US CPI Data: Latest Inflation Figures and Market Impact

Editor's Note: US CPI Data: Latest Inflation Figures and Market Impact have published today date. It is an important topic to read because it provides insights into the current state of the US economy and its potential impact on markets.

To help you understand the latest US CPI data and its market impact, we've put together this guide. Here are some key takeaways:

The Consumer Price Index (CPI)

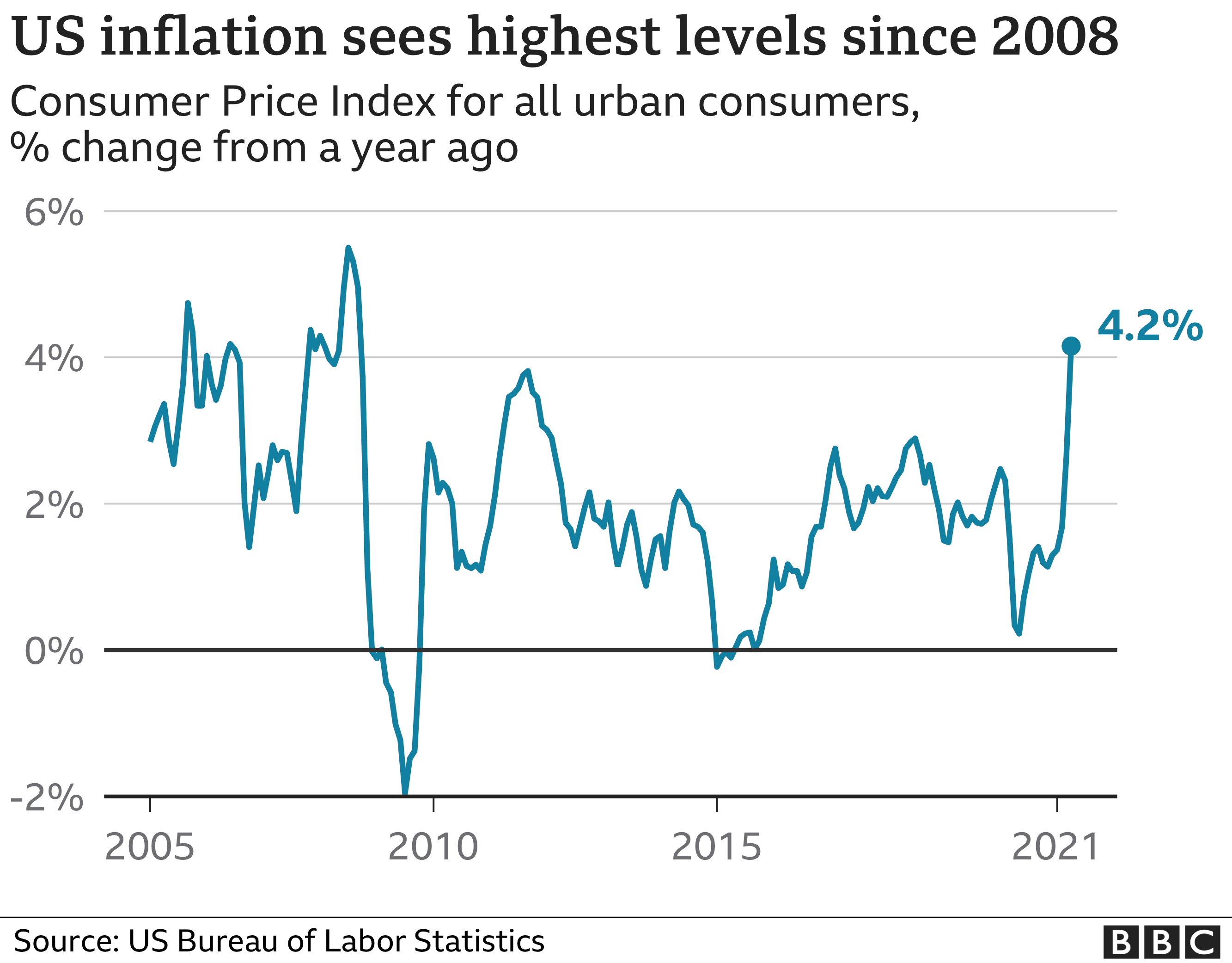

The CPI is a measure of the average change in prices over time in a fixed basket of goods and services purchased by households. It is one of the most widely used measures of inflation.

The latest CPI data

The latest CPI data showed that inflation rose by 0.6% in January 2023, following a 0.1% increase in December 2022. This brings the annual inflation rate to 6.4%, down from 6.5% in December.

The market impact of the CPI data

The release of the CPI data had a significant impact on the markets. Stock prices fell sharply, and bond yields rose. The US dollar also weakened against other currencies.

What the CPI data means for you

The CPI data is a reminder that inflation remains a major concern for the US economy. The Federal Reserve is likely to continue raising interest rates in an effort to bring inflation down to its target of 2%.

If you are concerned about the impact of inflation on your finances, you can take steps to protect yourself. Consider investing in inflation-protected assets, such as Treasury Inflation-Protected Securities (TIPS). You can also reduce your spending and increase your savings.

