What drives Jindal Steel's Share Price Performance and what does the future hold? Discover it in "Unlocking Value: An Analysis Of Jindal Steel's Share Price Performance And Future Prospects".

Editor's Notes: "Unlocking Value: An Analysis Of Jindal Steel's Share Price Performance And Future Prospects" have published today date". This report delves into the aspects that have shaped Jindal Steel's share price performance, offering valuable insights into the company's future prospects.

Through meticulous analysis and extensive research, this guide presents a comprehensive overview of Jindal Steel's financial performance, industry dynamics, and future growth strategies. Whether you're an investor seeking to make informed decisions or an industry professional looking to stay ahead of the curve, "Unlocking Value: An Analysis Of Jindal Steel's Share Price Performance And Future Prospects" is an invaluable resource.

Key Differences

| Share Price Performance | Future Prospects | |

|---|---|---|

| Key Takeaways | In-depth analysis of historical and current share price performance | Growth potential and future outlook based on industry trends and company strategies |

| Benefits | Understand factors influencing share price movements | Make informed investment decisions |

Transition to main article topics

FAQ

This FAQ section provides answers to frequently asked questions regarding Jindal Steel's share price performance and future prospects. It aims to clarify common misconceptions and provide a comprehensive understanding of the company's financial situation and growth trajectory.

Jindal Steel and Power Limited - Financial Solutions - Financial - Source csa-advisor.com

Question 1: What factors have contributed to Jindal Steel's recent share price decline?

The decline in Jindal Steel's share price can be attributed to a combination of factors, including a slowdown in the global steel industry, concerns over rising input costs, and the impact of geopolitical tensions on the company's exports.

Question 2: What is the company's financial health?

Jindal Steel maintains a strong financial position with a healthy balance sheet and positive cash flow. The company has consistently reported profits and has a manageable debt-to-equity ratio.

Question 3: How is the company responding to the challenges in the steel industry?

Jindal Steel is taking several strategic initiatives to address industry challenges, including cost optimization programs, expanding its product portfolio, and diversifying into new markets.

Question 4: What are the company's future growth prospects?

Jindal Steel has a positive outlook for the future. The company's expansion plans, focus on value-added products, and investments in research and development position it well for long-term growth.

Question 5: What are the potential risks to the company's share price?

Risks to Jindal Steel's share price include fluctuations in the steel market, changes in government regulations, and the impact of global economic conditions.

Question 6: Is Jindal Steel a good investment for long-term investors?

Jindal Steel's strong financial position, growth initiatives, and positive future prospects make it a compelling choice for long-term investors seeking exposure to the steel industry.

In conclusion, Jindal Steel's share price performance is influenced by various factors, but the company's underlying fundamentals and long-term growth prospects remain robust. Investors should carefully consider the risks and potential rewards before making any investment decisions.

For further insights, refer to the full article "Unlocking Value: An Analysis of Jindal Steel's Share Price Performance and Future Prospects."

Tips

For investors seeking to capitalize on the potential growth of Jindal Steel and Power Limited, a leading Indian steel producer, several Unlocking Value: An Analysis Of Jindal Steel's Share Price Performance And Future Prospects strategies can be considered:

