Raymond Share Price: Historical Performance, Analysis, And Forecasts: A Comprehensive Guide

We have analyzed the performance of Raymond shares over the past several years to identify key trends and patterns. We have also conducted an in-depth analysis of the company's financial statements to assess its financial health and prospects for growth. Additionally, we have reviewed the views of leading analysts to provide a balanced perspective on the company's future.

Key Differences or Key Takeaways:

This Raymond Share Price: Historical Performance, Analysis, And Forecasts guide provides valuable insights into the company's past performance and future prospects. By providing a comprehensive analysis of the company's financial performance, key risks, and growth opportunities, this guide helps investors make informed decisions about investing in Raymond Limited.

FAQs

This section compiles frequently asked questions surrounding Raymond Limited's stock price, offering a comprehensive overview of its historical performance, analysis, and forecasts.

Question 1: What factors have contributed to Raymond's stock price performance in the past?

Raymond's stock price has been influenced by a multitude of factors, including its financial performance, industry trends, and broader economic conditions. Strong quarterly results, market share gains, and positive industry outlooks have historically bolstered its share price, while macroeconomic headwinds, competitive pressures, and inventory challenges have posed headwinds.

Sales Performance Analysis And Comparison Table Excel Template And - Source slidesdocs.com

Question 2: How do analysts evaluate Raymond's stock?

Analysts employ various methods to assess Raymond's stock, including fundamental analysis, technical analysis, and discounted cash flow modeling. Fundamental analysis delves into the company's financial statements, operations, and management to gauge its intrinsic value. Technical analysis examines historical price patterns and trends to identify potential trading opportunities. Discounted cash flow modeling projects future cash flows to estimate the company's present value.

Question 3: What are the key metrics used to track Raymond's performance?

Several metrics are commonly used to monitor Raymond's performance, such as revenue growth, profit margins, return on equity (ROE), and earnings per share (EPS). These metrics provide insights into the company's financial health, profitability, and efficiency.

Question 4: What is the outlook for Raymond's stock price in the near term?

Market forecasts for Raymond's stock price in the near term vary depending on the brokerage firm or analyst. Some predict a positive trajectory based on the company's strong brand recognition, expansion plans, and cost optimization measures. Others adopt a more cautious stance, citing potential headwinds from economic slowdown or increased competition.

Question 5: What are the potential risks associated with investing in Raymond?

Investing in Raymond's stock carries certain risks, including fluctuations in the textile industry, changes in consumer preferences, and intense competition. Economic downturns, geopolitical uncertainties, and currency fluctuations can also impact its stock price.

Question 6: How can investors stay informed about Raymond's stock performance?

To stay up-to-date on Raymond's stock performance, investors can monitor the company's financial reports, press releases, and analyst coverage. Additionally, reputable financial news websites and mobile applications provide real-time stock quotes and market updates.

Understanding these aspects of Raymond's stock price performance can assist investors in making informed decisions and navigating the stock market.

Transition to the next article section: For further insights into Raymond Share, its business strategy, and industry dynamics, refer to the comprehensive analysis and expert commentary provided in the subsequent sections.

Tips

Consider the following tips when analyzing and forecasting Raymond Share Price: Historical Performance, Analysis, And Forecasts performance:

Tip 1: Examine historical trends and patterns. Studying past performance can provide insights into potential future movements.

Tip 2: Assess the company's financial statements. Evaluate metrics such as revenue, earnings, and cash flow to understand the financial health and growth prospects.

Tip 3: Monitor industry and economic trends. External factors can significantly impact stock prices, so it's essential to stay informed about industry dynamics and macroeconomic conditions.

Tip 4: Consider technical analysis. This involves studying price charts and patterns to identify potential trading opportunities.

Tip 5: Stay informed about company news and announcements. Significant events, such as mergers, acquisitions, or earnings reports, can have a material impact on stock prices.

Tip 6: Consult with financial professionals. Seeking expert advice can provide valuable insights and help refine your analysis.

Tip 7: Set realistic expectations. Remember that stock market performance is inherently volatile, and there are no guarantees of profit.

Tip 8: Diversify your portfolio. Investing in a range of assets helps spread risk and potentially enhance returns.

Raymond Share Price: Historical Performance, Analysis, And Forecasts

Raymond, a leading textile and apparel company, has witnessed a dynamic share price history. Understanding its historical performance, analyzing current trends, and forecasting future prospects are crucial for investors seeking to make informed decisions. This article delves into six key aspects that provide insights into Raymond's stock price behavior.

