Learn how to access your Employees Provident Fund (EPF) savings conveniently through an ATM.

Banking Tech News: 2019 ATM Trends to Watch - Source blog.burroughs.com

Editor's Notes: Our comprehensive guide on How to Easily Withdraw Money from Your EPFO Account Using an ATM was published today to provide a simple and informative resource for individuals seeking to access their EPF funds.

After doing in-depth research and analysis, we have compiled this guide to assist you in understanding the process and making informed decisions about withdrawing your EPF savings.

Key Differences:

|---|---|---|

Transition to main article topics:

FAQ

This FAQ section offers comprehensive answers to common questions regarding the effortless withdrawal of funds from your Employee Provident Fund Organization (EPFO) account through an ATM.

UAN Activation: How to activate UAN number of your EPF account on EPFO - Source www.91mobiles.com

Question 1: What documents are required to withdraw money from my EPFO account using an ATM?

You will need your Universal Account Number (UAN) and the last four digits of your Aadhaar number.

Question 2: How much money can I withdraw from my EPFO account using an ATM?

The maximum withdrawal amount is limited to a specific percentage of your EPF balance.

Question 3: What are the transaction charges for withdrawing money from my EPFO account using an ATM?

There may be nominal transaction fees applicable, which vary depending on the bank.

Question 4: Can I withdraw money from my EPFO account using any ATM?

EPFO withdrawals via ATMs are only available through designated bank ATMs linked to your EPFO account.

Question 5: What should I do if I encounter any issues while withdrawing money from my EPFO account using an ATM?

Contact your bank or the EPFO helpline for immediate assistance.

Question 6: Are there any restrictions on the number of withdrawals I can make from my EPFO account per month?

Yes, there may be a limit on the number of withdrawals allowed within a specific period.

By addressing these common queries, this FAQ aims to provide a thorough understanding of the process of withdrawing funds from your EPFO account using an ATM.

If you have any further questions or require additional information, please refer to the relevant EPFO guidelines or consult with an authorized EPFO representative.

Tips to Easily Withdraw Money From Your EPFO Account Using An ATM

How To Withdraw Money From Standard Bank ATM Without A Card - Source raisingthebar.co.za

The Employees' Provident Fund Organisation (EPFO) allows members to withdraw funds from their accounts using an ATM. This process is simple and convenient, but there are a few tips you should follow to ensure a smooth transaction.

Tip 1: Check your eligibility

Not all EPFO members are eligible to withdraw funds from their accounts. You must have been a member of the EPFO for at least 10 years and have reached the age of 58 to be eligible for withdrawal. You can also withdraw funds if you are unemployed for more than 2 months or if you have a medical emergency.

Tip 2: Activate your UAN

Before you can withdraw funds from your EPFO account, you must activate your Universal Account Number (UAN). You can do this by visiting the EPFO website and clicking on the "Activate UAN" link. You will need to provide your PAN number, Aadhaar number, and mobile number to activate your UAN.

Tip 3: Link your bank account

Once your UAN is activated, you need to link your bank account to your EPFO account. You can do this by visiting the EPFO website and clicking on the "Link Aadhaar" link. You will need to provide your Aadhaar number and the bank account number you want to link. How To Easily Withdraw Money From Your EPFO Account Using An ATM

Tip 4: Choose the right ATM

Not all ATMs can be used to withdraw funds from EPFO accounts. You need to use an ATM that is linked to the EPFO network. You can find a list of linked ATMs on the EPFO website.

Tip 5: Withdraw the funds

Once you have found a linked ATM, you can withdraw the funds from your EPFO account. To do this, insert your ATM card into the ATM and enter your PIN. Then, select the "EPFO" option from the menu and enter your UAN. You will then be able to enter the amount of money you want to withdraw. The funds will be withdrawn from your EPFO account and deposited into your bank account.

Summary

Withdrawing funds from your EPFO account using an ATM is a simple and convenient process. By following these tips, you can ensure that your transaction is smooth and hassle-free.

How To Easily Withdraw Money From Your EPFO Account Using An ATM

Withdrawing money from your Employees' Provident Fund Organisation (EPFO) account using an ATM is a convenient and accessible process. However, it requires careful attention to various aspects to ensure a smooth and hassle-free transaction.

- Activate UAN: Before initiating an ATM withdrawal, ensure your Universal Account Number (UAN) is activated.

- Link Aadhaar: Your Aadhaar number needs to be linked with your EPFO account to authenticate the transaction.

- Verify KYC: Complete your Know Your Customer (KYC) formalities to ensure your identity and address are verified.

- Minimum Balance: Check if your EPFO account has sufficient balance to cover the withdrawal amount and ATM charges.

- ATM Compatibility: Look for ATMs that are affiliated with the EPFO for seamless withdrawal transactions.

- Withdrawal Limit: Be aware of the daily withdrawal limit set by EPFO to avoid exceeding it and incurring additional charges.

By adhering to these key aspects, you can withdraw money from your EPFO account using an ATM conveniently and securely. Ensure you activate your UAN, link your Aadhaar, verify KYC, check account balance, use compatible ATMs, and respect the withdrawal limits to facilitate a smooth and successful transaction.