FAQ

This FAQ section provides insightful answers to frequently asked questions regarding the latest US CPI data and its potential market impact.

Cpi Report June 2024 - Nat Laurie - Source vidaybrittan.pages.dev

Question 1: What is the significance of the CPI data?

The CPI, or Consumer Price Index, measures the average change in prices over time for a basket of goods and services purchased by consumers. It serves as a key indicator of inflation or deflation in the economy.

Question 2: How does the CPI data affect financial markets?

CPI data can influence financial markets by providing insights into the current and future economic outlook. Higher inflation may lead to increased interest rates by central banks, potentially impacting stock and bond prices.

Question 3: What are the implications of the latest CPI data?

The latest CPI data reveals the current inflation rate and provides clues about the underlying inflationary pressures in the economy. It can inform decisions by policymakers, businesses, and investors.

Question 4: How can individuals use the CPI data?

Individuals can use the CPI data to understand the impact of inflation on their purchasing power. By tracking CPI changes over time, they can plan their spending and savings strategies accordingly.

Question 5: What factors influence CPI calculations?

CPI calculations consider a wide range of goods and services, including housing, transportation, healthcare, and food. Changes in these prices affect the overall CPI index.

Question 6: How frequently is the CPI data released?

The CPI data is typically released monthly by the Bureau of Labor Statistics (BLS). It provides timely insights into the latest changes in consumer prices.

Understanding the CPI data and its potential implications can empower individuals and market participants to make informed decisions in a constantly evolving economic landscape.

Next, we will delve into the specific details of the latest CPI data and its impact on various sectors of the financial market.

Tips

To better understand how CPI figures may impact the market, consider the following tips:

Tip 1: Monitor CPI releases closely. CPI reports are released monthly by the Bureau of Labor Statistics. Keeping up with these reports provides valuable insights into the current inflation landscape.

Tip 2: Pay attention to core CPI. Core CPI excludes volatile food and energy prices, offering a clearer picture of the underlying inflation trend.

Tip 3: Consider market expectations. Comparing actual CPI figures to market expectations can reveal market sentiment and potential price movements.

Tip 4: Assess the Federal Reserve's response. The Fed closely monitors CPI data to determine monetary policy decisions. Anticipating their reaction can inform investment strategies.

Tip 5: Diversify portfolio. Inflation can impact different assets in contrasting ways. Diversifying a portfolio across asset classes can mitigate risk during inflationary periods.

Tip 6: Invest in inflation-hedged assets. Consider investing in assets that tend to perform well during inflationary periods, such as gold, real estate, and TIPS (Treasury Inflation-Protected Securities).

Tip 7: Rebalance portfolio regularly. As inflation and market conditions evolve, it's essential to periodically rebalance a portfolio to maintain risk tolerance and investment goals.

By incorporating these tips into your investment approach, you can better navigate the complexities of inflation and its potential market impact. Stay informed, monitor key indicators, and adjust strategies accordingly to maximize returns and minimize risks.

US CPI Data: Latest Inflation Figures And Market Impact provides further insights into the latest CPI figures and their implications for the market.

US CPI Data: Latest Inflation Figures And Market Impact

The latest US CPI data provides crucial insights into the current inflationary landscape and its implications for the economy and financial markets. Here are six key aspects to consider:

- Headline Inflation: Measures overall price increases across a basket of goods and services.

- Core Inflation: Excludes volatile food and energy prices, offering a more underlying trend.

- Market Expectations: Compares actual figures to market forecasts, indicating surprises and their impact.

- Federal Reserve Response: The CPI data influences the Fed's monetary policy decisions, affecting interest rates.

- Stock Market Reaction: Equity markets respond positively to lower inflation and negatively to higher inflation.

- Bond Market Impact: Bond yields generally rise with higher inflation, as investors seek higher returns to offset the erosion of purchasing power.

These aspects are interconnected and provide a comprehensive understanding of the US CPI data's impact. For example, higher-than-expected headline inflation could prompt the Fed to raise interest rates more aggressively, leading to a rise in bond yields and potential stock market volatility. Conversely, lower-than-expected core inflation may indicate stabilizing inflationary pressures, easing concerns among investors.

