Editor's Notes: "U.S. Inflation Surges To Highest Level In Over Four Decades: Economic Implications And Policy Responses" have published today date. The U.S. inflation rate has surged to its highest level in over four decades, driven by a number of factors including supply chain disruptions, rising energy costs, and strong consumer demand.

This has raised concerns about the potential impact on the economy and has led to a number of policy responses from the Federal Reserve and other government agencies.

| Key | Differences or Takeaways |

|---|---|

| Fed Policy | The Federal Reserve has raised interest rates in an effort to cool inflation. |

| Government Spending | The government has increased spending on infrastructure and other programs in an effort to stimulate the economy. |

| Consumer Demand | Consumer demand remains strong, which is putting upward pressure on prices. |

FAQ

This FAQ section provides answers to frequently asked questions on the recent surge in US inflation, economic implications, and policy responses.

Us Current Inflation Rate 2024 - Holly Laureen - Source xenaclerissa.pages.dev

Question 1: What factors have contributed to the recent surge in inflation?

The surge in inflation is attributed to a combination of factors, including: supply chain disruptions caused by the COVID-19 pandemic, increased consumer demand as the economy reopens, and rising energy prices due to geopolitical tensions.

Question 2: What are the economic implications of high inflation?

High inflation erodes the purchasing power of consumers, reduces business profitability, and can lead to social unrest if not addressed effectively.

Question 3: How is the Federal Reserve responding to inflation?

The Federal Reserve has raised interest rates and signaled further increases, aiming to curb inflation by moderating economic growth and reducing demand.

Question 4: What other policy measures are being considered to address inflation?

Policymakers are also exploring measures to improve supply chains, reduce energy dependence, and provide targeted financial assistance to vulnerable populations.

Question 5: What can individuals do to mitigate the impact of inflation?

Individuals can consider budgeting, seeking higher-yielding investments, and exploring ways to supplement their income.

Question 6: What are the potential risks associated with the policy responses to inflation?

Policy responses to inflation could potentially lead to slower economic growth, increased unemployment, and heightened financial market volatility.

In conclusion, the surge in US inflation presents significant economic and social challenges. While policy responses are underway, the effectiveness and potential risks will require ongoing monitoring. Continuous dialogue and collaboration among policymakers, businesses, and individuals are essential to navigate this complex landscape.

Next, let's explore the broader economic outlook...

Tips

To combat the rising inflation, several economic and policy responses have been implemented. These include:

Cardiovascular Deaths Spike During Extremely Hot and Cold Weather - Source scitechdaily.com

Tip 1: Interest Rate Hikes

Central banks, such as the Federal Reserve, have raised interest rates to curb inflation. Higher interest rates make borrowing more expensive, slowing down economic activity and reducing demand, which can help ease inflationary pressures.

Tip 2: Fiscal Policy Adjustments

Governments can use fiscal policy, such as reducing government spending or increasing taxes, to reduce aggregate demand and mitigate inflation. However, balancing the need to control inflation with supporting economic growth can be challenging.

Tip 3: Supply-Side Measures

Focusing on increasing supply can help address inflationary pressures. This includes measures to improve productivity, reduce bottlenecks in supply chains, and promote competition.

Tip 4: Inflation Targeting

Central banks often adopt inflation targeting frameworks, setting a specific target for inflation and using monetary policy tools to maintain price stability. This provides transparency and accountability in the fight against inflation.

Tip 5: Coordinated Global Response

Inflation is a global issue, and international cooperation is crucial. Coordinated policy responses, such as information sharing and synchronized interest rate adjustments, can help mitigate inflationary pressures.

These tips demonstrate the complexity of addressing high inflation and the need for a multifaceted approach involving both economic and policy responses. U.S. Inflation Surges To Highest Level In Over Four Decades: Economic Implications And Policy Responses

As the situation evolves, policymakers will continue to assess the effectiveness of these measures and adapt their strategies to stabilize prices and promote economic stability.

U.S. Inflation Surges To Highest Level In Over Four Decades: Economic Implications And Policy Responses

The recent surge in U.S. inflation has reached the highest level in over four decades, bringing about significant economic implications and necessitating policy responses. Key aspects to consider in this context include rising consumer prices, potential impacts on consumer behavior, supply chain disruptions, labor market dynamics, the role of monetary policy, and fiscal policy considerations.

University Foot & Ankle Institute - Providers - Source balancehealth.com

- Rising Consumer Prices: Inflationary pressures have led to an increase in the cost of goods and services, impacting household budgets and purchasing power.

- Consumer Behavior Shifts: High inflation can alter consumer spending patterns, potentially leading to reduced discretionary spending and a preference for essential goods.

- Supply Chain Disruptions: The pandemic and geopolitical factors have caused supply chain disruptions, contributing to price increases due to shortages and higher production costs.

- Labor Market Impacts: Inflation can influence wage demands and collective bargaining, potentially affecting labor market dynamics and overall economic growth.

- Monetary Policy Responses: Central banks, including the Federal Reserve, may implement monetary policy measures such as interest rate hikes to control inflation by reducing demand.

- Fiscal Policy Considerations: Governments can use fiscal policy, such as tax adjustments or spending programs, to address inflation and its impact on the economy and vulnerable populations.

