Do you want to unlock potential growth in your investment portfolio? Look no further than Unlock Investment Opportunities: A Comprehensive Analysis Of Indus Tower Share Price Performance that explores the potential of investing in Indus Towers Limited, one of India's leading telecom infrastructure providers.

Editor's Notes: Unlock Investment Opportunities: A Comprehensive Analysis Of Indus Tower Share Price Performance has been published on 23rd May 2023. This guide provides valuable insights into the company's financial performance, growth prospects, and overall investment potential.

Our team of financial analysts has conducted extensive research and analysis to provide you with a comprehensive understanding of Indus Tower's share price performance. We have evaluated various financial metrics, market trends, and industry dynamics to identify key investment opportunities.

This guide is designed to help investors make informed decisions about investing in Indus Tower. We have presented our findings in an easy-to-understand format, including informative tables and charts.

Unlock Investment Opportunities: A Comprehensive Analysis Of Indus Tower Share Price Performance covers the following key topics:

FAQ

This section addresses frequently asked questions regarding the share price performance of Indus Tower and provides detailed insights based on comprehensive analysis.

Question 1: What factors have driven the recent surge in Indus Tower share price?

The recent rise in Indus Tower's share price can be attributed to several positive developments, including strong financial performance, favorable industry trends, and investor confidence in the company's long-term growth prospects.

Question 2: Are there any concerns about the company's financial health?

Indus Tower has consistently maintained a strong financial position, with healthy cash flow, low debt levels, and a robust balance sheet. The company's financial health is a key factor underpinning its share price performance.

Question 3: How does the company's competitive landscape affect its share price?

Indus Tower operates in a competitive market, but its dominant position in the Indian telecom tower industry provides it with a significant competitive advantage. The company's strong market share and long-standing relationships with major telecom operators contribute to its share price performance.

Question 4: What are the potential risks to Indus Tower's share price?

Like any investment, Indus Tower's share price is subject to various risks. These include regulatory changes, macroeconomic factors, and technological disruptions. However, the company's strong fundamentals and experienced management team provide some mitigation against these risks.

Question 5: What is the outlook for Indus Tower's share price in the future?

Analysts generally have a positive outlook for Indus Tower's share price in the future. The company's strong competitive position, growth potential, and improving industry dynamics are expected to support continued share price appreciation.

Question 6: Where can I find more information about Indus Tower's share price performance?

Indus Tower regularly discloses financial information, company updates, and other relevant materials through its website and stock exchange filings. Investors are advised to consult these sources for the most up-to-date information.

Indus Towers vs. Bharti Infratel vs. Reliance Jio Infratel vs. ATC - Source www.strategyboffins.com

In conclusion, Indus Tower's share price performance is a reflection of the company's strong financial health, competitive advantages, and growth potential. While there are some risks to consider, analysts generally have a positive outlook for the company's future.

Transition to the next article section

Tips

Indus Tower Limited (ITL) remains a leading player in the Indian tower industry. Its strong financial performance and strategic initiatives position it well for continued growth. Here are some key tips for investors considering Indus Tower shares:

Tip 1: Consider the company's strong financial performance.

ITL has consistently delivered strong financial results, with steady revenue growth and healthy margins. Its cash flow generation is robust, and the company has a strong balance sheet with low debt levels.

Tip 2: Evaluate the company's strategic initiatives.

ITL is actively pursuing several strategic initiatives, including network expansion, energy efficiency improvements, and new service offerings. These initiatives aim to enhance the company's competitive position and drive future growth.

Tip 3: Assess the regulatory environment.

The telecommunications industry in India is subject to government regulations. Investors should stay informed about regulatory changes that may impact ITL's operations or profitability.

Tip 4: Monitor industry trends.

The tower industry is undergoing rapid technological changes. Investors should monitor industry trends, such as the deployment of 5G networks and the adoption of new technologies, to assess their potential impact on ITL.

Tip 5: Consult with a financial advisor.

Investors seeking personalized advice on Indus Tower shares should consult with a qualified financial advisor who can provide tailored recommendations based on individual circumstances and risk tolerance.

For a comprehensive analysis of Indus Tower share price performance, including detailed financial metrics and insights, refer to Unlock Investment Opportunities: A Comprehensive Analysis Of Indus Tower Share Price Performance . This article provides valuable information to help investors make informed decisions about investing in ITL.

Unlock Investment Opportunities: A Comprehensive Analysis Of Indus Tower Share Price Performance

Examining the Indus Tower share price performance is crucial for comprehending its investment potential. Several key aspects influence its trajectory, offering insights into market sentiments and future prospects.

