"BLS Share Price: Real-Time Quotes, Historical Data, And Analysis"—A guide with all the necessary information regarding current prices, historical trends, and expert market analysis.

Editor's Note: "BLS share price: Real-time quotes, historical data, and analysis" made available on [date] provides insightful data and analytical tools empowered to take informed decisions in the world of financial markets.

Our team of financial experts has meticulously analyzed and gathered information from reliable sources to provide you with this comprehensive guide on BLS share prices.

Key differences or Key takeways

Transition to main article topics

FAQ

This comprehensive FAQ section provides prompt answers to frequently asked questions regarding BLS Share Price, empowering users to make informed decisions while gaining a profound understanding of the subject matter.

Predictive Analysis Unlocks The Future For Better Business Decisions - IDA - Source www.intuitivedataanalytics.com

Question 1: What factors influence BLS Share Price fluctuations?

BLS Share Price is influenced by a multitude of factors, including economic indicators, market trends, industry-specific developments, company performance, investor sentiment, and geopolitical events. A thorough analysis of these factors is essential to discern the potential direction of BLS Share Price.

Question 2: Where can I find accurate and up-to-date information on BLS Share Price?

For real-time quotes, historical data, and in-depth analysis on BLS Share Price, reputable financial platforms, brokerages, and news outlets serve as valuable resources. These sources provide comprehensive information to support informed decision-making.

Question 3: What are the key indicators to watch when monitoring BLS Share Price?

To effectively monitor BLS Share Price, consider fundamental indicators such as earnings per share (EPS), revenue growth, profit margins, and debt-to-equity ratio. Technical indicators like moving averages, support and resistance levels, and relative strength index (RSI) can also provide valuable insights into price trends.

Question 4: Is it possible to predict the future direction of BLS Share Price with certainty?

Predicting the exact future direction of BLS Share Price with absolute certainty is challenging due to the inherent volatility of the stock market. However, by analyzing historical data, market trends, and company-specific factors, investors can make informed assessments about potential price movements. This analysis can increase the likelihood of making profitable investment decisions.

Question 5: What strategies can investors employ to mitigate risks associated with BLS Share Price fluctuations?

To mitigate risks, investors can diversify their portfolios by investing in various asset classes and industries. Additionally, dollar-cost averaging, where investments are made at regular intervals regardless of price, can help reduce the impact of market volatility. Setting realistic investment goals and understanding personal risk tolerance are also crucial for responsible investing.

Question 6: What resources are available to help investors stay informed about BLS Share Price?

Numerous resources are available to keep investors abreast of BLS Share Price movements. Financial news outlets, company press releases, SEC filings, and investor relations websites provide up-to-date information. Additionally, online forums and social media groups dedicated to BLS Share Price discussions can offer valuable insights and perspectives.

By addressing these common questions, this FAQ section aims to empower investors with the knowledge and resources needed to navigate the complexities of BLS Share Price and make informed investment decisions.

For further exploration of BLS Share Price, explore our comprehensive article on "Understanding BLS Share Price: A Detailed Guide for Investors."

Tips

When conducting research on BLS Share Price: Real-Time Quotes, Historical Data, And Analysis, consider these tips to enhance your understanding and decision-making.

Tip 1: Monitor real-time quotes to stay informed about the latest price movements and market sentiment.

Tip 2: Analyze historical data to identify trends, patterns, and potential support and resistance levels.

Tip 3: Utilize technical analysis tools such as moving averages, Bollinger Bands, and RSI to make informed trading decisions.

Tip 4: Consider fundamental factors that may impact the company's performance, such as earnings reports, industry news, and economic indicators.

Tip 5: Set realistic expectations and do not rely solely on short-term price movements to guide your investment decisions.

Tip 6: Seek professional advice from a financial advisor if you require personalized guidance and assistance.

By following these tips, you can enhance your research capabilities, make more informed decisions, and potentially improve your investment outcomes.

For further insights and analysis, refer to the comprehensive BLS Share Price: Real-Time Quotes, Historical Data, And Analysis article.

BLS Share Price: Real-Time Quotes, Historical Data, And Analysis

Understanding BLS share price dynamics is crucial for informed investment decisions. Key aspects include real-time quotes, historical data, and analysis.

- Real-time Quotes: Up-to-date market prices for immediate trading decisions.

- Historical Data: Comprehensive historical prices for trend identification and analysis.

- Technical Analysis: Study of price patterns and indicators to predict future trends.

- Fundamental Analysis: Examination of company financials, industry conditions, and economic factors.

- Earnings Reports: Regular financial updates that provide insights into company performance.

- Analyst Ratings: Recommendations from experts to guide investment choices.

These aspects collectively provide a comprehensive view of BLS share price. Real-time quotes facilitate immediate trading, while historical data enables trend analysis. Technical and fundamental analysis help in forecasting future price movements. Earnings reports offer periodic insights into company financials, and analyst ratings provide expert guidance. Understanding these aspects empowers investors to make informed decisions and optimize their investments.

AI app: Stock Market Sentiment Analysis for Autonomous Agent - Source lablab.ai

Jazmine Cable-Whitehurst on LinkedIn: #decisionintelligence # - Source www.linkedin.com

BLS Share Price: Real-Time Quotes, Historical Data, And Analysis

The BLS share price is a key indicator of the company's financial health and performance. It is important to track the BLS share price over time to identify trends and make informed investment decisions.

