Tesla: Electrifying Growth And Valuation Scrutiny

Tesla Cybertruck Powertrain Explained - Out of Spec Podcast | Acast - Source play.acast.com

Editor's Notes: "Tesla: Electrifying Growth And Valuation Scrutiny" have published today date. This topic is important to read because it provides insights into Tesla's growth, financial performance, and valuation.

Our effort doing some analysis, digging information, made Tesla: Electrifying Growth And Valuation Scrutiny we put together this Tesla: Electrifying Growth And Valuation Scrutiny guide to help target audience make the right decision.

Key differences or Key takeways

| Tesla | Other Automakers | |

|---|---|---|

| Growth | Tesla has experienced rapid growth in recent years, with revenues increasing by over 50% in 2021. | Other automakers have seen more modest growth rates. |

| Valuation | Tesla is one of the most valuable automakers in the world, with a market capitalization of over $1 trillion. | Other automakers have lower valuations. |

| Scrutiny | Tesla has been the subject of much scrutiny from investors and analysts, due to its high valuation and ambitious growth plans. | Other automakers have received less scrutiny. |

Transition to main article topics

FAQs

This section addresses frequently asked questions and provides informative answers regarding Tesla's growth and valuation.

Question 1: How has Tesla achieved such rapid growth?

Tesla has experienced significant growth due to several factors. Its early adoption of electric vehicle technology and emphasis on innovation have differentiated it in the automotive industry. Additionally, its direct sales model, eliminating traditional dealerships, has lowered distribution costs and enhanced customer experience.

Tesla's 2022 Financial Data Impresses on Every Metric, but Slower - Source www.autoevolution.com

Question 2: Is Tesla's valuation justified?

Tesla's valuation reflects investors' expectations of its future growth prospects. The company's mission to accelerate the world's transition to sustainable energy and its technological leadership in the electric vehicle market contribute to its premium valuation

Question 3: What are the challenges Tesla faces?

Tesla faces challenges such as production bottlenecks, competition from established automakers, and regulatory headwinds. However, the company's focus on continuous improvement, its vertically integrated supply chain, and its brand loyalty provide a competitive advantage.

Question 4: What is Tesla's competitive edge?

Tesla's competitive edge lies in its vertically integrated business model, which allows it to control costs and optimize production. Its proprietary software and battery technology, along with its extensive charging network, further differentiate it from its rivals.

Question 5: What are the long-term growth drivers for Tesla?

Tesla's long-term growth drivers include expanding its vehicle lineup, entering new markets, and developing autonomous driving technology. The company's commitment to innovation and its focus on sustainability position it for continued growth.

Question 6: What should investors consider when evaluating Tesla?

Investors should consider Tesla's financial performance, its technological advancements, its competitive landscape, and its regulatory environment. A comprehensive evaluation, considering both risks and opportunities, is crucial for making informed investment decisions.

Understanding these frequently asked questions provides a deeper insight into Tesla's growth trajectory and the factors shaping its valuation.

...

Tips by "Tesla: Electrifying Growth And Valuation Scrutiny"

The "Tesla: Electrifying Growth And Valuation Scrutiny" report provides valuable insights into the company's growth and valuation. Here are its key takeaways:

Tip 1: Understand Tesla's Business Model

Tesla operates a unique business model, with a focus on electric vehicle production, energy storage solutions, and software development.

