"Purple United Sales IPO GMP: Real-Time Insights And Analysis For Investors", a crucial topic for understanding the potential prospects of Purple United Sales' Initial Public Offering (IPO), has recently gained substantial attention.

Editor's Notes: "Purple United Sales IPO GMP: Real-Time Insights And Analysis For Investors" have published on today date. As the IPO market continues to witness a surge in activity, staying informed about upcoming offerings is essential for investors seeking to make well-informed decisions.

Through extensive analysis and thorough research, we have compiled this comprehensive Purple United Sales IPO GMP: Real-Time Insights And Analysis For Investors guide. Our aim is to provide investors with the necessary insights and information to help them assess the potential of Purple United Sales' IPO and make informed investment decisions.

Key differences or Key takeways, provide in informative table format

Transition to main article topics.

FAQs

This FAQ section provides insights into key aspects of the Purple United Sales IPO GMP, helping investors make informed decisions.

Question 1: What is the Grey Market Premium (GMP) for Purple United Sales?

The GMP for Purple United Sales is an indication of the anticipated premium investors are willing to pay above the IPO price. It reflects the market's expectations for the company's future performance and demand for its shares.

Tata Technologies IPO GMP at Rs 100 even before official price band - Source www.businesstoday.in

Question 2: How is the GMP determined?

The GMP is determined by market participants, including brokers, dealers, and institutional investors, who trade the IPO shares unofficially before the listing date. These participants consider various factors, such as the company's financial performance, industry outlook, and investor sentiment, to arrive at a consensus on the premium.

Question 3: Is the GMP a reliable indicator of IPO performance?

While the GMP provides insights into market sentiment, it's important to note that it's not a guaranteed predictor of IPO performance. Factors such as market conditions, news events, and investor appetite can influence the actual listing price and subsequent share price movement.

Question 4: How can investors utilize the GMP?

Investors can use the GMP to gauge the market's demand for Purple United Sales shares. A high GMP may indicate strong investor interest, while a low GMP may suggest weaker demand. This information can help investors assess the potential risks and rewards associated with investing in the IPO.

Question 5: Are there any risks associated with relying on the GMP?

The GMP is an unofficial indicator and can be subject to manipulation or inaccurate assumptions. It's essential for investors to conduct thorough research and consult with financial advisors before making investment decisions.

Question 6: Where can investors find up-to-date information on the Purple United Sales GMP?

Reputable financial news sources, brokers, and investment websites provide real-time updates on the GMP and other relevant IPO-related information.

In conclusion, the Purple United Sales IPO GMP serves as a valuable tool for investors seeking insights into market sentiment. By understanding the factors that influence the GMP and its potential limitations, investors can make informed decisions about investing in the IPO.

For further analysis and insights on the Purple United Sales IPO, please refer to the subsequent article sections.

Tips for Understanding Purple United Sales IPO GMP

The Grey Market Premium (GMP) is a crucial factor for investors to consider during an Initial Public Offering (IPO). Purple United Sales IPO GMP: Real-Time Insights And Analysis For Investors can provide valuable insights into the demand and pricing dynamics of an upcoming IPO. Here are some tips to help you effectively utilize Purple United Sales IPO GMP:

Emcure Pharmaceuticals IPO: GMP, Pricing, Timelines, and Financial - Source tradesmartonline.in

Tip 1: Monitor GMP Trends:

Tracking the GMP over time can provide valuable insights into the market sentiment towards the IPO. A rising GMP indicates strong demand, while a falling GMP suggests weaker interest.

Tip 2: Analyze GMP Movement:

Sudden changes in the GMP can provide signals about the IPO's potential performance. A sharp increase in GMP may indicate positive developments within the company or the industry, while a sudden drop could suggest concerns.

Tip 3: Compare GMP with Peers:

Comparing the GMP of Purple United Sales with similar companies that have recently gone public can provide a benchmark to assess its relative attractiveness.