How to Apply for Online PF/EPF Loan? - Check Your Eligibility - Source navi.com

How To Easily Withdraw Money From Your EPFO Account Using An ATM

The Employees' Provident Fund Organisation (EPFO) has made it easy for its members to withdraw money from their accounts using an ATM. This facility is available at all ATMs of banks that are authorised by the EPFO. To withdraw money from your EPFO account using an ATM, you will need to have your EPFO account number and your ATM card.

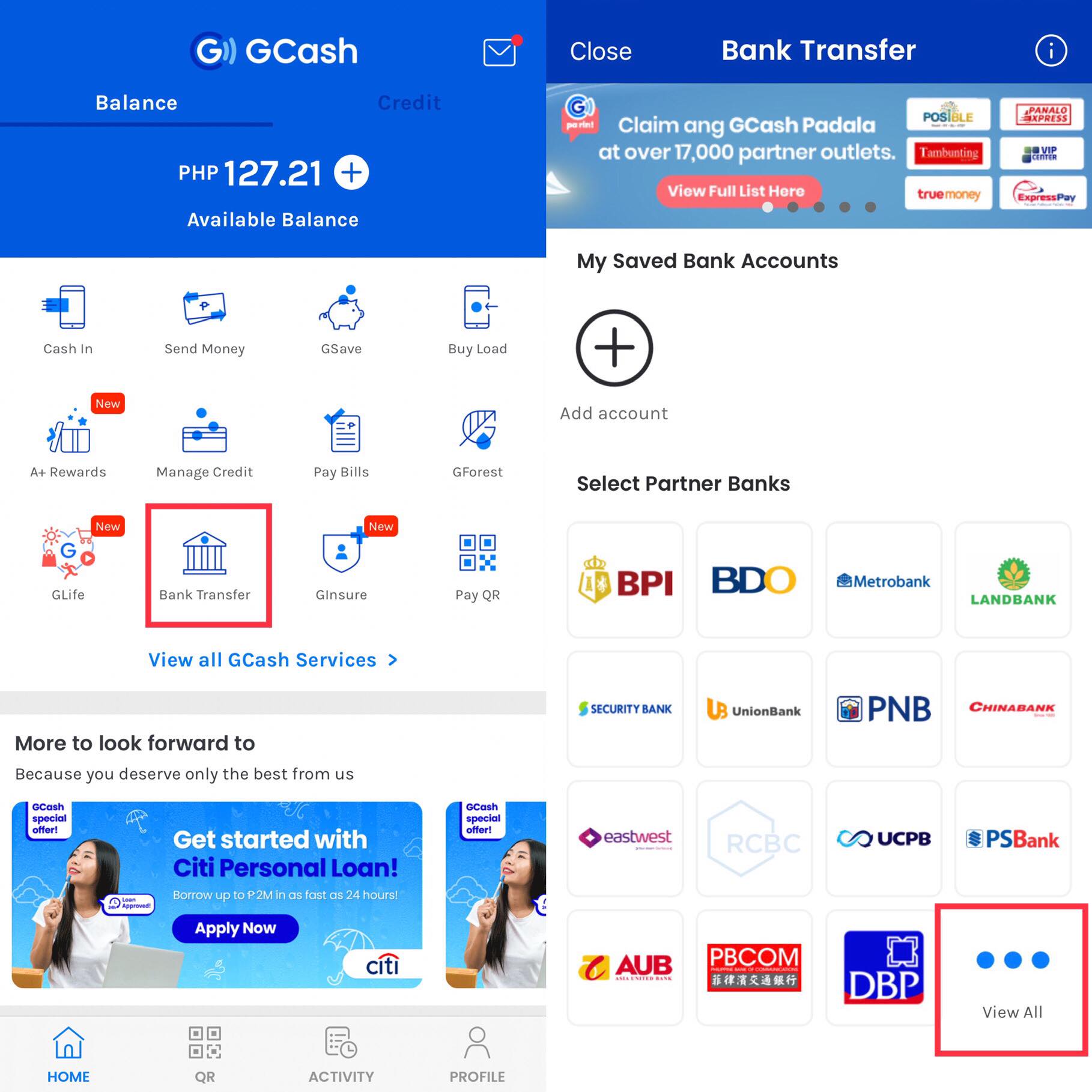

HOW TO CASH OUT IN GCASH? 3 Easy Ways to Withdraw Money from your GCASH - Source www.pinoyadventurista.com

To withdraw money from your EPFO account using an ATM, follow these steps:

1. Insert your ATM card into the ATM.

2. Select the "EPFO" option on the ATM screen.

3. Enter your EPFO account number.

4. Enter the amount of money you want to withdraw.

5. Confirm the transaction.

6. Take your money from the ATM.

There are some important things to keep in mind when withdrawing money from your EPFO account using an ATM. First, you can only withdraw up to a certain amount of money per day. The daily withdrawal limit is Rs. 50,000. Second, you will need to pay a transaction fee of Rs. 25 for each withdrawal. Third, you can only withdraw money from your EPFO account if your account has a positive balance.

Withdrawing money from your EPFO account using an ATM is a quick and easy way to access your money. However, it is important to keep in mind the daily withdrawal limit and the transaction fee.

Conclusion

Withdrawing money from your EPFO account using an ATM is a convenient and easy way to access your funds. However, it is important to be aware of the daily withdrawal limit and the transaction fee. By following the steps outlined in this article, you can easily withdraw money from your EPFO account using an ATM.

If you have any questions or concerns about withdrawing money from your EPFO account using an ATM, you should contact your EPFO office.