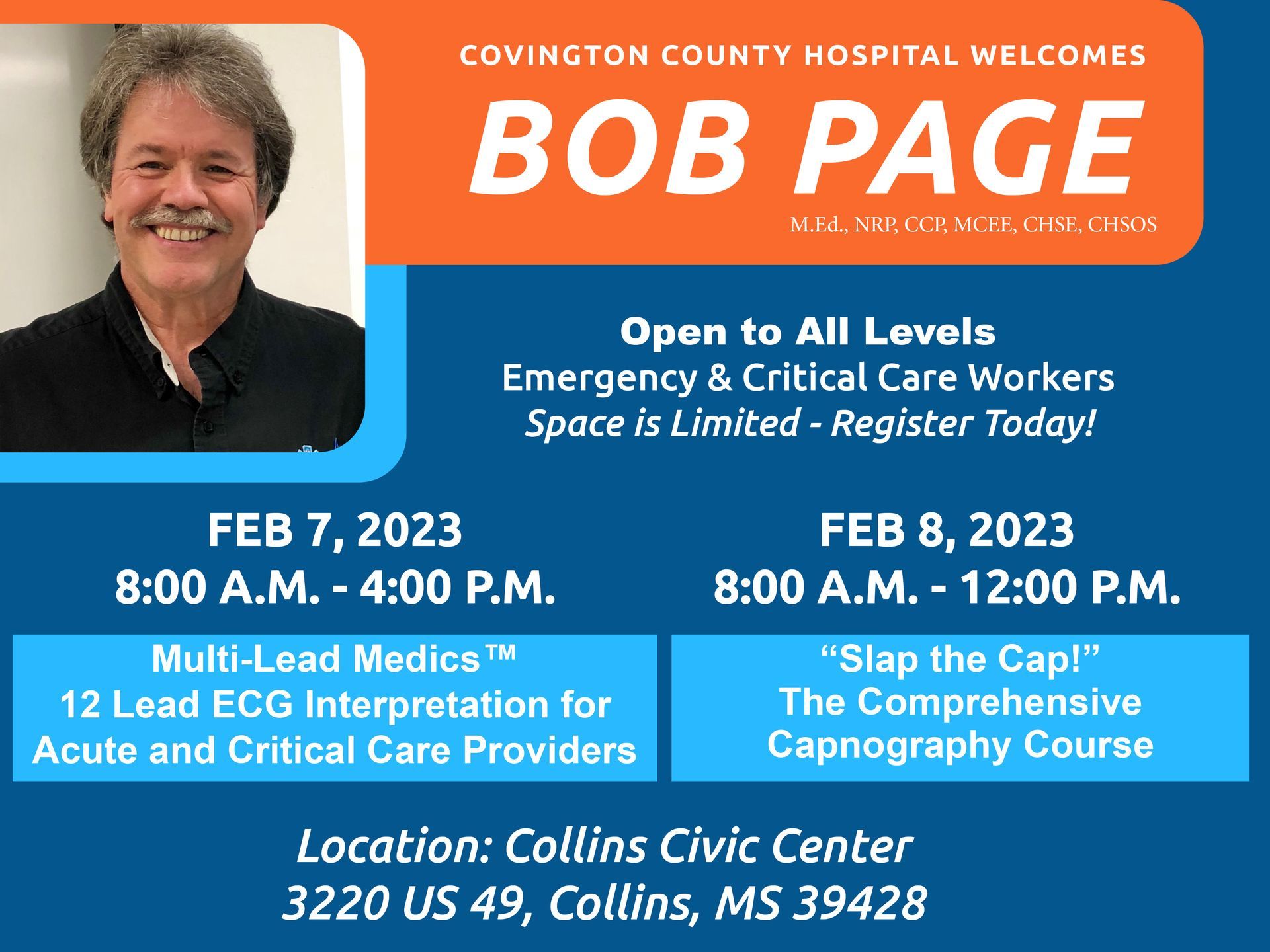

Renowned EMS Speaker Comes to Collins - Source www.covingtoncountyhospital.com

These key aspects are interconnected and require a comprehensive understanding to develop effective policy responses. The impact of inflation on economic growth, employment, and overall financial stability necessitates careful consideration of the appropriate mix of monetary and fiscal policy measures. Timely and well-coordinated policy actions can help mitigate the adverse effects of inflation and promote sustainable economic recovery.

U.S. Inflation Surges To Highest Level In Over Four Decades: Economic Implications And Policy Responses

The recent surge in U.S. inflation to its highest level in over four decades has significant economic implications and has prompted a range of policy responses. The causes of this inflation are complex and include factors such as supply chain disruptions, increased consumer demand, and rising energy prices.

About | Elcora Engineering - Source www.elcoraengineering.com

The impact of inflation on the economy is multifaceted. It can erode the purchasing power of consumers, reduce business profits, and lead to social unrest. To address these concerns, the Federal Reserve has begun raising interest rates in an effort to slow inflation.

Policymakers are also considering fiscal measures to help mitigate the effects of inflation on low-income households. The Biden administration has proposed a range of measures, including tax credits and increased spending on social programs.

The effectiveness of these policy responses will depend on a number of factors, including the underlying causes of inflation and the global economic outlook. It is important to monitor the situation closely and to adjust policy as needed.

Table: Economic Implications and Policy Responses to U.S. Inflation

| Economic Implication | Policy Response |

|---|---|

| Reduced consumer purchasing power | Interest rate hikes |

| Reduced business profits | Fiscal measures |

| Social unrest | Tax credits |

Conclusion

The surge in U.S. inflation is a serious challenge that requires a multifaceted policy response. The Federal Reserve is raising interest rates to slow inflation, while the Biden administration is considering fiscal measures to help mitigate the effects of inflation on low-income households. The effectiveness of these policy responses will depend on a number of factors, including the underlying causes of inflation and the global economic outlook. It is important to monitor the situation closely and to adjust policy as needed.

The surge in inflation is a reminder that the economy is a complex system and that there are no easy solutions to inflation. However, by working together, policymakers can develop a comprehensive response that will help to bring inflation under control and promote economic growth.