Share Price: Real-Time Updates, Historical Data, And Expert Analysis can help investors make informed decisions about investing in the company.

Tip 1: Research the Company: Before investing in SAMIL, it is essential to research the company's financial performance, management team, and industry outlook. This information can be found in the company's annual reports, press releases, and industry analysis reports.

Tip 2: Consider the Company's Strengths: SAMIL has several strengths that make it an attractive investment. These include its strong global presence, diverse product portfolio, and commitment to innovation. The company has a presence in over 40 countries and manufactures a wide range of automotive components, including wiring harnesses, bumpers, and interior trim.

Tip 3: Evaluate the Company's Risks: While SAMIL is a strong company, there are certain risks that investors should be aware of. These include competition from global rivals, fluctuations in commodity prices, and changes in government regulations. It is important to consider these risks when making an investment decision.

Tip 4: Set Realistic Expectations: When investing in SAMIL, it is important to set realistic expectations. The company's share price may fluctuate in the short term, but over the long term, it has the potential to deliver strong returns. Investors should be prepared to hold the stock for a period of time to reap the benefits of the company's growth.

Tip 5: Monitor the Company's Performance: Once you have invested in SAMIL, it is important to monitor the company's performance on a regular basis. This can be done by following the company's stock price, reading analyst reports, and attending investor conferences. Monitoring the company's performance will help you stay informed about its progress and make informed decisions about your investment.

Summary: Investing in Samvardhana Motherson International Limited is a strategic decision that can potentially yield significant returns. By following these tips, investors can increase their chances of success when investing in this global automotive component manufacturer.

For more information on Samvardhana Motherson International Limited, please visit the company website.

Samvardhana Motherson Share Price: Real-Time Updates, Historical Data, And Expert Analysis

The Samvardhana Motherson share price is a crucial indicator of the company's financial performance, influenced by various factors and analyzed by experts for insights.

By considering these key aspects, investors can make informed decisions about buying, selling, or holding Samvardhana Motherson shares. For instance, real-time updates facilitate quick responses to market fluctuations, while historical data helps identify long-term trends. Expert analysis provides valuable guidance on market sentiment and potential risks.

Share Market News: PNB, Reliance Power, Power Grid, Samvardhana - Source www.zeebiz.com

Szijjártó: Száz új munkahelyet teremt a Samvardhana Motherson Group - Source www.magyarhirlap.hu

Samvardhana Motherson Share Price: Real-Time Updates, Historical Data, And Expert Analysis

Samvardhana Motherson Share Price: Real-Time Updates, Historical Data, And Expert Analysis, is a comprehensive resource that provides the most up-to-date information on the company's stock performance. It includes real-time quotes, historical data, and expert analysis to help investors make informed decisions about their investments.

Motherson group - Prewave.ai - Source www.prewave.com

The share price of Samvardhana Motherson is influenced by a number of factors, including the company's financial performance, the overall market conditions, and the sentiment of investors.

By providing real-time updates, historical data, and expert analysis, Samvardhana Motherson Share Price: Real-Time Updates, Historical Data, And Expert Analysis, helps investors make informed decisions about their investments. It is a valuable resource for anyone who wants to track the company's stock performance and make informed investment decisions.