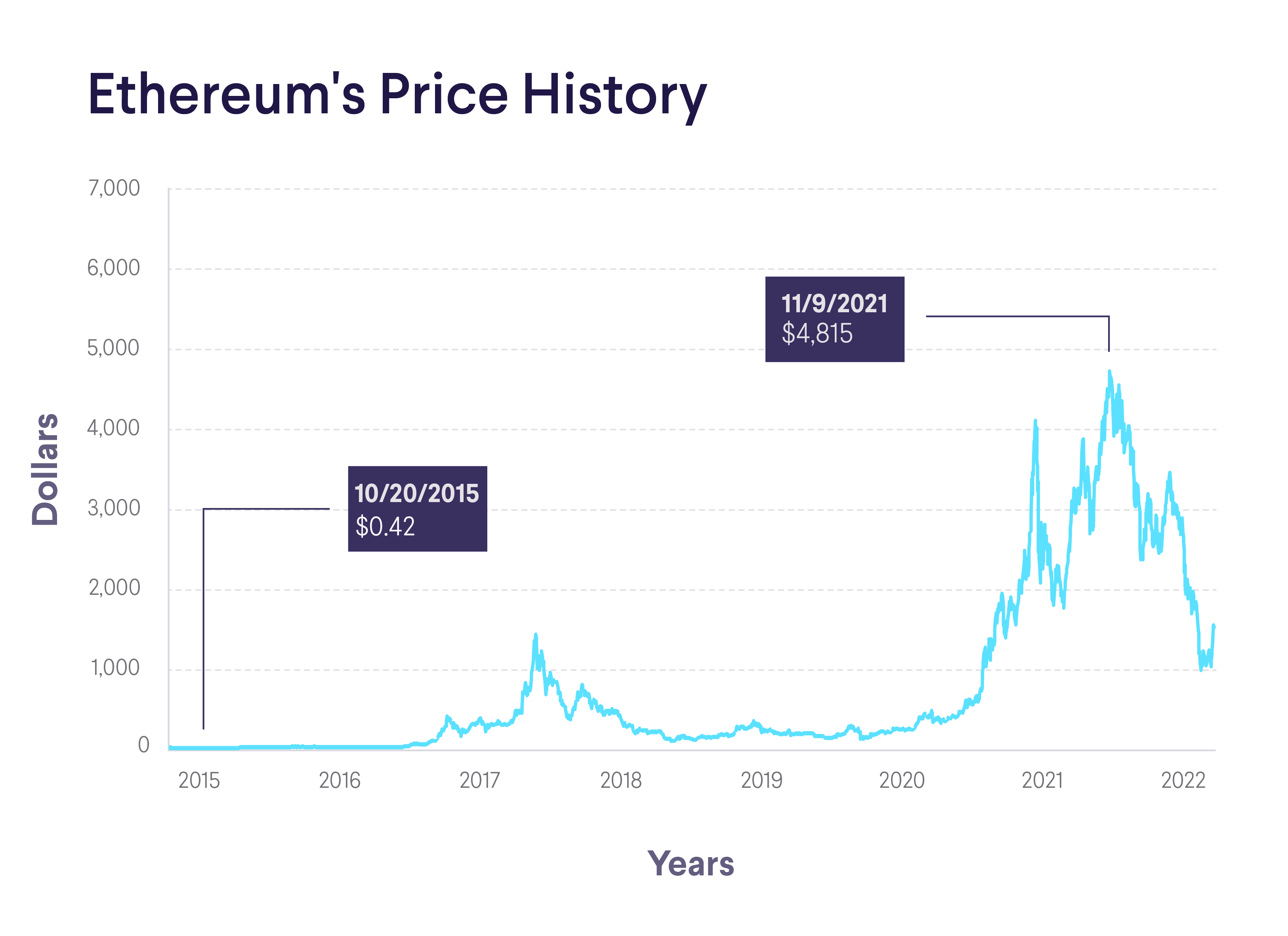

Ethereum Price History: 2015-2022 | SoFi - Source www.sofi.com

- Historical Performance: Raymond's share price has exhibited significant fluctuations over time, influenced by factors such as economic conditions, industry trends, and company-specific events.

- Financial Analysis: Evaluating Raymond's financial statements, including revenue growth, profitability margins, and debt levels, provides insights into the company's financial health and its impact on share prices.

- Market Analysis: Assessing the overall market conditions, including economic indicators and industry dynamics, helps determine the external factors influencing Raymond's share price performance.

- Technical Analysis: Studying historical price charts and patterns can identify potential trading opportunities and assess market sentiment towards Raymond's stock.

- Forecasts: Utilizing various forecasting techniques, analysts provide their projections for Raymond's share price, considering historical data, industry trends, and market expectations.

- Company-Specific Factors: Events related to management changes, strategic initiatives, or industry disruptions can significantly impact Raymond's share price.

These key aspects collectively provide a comprehensive view of Raymond's share price trajectory. By considering historical performance, analyzing financial and market conditions, and reviewing forecasts, investors can gain valuable insights into the company's future prospects. Understanding the dynamics of these factors empowers investors to make informed investment decisions and navigate the volatility of the stock market.

UPL Share Price: Historical Performance and Factors Influencing it by - Source issuu.com

Raymond Share Price: Historical Performance, Analysis, And Forecasts

The historical performance of Raymond's share price can provide valuable insights into the company's financial health and growth prospects. By analyzing past trends and patterns, investors can gain a better understanding of the factors that have influenced the company's share price and make more informed investment decisions.

A 2023-as bitcoin ár-előrejelzések megvannak, és a bikák és a medvék - Source dartwhite.com

One of the most important factors to consider when analyzing the historical performance of Raymond's share price is the company's earnings. Earnings are a measure of a company's profitability, and they can have a significant impact on the company's share price. When a company's earnings are growing, it is typically a sign that the company is doing well and that its share price is likely to increase. Conversely, when a company's earnings are declining, it is typically a sign that the company is struggling and that its share price is likely to decrease.

In addition to earnings, investors should also consider other factors when analyzing the historical performance of Raymond's share price, such as the company's revenue, debt, and cash flow. These factors can all provide valuable insights into the company's financial health and growth prospects.

By carefully analyzing the historical performance of Raymond's share price, investors can gain a better understanding of the factors that have influenced the company's share price and make more informed investment decisions.

Conclusion

The historical performance of Raymond's share price is a valuable tool that investors can use to make more informed investment decisions. By carefully analyzing past trends and patterns, investors can gain a better understanding of the factors that have influenced the company's share price and make more informed investment decisions.

Investors should consider a variety of factors when analyzing the historical performance of Raymond's share price, including the company's earnings, revenue, debt, and cash flow. These factors can all provide valuable insights into the company's financial health and growth prospects.