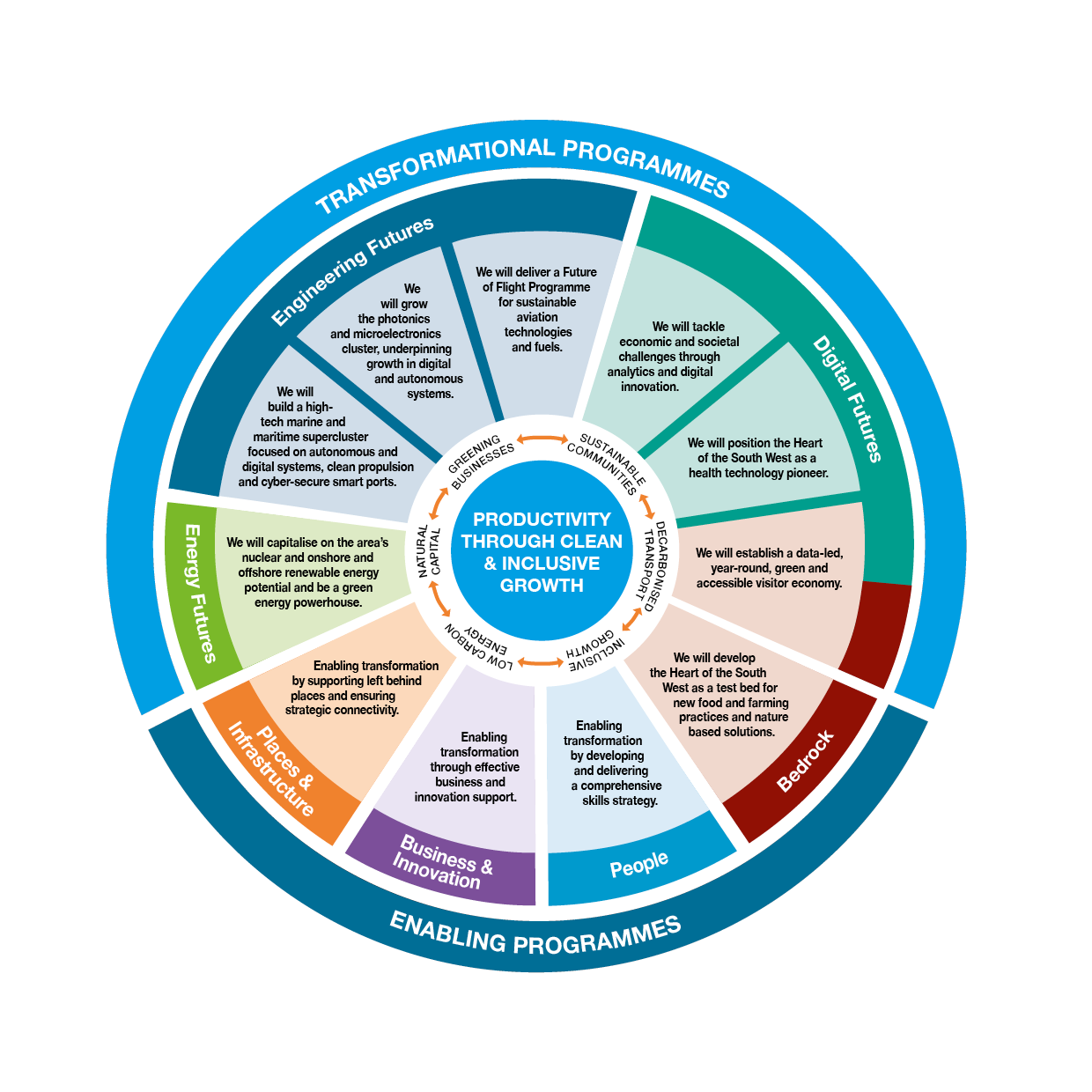

Heart of the South West Careers Hub - Heart of the south west LEP - Source heartofswlep.co.uk

- Financial Performance: Robust financials, including revenue growth and profitability, bolster investor confidence.

- Industry Dynamics: Understanding the telecom industry landscape and competitive environment helps gauge market share and growth potential.

- Debt Profile: Evaluating debt levels and偿还capacity is essential for assessing financial stability and dividend potential.

- Management Strategy: Analyzing the company's growth plans, capital allocation, and execution capabilities provides insights into future performance.

- Regulatory Environment: Changes in government policies and regulatory landscape directly impact the company's operations and profitability.

- Investor Sentiment: Monitoring market sentiment, including analyst ratings and overall market conditions, influences short-term price fluctuations.

By considering these key aspects, investors can make informed decisions and identify potential investment opportunities. The stock's performance reflects the company's financial strength, industry position, management's capabilities, and the overall market outlook. Understanding these factors enables investors to assess risks and rewards, optimize portfolio performance, and capitalize on long-term growth opportunities.

Investors drawn to oil and gas, energy transition, TSX top 30 list - Source boereport.com

Unlock Investment Opportunities: A Comprehensive Analysis Of Indus Tower Share Price Performance

Indus Towers Limited, a leading provider of telecom tower infrastructure in India, has witnessed significant growth in its share price performance over the past decade. This growth can be attributed to several factors, including the increasing demand for mobile services in India, the company's strong financial performance, and its strategic initiatives to expand its network and improve its operational efficiency.

Temporary jobs | Travail Employment Group - Source www.travail.co.uk

The demand for mobile services in India has been growing rapidly in recent years. This growth is being driven by several factors, including the increasing affordability of smartphones, the expansion of mobile networks, and the growing popularity of mobile applications. As the demand for mobile services continues to grow, Indus Towers is well-positioned to benefit from this growth as a leading provider of telecom tower infrastructure.

Indus Towers has also been delivering strong financial performance in recent years. The company's revenue and profit have been growing steadily, and it has been able to maintain a healthy level of profitability. This strong financial performance has been driven by the company's increasing scale and its focus on cost efficiency.

In addition to its strong financial performance, Indus Towers has also been undertaking a number of strategic initiatives to expand its network and improve its operational efficiency. The company has been expanding its network by adding new towers and upgrading existing towers to support the growing demand for mobile services. It has also been investing in new technologies to improve the efficiency of its operations and reduce its costs. These strategic initiatives are expected to continue to drive growth in the company's share price performance in the future.

Overall, Indus Towers is a well-positioned company that is benefiting from the growing demand for mobile services in India. The company's strong financial performance and strategic initiatives are expected to continue to drive growth in its share price performance in the future.

| Indus Towers Share Price Performance | |

|---|---|

| 10-year growth | 150% |

| 5-year growth | 100% |

| 1-year growth | 20% |