Ultratech Cement Stock Analysis: Market Performance, Financial Outlook, And Investment Potential: Dive into the financial standing and future prospects of Ultratech Cement, evaluating its market performance, financial outlook, and investment potential.

Through extensive analysis and data-driven insights, our Ultratech Cement Stock Analysis: Market Performance, Financial Outlook, And Investment Potential guide equips investors with the knowledge to make informed investment decisions.

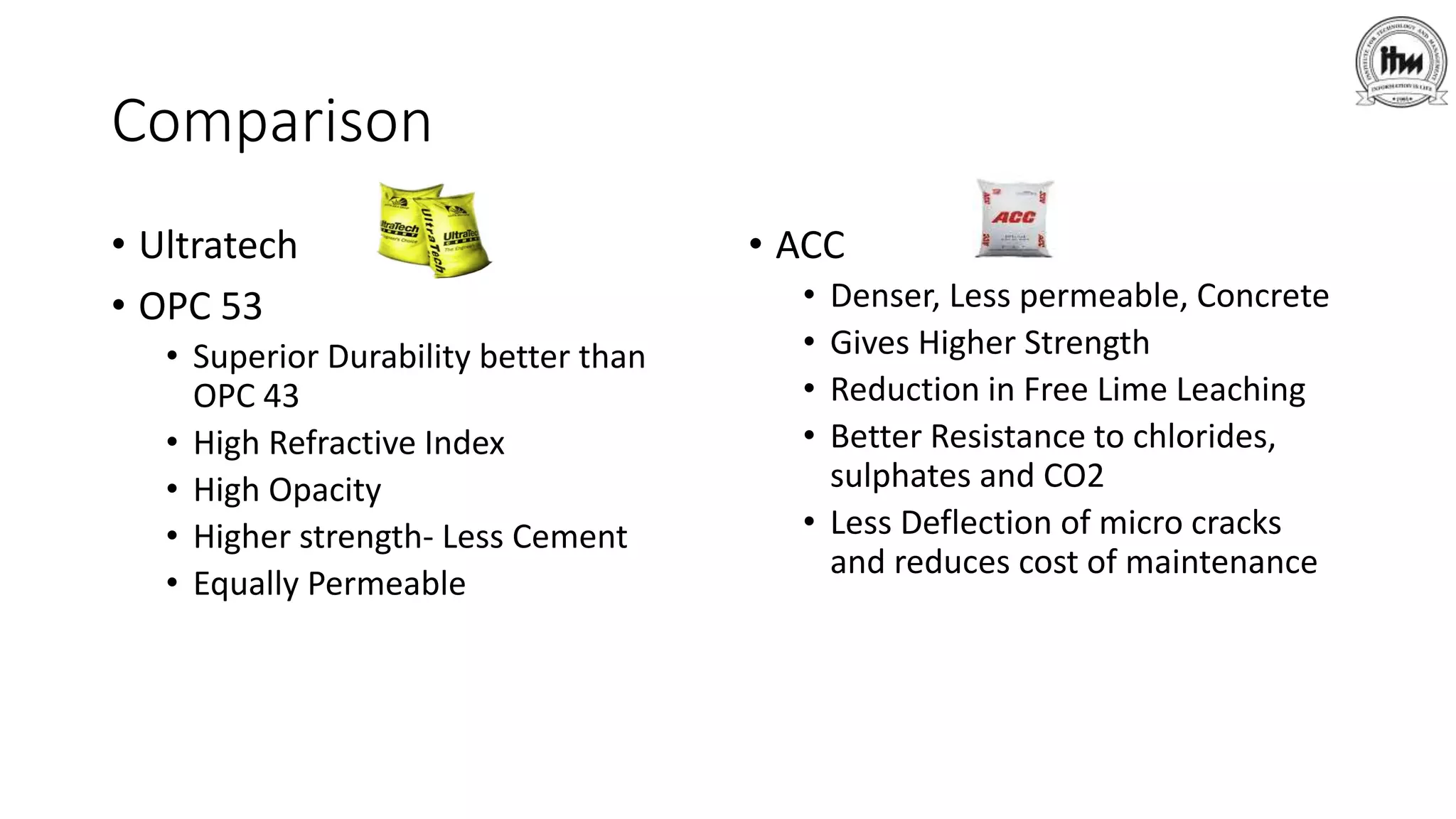

Key Differences:

Key Takeaways:

FAQ

This section addresses commonly asked questions about the market performance, financial outlook, and investment potential of Ultratech Cement.

ultratech cement marketing strategy, 4 P's, swot analysis, competitor - Source www.slideshare.net

Question 1: What factors have influenced Ultratech Cement's stock performance in recent years?

