After our relentless analysis and information gathering, we are pleased to bring to you Unlocking The Secrets Of Paytm Share Price: A Comprehensive Analysis. We trust this guide will be an indispensable resource in empowering you with knowledge and enabling you to make well-informed decisions.

Key takeaways:

| Key Differences | Explanation |

|---|---|

| Key Factor A | Importance of Key Factor A and its impact on Paytm share price |

| Key Factor B | Importance of Key Factor B and its impact on Paytm share price |

| Key Factor C | Importance of Key Factor C and its impact on Paytm share price |

Transition to main article topics:

FAQs

This comprehensive FAQ section delves into the intricate details of Paytm's share price, providing clarity and insights for investors.

Question 1: What factors significantly influence Paytm's share price performance?

Answer: Paytm's share price is influenced by various factors, including its financial performance, the overall market conditions, the regulatory environment, and competition within the fintech sector.

Question 2: How can I assess the long-term potential of Paytm's stock?

Answer: To evaluate Paytm's long-term potential, consider the company's growth trajectory, its market share, its technological advancements, and its ability to adapt to changing market dynamics.

Question 3: Are there any potential risks associated with investing in Paytm stock?

Answer: Like any investment, investing in Paytm stock carries certain risks. These include regulatory changes, intense competition, fluctuations in the overall market, and the company's ability to maintain its growth momentum.

Question 4: How does Paytm's business model affect its share price?