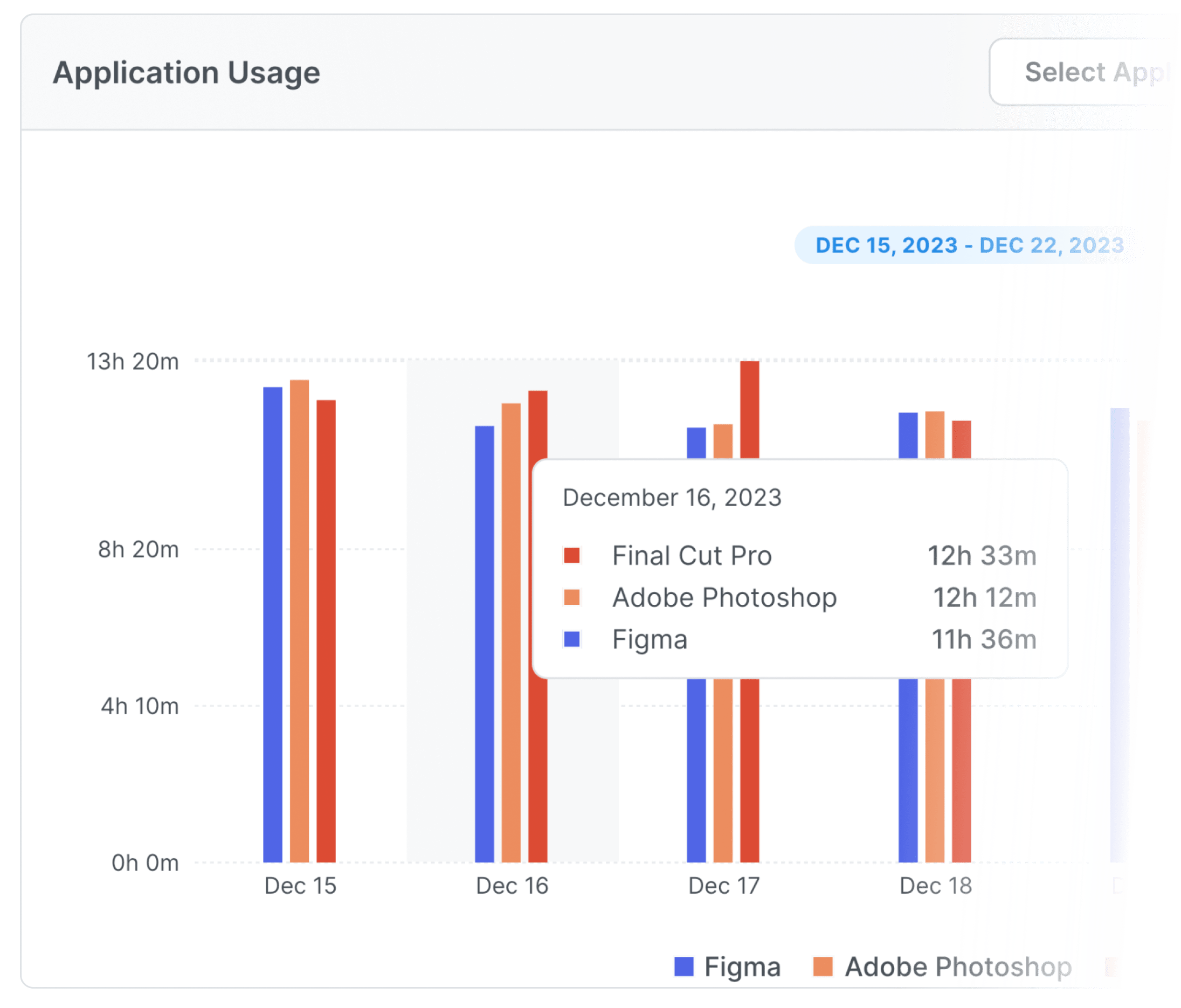

Application Monitoring | Efficense - Source efficense.com

There are a number of factors that can affect the BLS share price, including the company's earnings, revenue, and debt levels. The overall economic climate and the performance of the stock market can also impact the BLS share price.

Investors should carefully consider all of these factors when making investment decisions. By understanding the factors that can affect the BLS share price, investors can make more informed decisions and potentially increase their returns.

The following table provides a summary of key insights regarding the connection between "BLS Share Price: Real-Time Quotes, Historical Data, And Analysis":

| Key Insight | Explanation |

|---|---|

| The BLS share price is a key indicator of the company's financial health and performance. | The share price reflects the market's assessment of the company's value, which is based on a number of factors including earnings, revenue, and debt levels. |

| It is important to track the BLS share price over time to identify trends and make informed investment decisions. | By tracking the share price over time, investors can identify patterns and trends that can help them make informed investment decisions. |

| There are a number of factors that can affect the BLS share price, including the company's earnings, revenue, and debt levels. | These factors can impact the company's financial health and performance, which in turn can impact the share price. |

| The overall economic climate and the performance of the stock market can also impact the BLS share price. | The overall economic climate can impact the company's earnings and revenue, which in turn can impact the share price. The performance of the stock market can also impact the share price, as investors may sell or buy shares based on the overall market sentiment. |

Conclusion

The BLS share price is a complex and dynamic indicator that can be affected by a number of factors. By understanding the factors that can affect the share price, investors can make more informed investment decisions and potentially increase their returns.

However, it is important to note that investing in the stock market always carries some risk. Investors should carefully consider their investment goals and risk tolerance before making any investment decisions.