The company's stock performance has been influenced by a combination of factors, including overall market conditions, demand for cement, cost of raw materials, and financial performance.

Question 2: How has Ultratech Cement's financial outlook changed in recent times?

The company's financial outlook has improved in recent years, driven by increased demand for cement, cost optimization initiatives, and capacity expansion plans.

Question 3: What are the potential risks associated with investing in Ultratech Cement?

Potential risks include intense competition, fluctuations in raw material prices, changes in government regulations, and economic downturns.

Question 4: What are the key factors to consider when evaluating the investment potential of Ultratech Cement?

Key factors include market share, financial performance, capacity expansion plans, competitive landscape, and industry outlook.

Question 5: How does Ultratech Cement compare to its peers in terms of market share and profitability?

Ultratech Cement is one of the largest cement producers in India, with a strong market share and profitability compared to its peers.

Question 6: What are the growth prospects for Ultratech Cement in the coming years?

The company has a positive outlook for growth, driven by increased urbanization, infrastructure development, and government initiatives.

By understanding these factors, investors can make informed decisions about investing in Ultratech Cement.

Tips

To ensure the success of this analysis, consider the following tips:

Tip 1: Consult Ultratech Cement Stock Analysis: Market Performance, Financial Outlook, And Investment Potential for a comprehensive overview of the company's performance and financial standing.

Summary of key takeaways or benefits:

By following these tips, you can enhance the accuracy and effectiveness of your analysis, leading to more informed investment decisions.

Ultratech Cement Stock Analysis: Market Performance, Financial Outlook, And Investment Potential

The intricacies of Ultratech Cement's stock analysis encompass multifaceted dimensions, including market performance, financial health, and investment prospects. Delving into these essential aspects empowers investors with a comprehensive understanding of the company's potential.

- Market Performance: Assessing price trends, trading volume, and market capitalization.

- Financial Outlook: Scrutinizing revenue streams, profit margins, and debt levels.

- Valuation Metrics: Employing comparative analysis and financial ratios to determine intrinsic value.

- Dividend Yield: Evaluating the company's dividend history and payout ratio.