Tip 2: Assess Tesla's Financial Performance

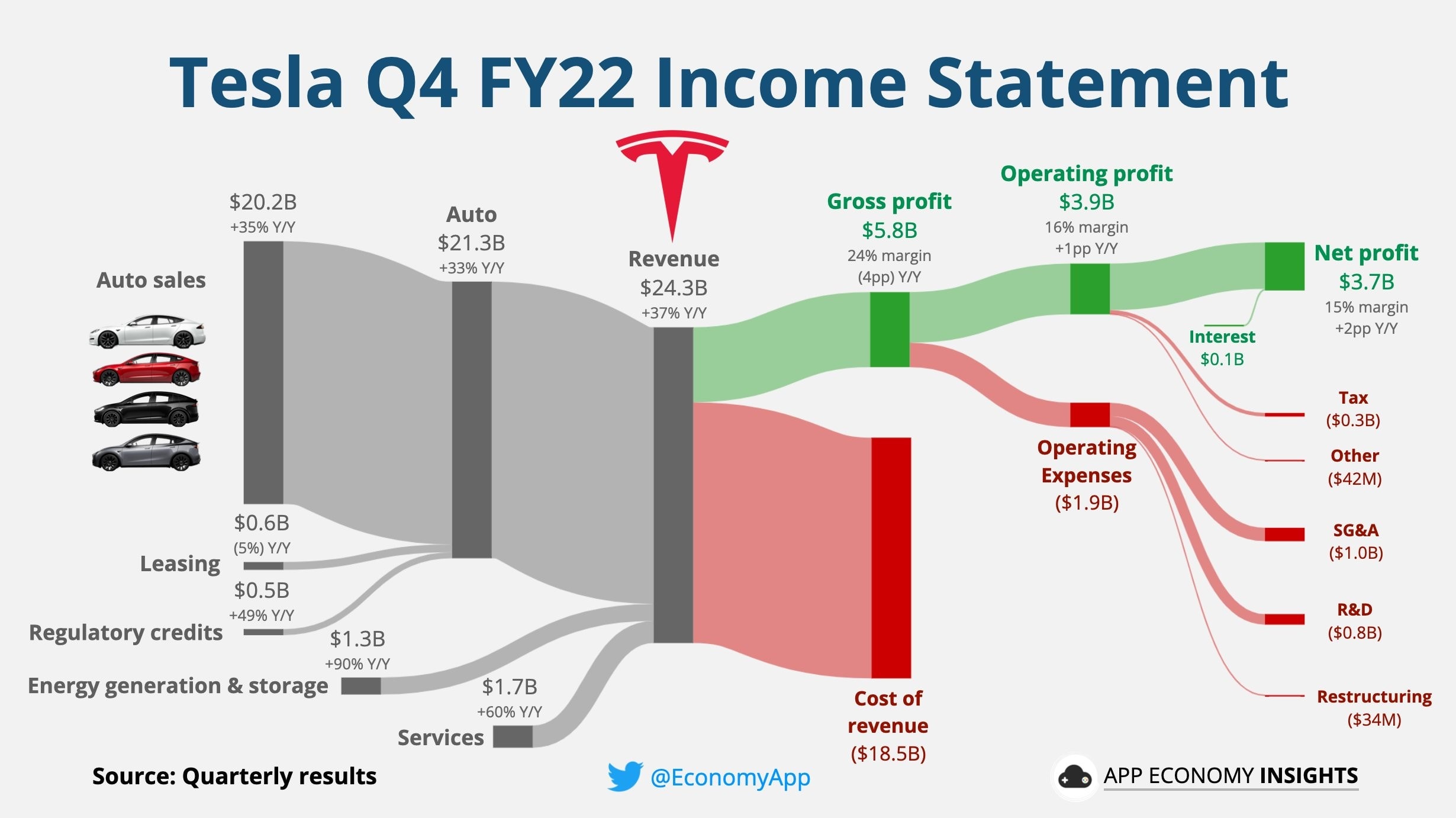

Tesla has experienced strong financial growth in recent years, driven by increasing vehicle sales and revenue from its energy storage business. However, its valuation remains a subject of scrutiny due to its high price-to-earnings ratio.

Tip 3: Consider Tesla's Technological Advantages

Tesla holds significant advantages in electric vehicle technology, including its battery performance, drivetrain efficiency, and over-the-air software updates.

Tip 4: Evaluate Tesla's Competitive Landscape

The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants vying for market share. Tesla faces competition from companies like Ford, General Motors, and Rivian.

Tip 5: Monitor Tesla's Regulatory Environment

Government regulations and incentives play a crucial role in the electric vehicle industry. Tesla's growth could be impacted by changes in government policies.

By following these tips, investors can gain a comprehensive understanding of Tesla's business and make informed decisions about its investment potential.

For a detailed analysis of Tesla's growth and valuation, refer to the report Tesla: Electrifying Growth And Valuation Scrutiny.

Tesla: Electrifying Growth And Valuation Scrutiny

The electric vehicle industry is a rapidly growing industry, and Tesla is one of the leading companies in this space. The company has seen tremendous growth in recent years, and its stock price has followed suit. However, Tesla's valuation has also come under scrutiny, with some analysts questioning whether the company is overvalued. In this article, we will explore six key aspects of Tesla's electrifying growth and valuation scrutiny.

- Electrifying growth: Tesla has seen tremendous growth in recent years. In 2021, the company delivered over 936,000 vehicles, a 87% increase over the previous year. This growth has been driven by strong demand for the company's electric vehicles, as well as the company's expansion into new markets.