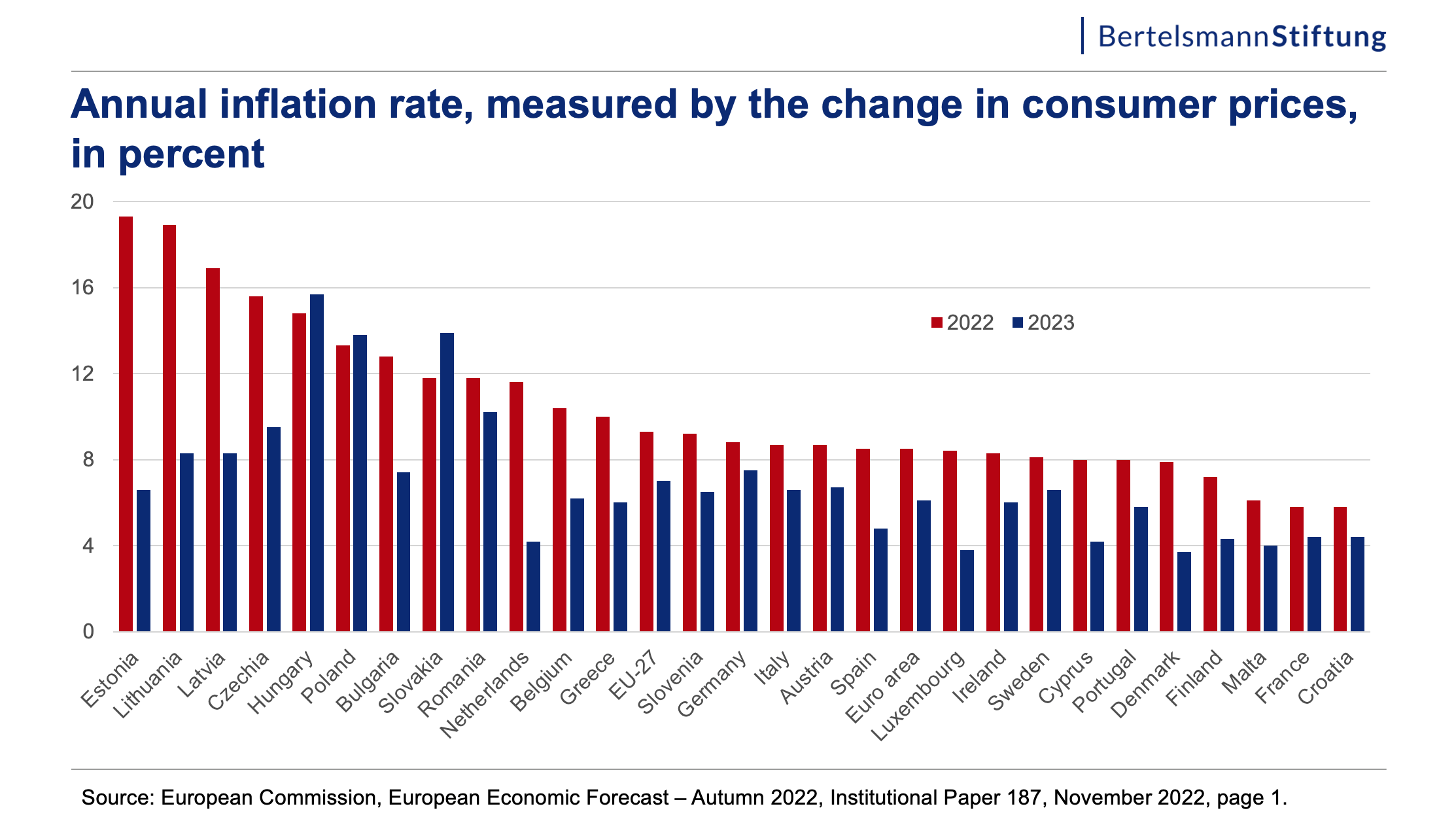

Inflation Rate 2024 Colorado - Alfie Rosalind - Source fredytabitha.pages.dev

US CPI Data: Latest Inflation Figures And Market Impact

The Consumer Price Index (CPI) is a measure of inflation that tracks the prices of goods and services purchased by households. CPI data is an important economic indicator that is closely watched by investors, businesses, and policymakers. Lately, the CPI data has shown that inflation is rising at its fastest pace in decades. This has raised concerns about the potential impact on the economy and financial markets.

Rising inflation can lead to higher interest rates, which can slow economic growth. It can also reduce the value of savings and investments. In addition, inflation can make it more difficult for businesses to plan for the future.

The market reaction to the latest CPI data has been mixed. Some investors have sold stocks and other risky assets, while others have bought inflation-protected securities. The US dollar has also weakened against other currencies.

It is unclear how long inflation will remain elevated. The Federal Reserve is closely monitoring the situation and has indicated that it is prepared to raise interest rates if necessary.

Key Points:

| Key Point | Explanation |

|---|---|

| CPI data is an important economic indicator that is closely watched by investors, businesses, and policymakers. | CPI data can provide insights into the current state of the economy and potential future trends. |

| Lately, the CPI data has shown that inflation is rising at its fastest pace in decades. | High inflation can have negative consequences for the economy and financial markets. |

| The market reaction to the latest CPI data has been mixed. | Investors are uncertain about the long-term implications of high inflation. |

| The Federal Reserve is closely monitoring the situation and has indicated that it is prepared to raise interest rates if necessary. | The Fed's actions could have a significant impact on the economy and financial markets. |

Conclusion

The latest CPI data is a reminder that inflation is a major concern for the economy and financial markets. The Federal Reserve is likely to continue to raise interest rates in an effort to bring inflation under control. However, it is unclear how long it will take for inflation to return to more normal levels.

Investors should be aware of the risks associated with inflation and take steps to protect their portfolios. One way to do this is to invest in inflation-protected securities. These securities are designed to provide a return that is linked to the rate of inflation.