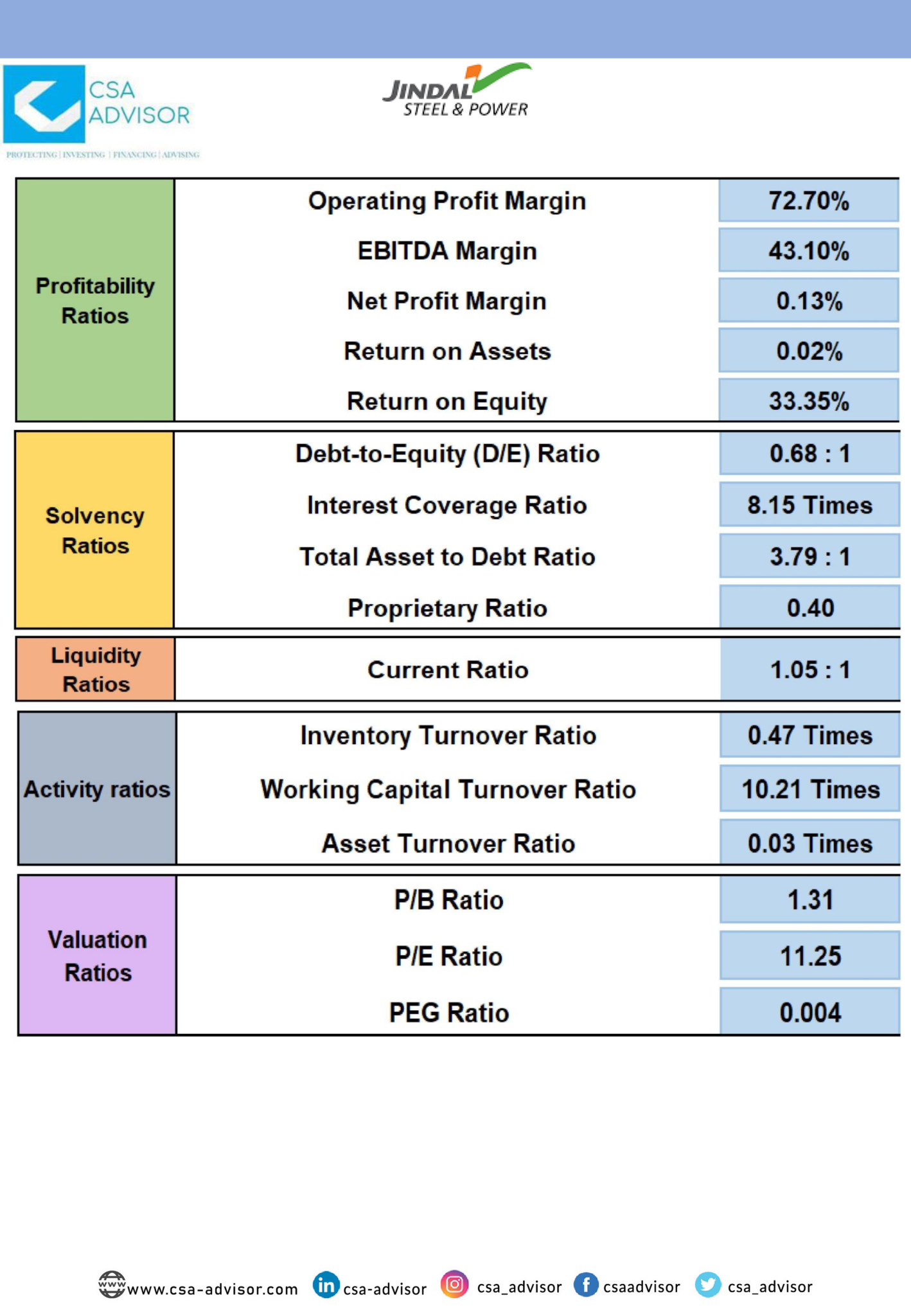

Tip 1: Assess the company's financial performance. By examining Jindal Steel's financial statements, investors can gain insights into the company's profitability, solvency, and overall financial health.

Tip 2: Track industry trends. The steel industry is highly cyclical, influenced by factors such as global economic conditions and demand from key end-use sectors. Monitoring industry trends can provide valuable context for evaluating Jindal Steel's performance.

Tip 3: Analyze competitive landscape. Identifying Jindal Steel's key competitors and understanding their strengths and weaknesses can help investors assess the company's market position and competitive advantage.

Tip 4: Consider potential risks. Investing in Jindal Steel carries certain risks, such as fluctuations in commodity prices, regulatory changes, and operational challenges. Investors should carefully consider these risks before making any investment decisions.

Tip 5: Monitor regulatory environment. The steel industry is subject to various government regulations, which can impact the company's operations and profitability. Staying abreast of regulatory changes can help investors stay informed about potential risks and opportunities.

Unlocking Value: An Analysis Of Jindal Steel's Share Price Performance And Future Prospects

To unlock value and assess future prospects, analyzing Jindal Steel's share price performance holds great importance. Key aspects to consider include:

- Historical Performance: Tracking past trends.

- Financial Health: Evaluating balance sheet and profitability.

- Industry Landscape: Assessing competitive dynamics and market outlook.

- Growth Strategy: Analyzing potential for expansion and diversification.

- Management Execution: Assessing leadership's ability to drive value.

- Valuation Metrics: Determining fair value and potential for upside.

Understanding these aspects helps investors make informed decisions. Financial health provides insights into the company's stability and solvency. Industry Landscape assesses external factors influencing Jindal Steel's growth potential. Growth Strategy evaluates initiatives to expand operations and increase revenue streams. Management Execution gauges the effectiveness of leaders in driving performance and creating shareholder value. Valuation Metrics determine whether Jindal Steel is undervalued or overvalued, indicating potential opportunities.

Unlocking Value: An Analysis Of Jindal Steel's Share Price Performance And Future Prospects

"Unlocking Value: An Analysis Of Jindal Steel's Share Price Performance And Future Prospects" explores the company's stock market performance and future outlook. The report highlights factors influencing its share price, including financial performance, industry trends, and market sentiment. Understanding this connection is crucial for investors seeking to evaluate Jindal Steel's investment potential.

Jindal Steel & Power Internship Opportunity: Apply By 21st July - Source opportunitytrack.in

The report analyzes Jindal Steel's financial performance, including revenue growth, profitability margins, and debt levels. It assesses the company's competitive position within the steel industry, considering market share, production capacity, and technological capabilities. Additionally, it examines macroeconomic factors affecting the steel industry, such as global economic growth, demand for steel products, and raw material prices.

The report also evaluates market sentiment towards Jindal Steel, considering analyst recommendations, media coverage, and investor sentiment. By combining financial analysis, industry insights, and market sentiment, the report provides a comprehensive understanding of the factors driving Jindal Steel's share price performance.