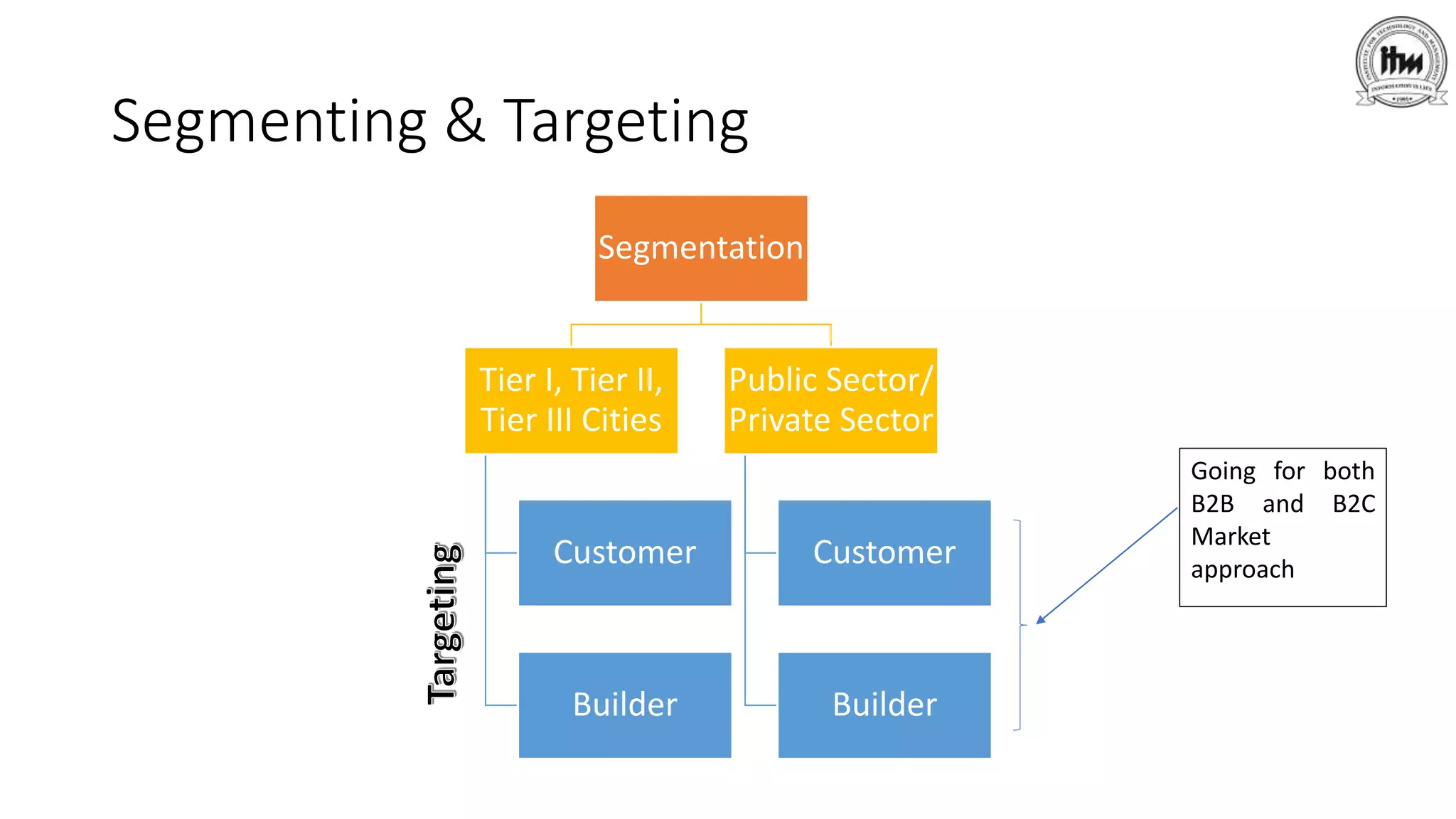

- Industry Dynamics: Monitoring competitive landscape, demand trends, and regulatory environment.

- Investment Potential: Weighing growth prospects, risk appetite, and return expectations.

By carefully considering these key aspects, investors can gain insights into Ultratech Cement's financial stability, market positioning, and potential for long-term returns. A thorough understanding of these elements forms the basis for informed investment decisions and a comprehensive analysis of the company's stock.

GreenLine flags-off its LNG-powered fleet at UltraTech Cement’s - Source greenline.in

Ultratech Cement Stock Analysis: Market Performance, Financial Outlook, And Investment Potential

A deep understanding of Ultratech Cement's market performance, financial outlook, and investment potential is crucial for informed decision-making in the stock market. A comprehensive analysis of these factors provides investors with valuable insights into the company's strengths, weaknesses, and future prospects.

ultratech cement marketing strategy, 4 P's, swot analysis, competitor - Source www.slideshare.net

Market performance analysis involves examining Ultratech Cement's stock price movements over time, considering factors such as industry trends, economic conditions, and company-specific news. Financial outlook analysis delves into the company's financial statements, including revenue, expenses, profits, and cash flow, to assess its financial health and stability. Finally, investment potential analysis evaluates the company's growth prospects, competitive advantages, and risk factors to determine its attractiveness as an investment.

This comprehensive analysis enables investors to make informed decisions about whether to buy, sell, or hold Ultratech Cement stock. It empowers them to identify potential opportunities for capital appreciation and mitigate risks associated with investing in the company's stock.

It is important to note that stock market analysis is a dynamic process, and investors should continuously monitor the market and company-specific developments to stay informed and make timely adjustments to their investment strategies.

Conclusion

A thorough understanding of Ultratech Cement's market performance, financial outlook, and investment potential is essential for making informed investment decisions. By analyzing these factors, investors can assess the company's strengths, weaknesses, and future prospects, enabling them to identify potential opportunities and mitigate risks.

It is crucial to remember that the stock market is constantly evolving, and investors should vigilantly monitor the market and company-specific developments to make timely adjustments to their investment strategies.