Tip 4: Consider GMP Range:

Instead of focusing solely on the absolute GMP value, consider the range of GMPs being quoted. A wide range may indicate uncertainty in the market, while a narrow range suggests more consensus.

Tip 5: Use GMP as a Risk Indicator:

A high GMP may indicate strong demand, but it also suggests that the stock may be priced at a premium. Conversely, a low GMP could indicate weaker interest, but it may also present an opportunity to acquire shares at a lower price.

Understanding and utilizing Purple United Sales IPO GMP can empower investors to make informed decisions during the IPO process. By following these tips, you can gain valuable insights into the market sentiment and potential performance of the IPO.

Purple United Sales IPO GMP: Real-Time Insights And Analysis For Investors

Understanding the key aspects of Purple United Sales IPO GMP is crucial for informed investment decisions. These aspects encompass the stock performance, market dynamics, company financials, industry analysis, and expert opinions, providing comprehensive insights into the IPO's potential.

- Stock Performance: Track the GMP (Grey Market Premium) to gauge investor sentiment and anticipate post-listing price movements.

- Market Dynamics: Analyze overall market conditions, including indices, sector performance, and economic indicators, to assess the IPO's timing.

- Company Financials: Scrutinize the company's financial statements, revenue growth, profitability, and debt levels to evaluate its financial health.

- Industry Analysis: Understand the competitive landscape, growth prospects, and regulatory environment of the industry in which the company operates.

- Expert Opinions: Seek insights from analysts, market experts, and industry insiders to gain valuable perspectives on the IPO's potential.

- Real-Time Data: Monitor live GMP updates, news, and market commentary to stay informed about the latest developments and make timely investment decisions.

By considering these key aspects, investors can make informed decisions about participating in the Purple United Sales IPO. Understanding the stock performance, market dynamics, company financials, industry analysis, expert opinions, and real-time data empowers investors to navigate the IPO process effectively and maximize their investment potential.

Listing alternatives to a full IPO - Source www.minterellison.co.nz

Purple United Sales IPO GMP: Real-Time Insights And Analysis For Investors

As Purple United Sales prepares for its much-anticipated initial public offering (IPO), investors are eagerly monitoring the Grey Market Premium (GMP) to gauge market sentiment and make informed investment decisions. In this analysis, we will provide real-time insights and analysis to help investors better understand the connection between GMP and Purple United Sales' IPO performance.