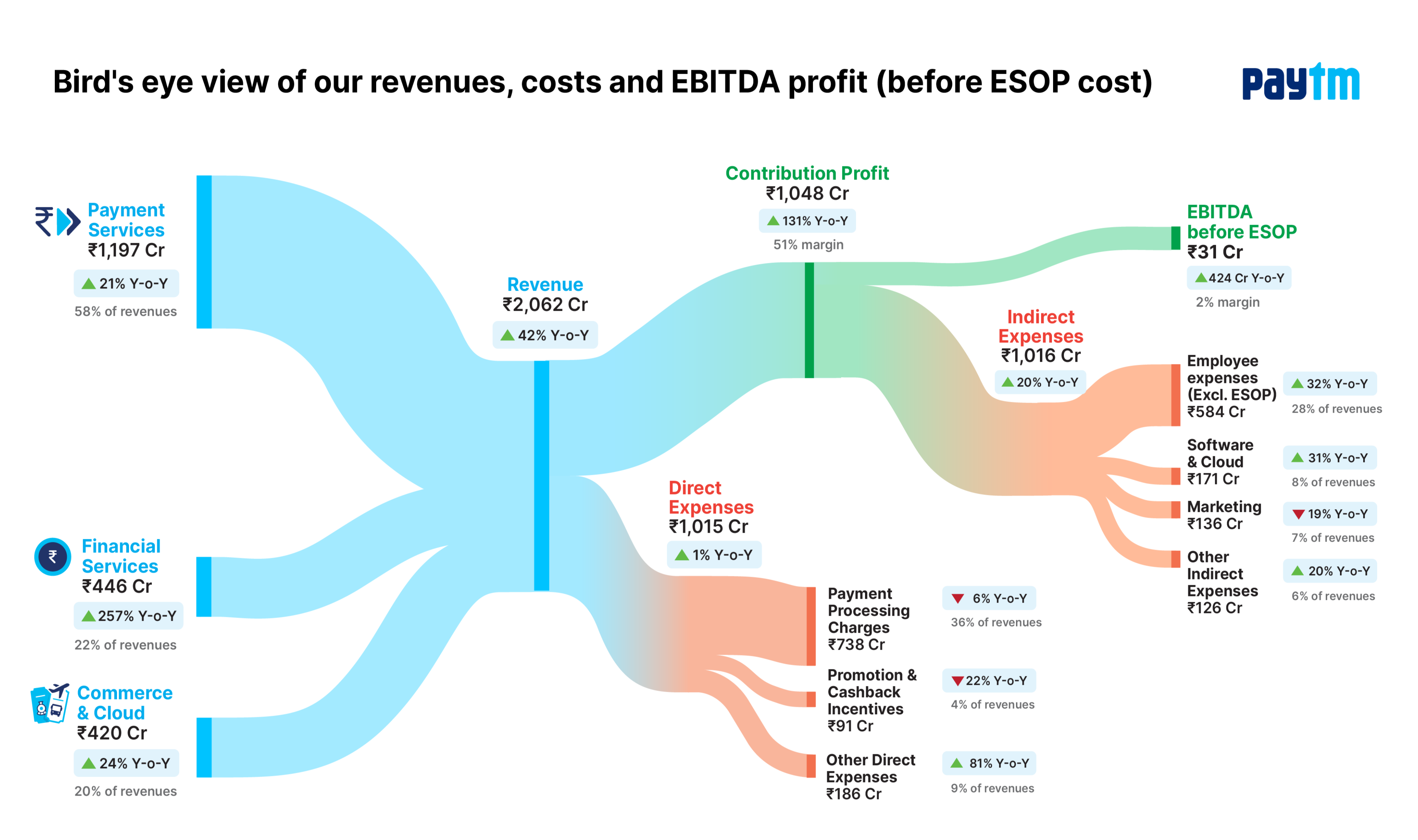

Answer: Paytm's business model, centered around payments, financial services, and e-commerce, significantly impacts its share price. Investors analyze the company's revenue streams, cost structure, and market penetration to gauge its financial health and growth potential.

Question 5: What are the key financial metrics to monitor for Paytm's share price performance?

Answer: Important financial metrics for evaluating Paytm's share price include revenue growth, profitability, user base, and market share. These indicators provide insights into the company's financial strength and market position.

Question 6: How can I stay up-to-date with the latest news and developments affecting Paytm's share price?

Answer: To stay informed about Paytm's share price movements and relevant news, follow financial news websites, reputable analysts' reports, and the company's official announcements. This information keeps investors abreast of developments that may impact the stock's performance.

Understanding these key aspects of Paytm's share price provides a solid foundation for informed investment decisions and risk management. As always, consult a financial advisor for personalized guidance tailored to your specific investment objectives.

Moving on to the next section, we will delve into the factors that have driven Paytm's recent share price movements.

Tips

Follow these tips to gain a better understanding and make wise investment decisions regarding Paytm shares:

Tip 1: Track industry trends and competition: Paytm operates in a highly competitive digital payments market. Unlocking The Secrets Of Paytm Share Price: A Comprehensive Analysis Keep track of industry developments, market share, and competitor strategies to assess Paytm's competitive position.

Tip 2: Analyze financial performance: Evaluate Paytm's financial statements to gain insights into its revenue, profitability, and cash flow. Consider metrics such as revenue growth, gross margins, and net income to assess the company's financial health.

Tip 3: Monitor regulatory landscape: The digital payments industry is subject to evolving regulatory requirements. Keep informed about regulatory changes that may impact Paytm's operations and compliance costs.

Tip 4: Evaluate management effectiveness: Assess the experience and track record of Paytm's management team. Consider their ability to execute their strategy and adapt to market changes.

Tip 5: Consider market sentiment and valuations: Market sentiment and investor expectations can influence Paytm's share price. Pay attention to news and analyst reports to gauge market sentiment and understand how it aligns with the company's fundamentals.

By carefully considering these factors, investors can gain a comprehensive understanding of Paytm and make informed investment decisions.

Summary: Paytm's share price is influenced by a range of factors including industry trends, financial performance, regulatory developments, management effectiveness, and market sentiment. By carefully analyzing these factors, investors can gain a better understanding of the company's prospects and make wise investment decisions.