- Valuation scrutiny: Tesla's valuation has come under scrutiny, with some analysts questioning whether the company is overvalued. Tesla's current market capitalization is over $1 trillion, which is more than the combined market capitalization of the top five traditional automakers. This high valuation is based on the company's growth potential, but it also raises concerns about whether the company is overvalued.

- Production challenges: Tesla has faced some production challenges in recent years. In 2022, the company was forced to temporarily shut down its production facility in Shanghai due to COVID-19 lockdowns. The company has also faced challenges ramping up production of its new Model Y SUV. These challenges have impacted the company's profitability, and they have also raised concerns about the company's ability to meet demand.

- Regulatory risks: Tesla faces regulatory risks in a number of markets. In the United States, the company is facing a lawsuit from the Securities and Exchange Commission (SEC) over tweets that Musk made about taking the company private. The company also faces regulatory risks in other markets, such as China and Europe. These regulatory risks could impact the company's business and financial performance.

- Competition: Tesla faces competition from a number of traditional automakers, as well as from other electric vehicle startups. The traditional automakers are investing heavily in electric vehicles, and they have a strong track record of producing and selling cars. The electric vehicle startups are also gaining market share, and they are offering competitive products at lower prices.

- Innovation: Tesla is a leader in innovation in the electric vehicle industry. The company has developed a number of new technologies, such as its Autopilot driver assistance system and its over-the-air software updates. Tesla is also investing heavily in new products, such as its Cybertruck and its Semi truck. These innovations could help Tesla to maintain its leadership position in the electric vehicle industry.

Tesla's electrifying growth and valuation scrutiny is a complex and multifaceted issue. The company has a number of advantages, such as its strong brand, its innovative products, and its first-mover advantage in the electric vehicle industry. However, the company also faces a number of challenges, such as production challenges, regulatory risks, and competition. It remains to be seen whether Tesla can continue to grow at a high rate and justify its current valuation.

Buy Splash Guards Mud Flaps Compatible with 2021-2023 Tesla Model Y - Source www.desertcart.in

Tesla: Electrifying Growth And Valuation Scrutiny

Tesla, an electric vehicle and clean energy company, has experienced phenomenal growth in recent years, driven by increasing demand for its electric cars, energy storage products, and solar solutions. However, with its rapid growth comes heightened valuation scrutiny, prompting questions about the sustainability of its current valuation and its ability to continue delivering exceptional returns for investors. This article delves into the connection between Tesla's electrifying growth and the valuation scrutiny it faces.

Tesla Sinks as Euphoria Shifts to Scrutiny on Growth, Valuation - Bloomberg - Source www.bloomberg.com

Tesla's growth has been nothing short of remarkable. In 2022, the company delivered over 1.3 million vehicles, a 40% increase from the previous year. This surge in demand has been fueled by rising consumer awareness of climate change, government incentives for electric vehicles, and Tesla's innovative product offerings. The company's energy storage and solar businesses have also experienced significant growth, contributing to its overall revenue and profitability.

Despite its impressive growth, Tesla's valuation has come under scrutiny. The company's market capitalization has soared to over $800 billion, making it one of the most valuable companies in the world. This valuation is based on expectations of continued high growth and profitability, but some analysts have raised concerns about the sustainability of these expectations. The electric vehicle market is highly competitive, and Tesla faces increasing competition from both established automakers and emerging EV startups. Additionally, the company's profitability is heavily dependent on government subsidies, which may not be guaranteed in the long run.

The valuation scrutiny surrounding Tesla is a reminder that even the most successful companies are not immune to market skepticism. Investors should carefully consider the risks and uncertainties associated with Tesla before making investment decisions. While the company's growth potential is undeniable, it is essential to remain cautious and to manage expectations. Tesla's ability to navigate the challenges it faces, including competition, regulatory changes, and supply chain disruptions, will ultimately determine its long-term success.

Table: Key Insights

| Key Insight | Implication |

|---|---|

| Tesla's growth has been exceptional, driven by rising demand for electric vehicles and energy storage products. | This growth has contributed to Tesla's high valuation, but it also raises questions about the sustainability of this valuation. |

| Tesla faces increasing competition in the electric vehicle market from both established automakers and emerging EV startups. | This competition could put pressure on Tesla's margins and growth prospects. |

| Tesla's profitability is heavily dependent on government subsidies. | A reduction or elimination of these subsidies could negatively impact Tesla's profitability and valuation. |

| Investors should carefully consider the risks and uncertainties associated with Tesla before making investment decisions. | While the company's growth potential is undeniable, it is essential to remain cautious and to manage expectations. |