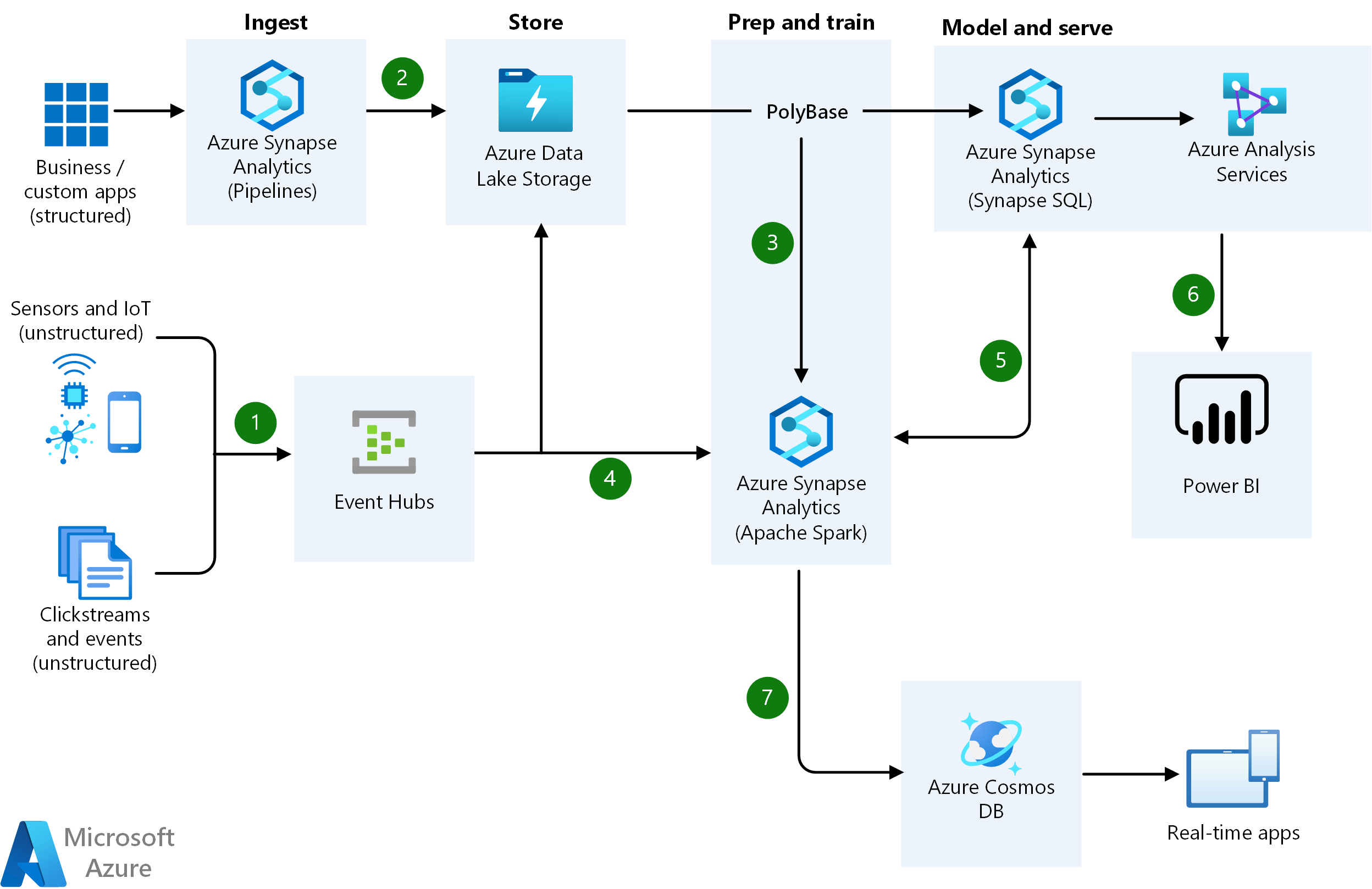

Análise em tempo real na arquitetura de Big Data - Azure Solution Ideas - Source learn.microsoft.com

GMP is a crucial indicator of market demand for an upcoming IPO. It reflects the premium investors are willing to pay for shares in the grey market, which operates unofficially before the official listing. A higher GMP indicates strong investor interest and anticipation of a successful IPO. Conversely, a lower GMP may signal concerns about the company's prospects or market conditions.

In the case of Purple United Sales, the GMP has been fluctuating in recent days. This volatility suggests that investors are still assessing the company's IPO details, including its financial performance, industry outlook, and overall growth potential. A sustained high GMP would suggest that investors are confident in Purple United Sales' prospects, while a significant decline could raise concerns.

It's important to note that GMP is not a perfect predictor of IPO performance. However, it can provide valuable insights into market sentiment and help investors make informed decisions. By closely monitoring the GMP and analyzing relevant factors, investors can better position themselves to capitalize on potential opportunities or mitigate risks associated with Purple United Sales' IPO.

| Factor | Influence on GMP |

|---|---|

| Company's Financial Performance | Strong financials can boost GMP, indicating investor confidence in the company's growth prospects. |

| Industry Outlook | A positive industry outlook can drive higher GMP, as investors see potential for the company's growth within the sector. |

| Overall Market Conditions | Bullish market conditions can lead to higher GMP, while bearish conditions can suppress it. |

| Investor Sentiment | Positive investor sentiment towards the company and its IPO can drive up GMP. |