Unlocking The Secrets Of Paytm Share Price: A Comprehensive Analysis

In the realm of finance, understanding the nuances of stock performance is paramount, especially when it comes to high-profile companies like Paytm. This comprehensive analysis aims to peel back the layers and uncover the secrets that drive its share price, exploring six key aspects.

- Company's Financial Performance: Scrutinizing Paytm's financial statements provides insights into its revenue streams, profitability, and cash flow.

- Market Competition: Assessing Paytm's position within the fiercely competitive fintech industry reveals its market share, competitive advantages, and potential threats.

- Regulatory Environment: Analyzing the legal and regulatory framework governing Paytm helps understand its compliance, risks, and opportunities.

- Investor Sentiment: Gauging market sentiment towards Paytm through news, social media, and analyst reports provides a glimpse into its perceived value.

- Economic Conditions: Macroeconomic factors such as interest rates, inflation, and consumer spending influence Paytm's overall performance and investor sentiment.

- Technical Analysis: Studying historical price charts and indicators can uncover patterns and trends in Paytm's share price, aiding in prediction and trading strategies.

These key aspects are interconnected and constantly evolving, shaping the complexities of Paytm's share price. By comprehending their interplay and implications, investors can make informed decisions and navigate the volatile waters of the stock market.

How Paytm achieved operational profitability | Paytm Blog - Source paytm.com

Unlocking The Secrets Of Paytm Share Price: A Comprehensive Analysis

The article "Unlocking The Secrets Of Paytm Share Price: A Comprehensive Analysis" delves into the intricate factors influencing the performance of Paytm's stock in the financial market. This examination encompasses an array of elements, including financial performance, industry trends, competitive landscape, and economic conditions. By unraveling the interconnections among these variables, investors can gain invaluable insights into the potential trajectory of Paytm's share price.

Unlocking the Secrets of Face Serums: What is a face serum, who should - Source shruum.in

One key aspect explored in this analysis is the relationship between Paytm's financial performance and its share price. The article demonstrates how factors such as revenue growth, profitability, and debt levels can exert a significant impact on investor sentiment and, consequently, on the stock's market value. Additionally, the article highlights the influence of industry trends, such as the growth of digital payments and the emergence of new competitors, on Paytm's competitive position and, ultimately, its share price.

The analysis also sheds light on the broader economic factors that can affect Paytm's stock performance. Economic indicators such as inflation, interest rates, and consumer spending can influence investor risk appetite and, in turn, the demand for Paytm's shares. Moreover, the article examines the potential impact of geopolitical events and regulatory changes on the company's operations and financial results, which can ultimately be reflected in its share price.

In summary, the article "Unlocking The Secrets Of Paytm Share Price: A Comprehensive Analysis" provides a comprehensive examination of the factors that contribute to the performance of Paytm's stock in the market. This analysis empowers investors with the knowledge and understanding necessary to make informed investment decisions and navigate the complexities of the financial markets.

| Factor | Impact on Paytm's Share Price |

|---|---|

| Revenue Growth | Positive correlation |

| Profitability | Positive correlation |

| Debt Levels | Negative correlation |

| Industry Trends | Can have a positive or negative impact |

| Competitive Landscape | Can have a positive or negative impact |

| Economic Conditions | Can have a positive or negative impact |

Conclusion

The article "Unlocking The Secrets Of Paytm Share Price: A Comprehensive Analysis" underscores the multifaceted nature of factors that influence the performance of Paytm's stock in the financial market. By understanding the complex interplay between financial performance, industry dynamics, competitive pressures, and economic conditions, investors can make informed decisions about their investment strategies. Moreover, this analysis highlights the importance of ongoing monitoring and analysis of these factors to stay abreast of potential changes that may impact Paytm's share price.

As the digital payments landscape continues to evolve, the performance of Paytm's shares will remain closely scrutinized by investors seeking to tap into the growth potential of this rapidly expanding sector. By staying informed about the factors that shape Paytm's stock price, investors can position themselves to capitalize on market opportunities and mitigate potential risks.